As filed with the Securities and Exchange Commission on

February 1, 2021

Registration No. 333-251311

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment

No. 1

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

GT BIOPHARMA, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

2834

|

|

94-1620407

|

|

State or other jurisdiction

|

|

(Primary Standard Industrial

|

|

(I.R.S. Employer

|

|

incorporation or organization

|

|

Classification Code Number)

|

|

|

9350 Wilshire Blvd. Suite 203

Beverly Hills, CA 90212

(800) 304-9888

(Address, including zip code, and telephone number, including area

code, of registrant’s principal executive

offices)

Anthony J. Cataldo

Chief Executive Officer

9350 Wilshire Blvd. Suite 203

Beverly Hills, CA 90212

(800) 304-9888

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Copies of Communications to:

|

Roger W. Bivans

Baker & McKenzie LLP

1900 N. Pearl Street, Suite 1500

Dallas, TX 75201, USA

(214) 978 3000

|

Ralph V. De Martino

Cavas S. Pavri

Alec Orudjev

Schiff Hardin LLP

901 K Street NW, Suite 700

Washington, DC 20001

Telephone: (202) 778-6400

Facsimile: (202) 778-6460

|

Approximate date of commencement of proposed sale to the

public: As soon as practicable

after the effective date of this registration

statement.

If any securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933,

check the following box. ☒

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the following box and

list the Securities Act

registration statement number of the earlier effective registration

statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule

462(c) under the Securities

Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same

offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule

462(d) under the Securities

Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same

offering. ☐

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer,

smaller reporting company, or

an emerging growth company. See

the definitions of “large accelerated filer,”

“accelerated filer,” “smaller reporting

company,” and “emerging

growth company” in Rule

12b-2 of the Exchange

Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

|

|

|

Non-accelerated filer ☒

|

Smaller reporting company ☒

|

|

|

|

|

|

Emerging growth company ☐

|

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the

extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section

7(a)(2)(B) of the Securities

Act. ☐

_______________________

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities To Be Registered

|

Proposed Maximum

Aggregate

Offering Price(1)(2)(3)

|

Amount of

Registration Fee(6)

|

|

Units

consisting of:

|

$10,000,000

|

$1,091.00

|

|

Shares

of common stock, par value $0.001 per share (the “Common

Stock”), included in the Units

|

—(4)

|

—

|

|

Warrants

to purchase common stock included in the Units

|

—(4)

|

—

|

|

Pre-Funded

Units consisting of:

|

$10,000,000

|

$1,091.00

|

|

Warrants

to purchase common stock included in the Pre-Funded

Units

|

—(4)

|

—

|

|

Pre-funded

warrants to purchase common stock included in the Pre-Funded

Units

|

—(4)

|

—

|

|

Underwriter’s

over-allotment option (5)

|

$3,000,000

|

$327.30

|

|

Underwriter’s

warrants (5)

|

$1,250,000

|

$136.39

|

|

Shares

of common stock issuable upon exercise of the Underwriter’s

warrants (5)

|

—(4)

|

—

|

|

Shares

of common stock issuable upon exercise of the warrants included in

the Units and Pre-Funded Units

|

—(4)

|

—

|

|

Shares

of common stock issuable upon exercise of the pre-funded warrants

included in the Pre-Funded Units

|

—(4)

|

—

|

|

Shares

of common stock issuable upon exercise of the warrants included in

the Underwriter’s over-allotment option (5)

|

—(4)

|

—

|

|

Total

|

$24,250,000

|

$2,645.68

|

_____________

(1)

Pursuant to Rule 416 promulgated under the

Securities Act of 1933, as amended (the “Securities Act”), this registration

statement shall also cover any an indeterminate number of

additional shares of the registrant’s common stock as may be issuable because of any

future stock dividends, stock distributions, stock splits, similar

capital readjustments or other anti-dilution

adjustments.

(2)

All

amounts in this table are estimated solely for the purpose of

calculating the registration fee in accordance with Rule 457(o)

under the Securities Act. The registrant may increase or decrease

the size of the offering prior to effectiveness.

(3)

The

proposed maximum aggregate offering price of the Units and

Pre-Funded Units, if any, is $24,250,000. This

registration fee table shows a proposed maximum aggregate offering

price of $24,250,000 solely for purposes of complying

with guidance of the Securities and Exchange Commission (the

“SEC”) relating to the payment of registration fees, as

we are required by the SEC to register separately the Units, the

Pre-Funded Units, the shares of common stock included in the Units,

the warrants included in the Units and Pre-Funded Units, the

pre-funded warrants included in the Pre-Funded Units, the shares of

common stock issuable upon exercise of the warrants included in the

Units and Pre-Funded Units, the shares of common stock issuable

upon exercise of the pre-funded warrants included in the Pre-Funded

Units. The aggregate offering price of the Units proposed to be

sold in the offering will be reduced on a dollar-for-dollar basis

based on the aggregate offering price of the Pre-Funded Units

offered and sold in the offering (plus the aggregate exercise price

of the shares of common stock issuable upon exercise of the

pre-funded warrants included in the Pre-Funded Units).

(4)

No

additional registration fee is payable pursuant to Rule 457(i)

under the Securities Act.

(5)

Includes

additional Units which may be issued upon the exercise of a 45-day

option granted to the underwriters to cover

over-allotments, if any, up to 15% of the total number of Units to

be offered,

which may be exercised for shares of common stock, warrants or both

at the election of the

underwriters.

We have calculated the proposed maximum aggregate offering price of

the common stock underlying the underwriter’s warrants to

purchase up to 5% of the securities sold in this offering by

assuming that such warrants are exercisable at a price per share

equal to 125% of the public offering price of the common stock in

the units sold in this offering.

The registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become

effective in accordance with section 8(a) of the Securities Act of

1933 or until the registration statement shall become effective on

such date as the Securities and Exchange Commission acting pursuant

to said section 8(a), may determine.

The information in this preliminary prospectus is not complete and

may be changed. We may not sell these securities until the

registration statement filed with the Securities and Exchange

Commission is effective. This preliminary prospectus is not an

offer to sell these securities and it is not soliciting an offer to

buy these securities in any state or jurisdiction where the offer

or sale is not permitted.

SUBJECT TO COMPLETION, DATED February

1, 2021

PRELIMINARY PROSPECTUS

Up to

Units

(Each Unit Consisting of One Share of Common Stock and One Common

Warrant to Purchase

Shares of Common Stock)

Up to

Pre-Funded Units

(Each Pre-funded Unit Consisting of

One Pre-Funded Warrant to Purchase One Share of Common Stock and

One Common Warrant to Purchase

Shares of Common Stock)

We are offering up

to

units (the “Units”), with

each Unit consisting of (i) one share of common stock, par value

$0.001 per share (the “Common Stock”), of GT Biopharma,

Inc., a Delaware corporation (the “Company”), and (ii)

one warrant to purchase

shares of common stock (a “Common

Warrant”). The Common Warrants will have an exercise price of

$

per share, will be exercisable at any time

after the date of issuance and will expire

years from the date of issuance. Each

Unit will be sold at a price to the public of $

per Unit.

We are

also offering to those purchasers, if any, whose purchase of Units

in this offering would result in the purchaser, together with its

affiliates and certain related parties, beneficially owning more

than 4.99% (or, at the election of the purchaser, 9.99%) of our

outstanding common stock immediately following the consummation of

this offering, the opportunity to purchase, in lieu of Units that

would otherwise result in ownership in excess of 4.99% (or, at the

election of the purchaser, 9.99%) of our outstanding common stock,

pre-funded units (the “Pre-Funded Units”), with each

Pre-Funded Unit consisting of (i) a pre-funded warrant to purchase

one share of Common Stock (the “Pre-Funded Warrant”),

and (ii) one Common Warrant. Because we will issue a Common Warrant

as part of each Unit or Pre-Funded Unit, the number of Common

Warrants sold in this offering will not change as a result of a

change in the mix of the Units and Pre-Funded Units sold. Each

Pre-Funded Warrant contained in a Pre-Funded Unit will be

exercisable for one share of Common Stock. The purchase price of

each Pre-Funded Unit will equal the price per Unit being sold to

the public in this offering, less $0.001, and the exercise price of

each Pre-Funded Warrant included in the Pre-Funded Unit will be

$0.001 per share. Each Pre-Funded Warrant is exercisable for one

share of our Common Stock at any time at the option of the holder,

provided that the holder will be prohibited from exercising

Pre-Funded Warrants for shares of our Common Stock if, as a result

of such exercise, the holder, together with its affiliates, would

own more than 4.99% of the total number of shares of our Common

Stock then issued and outstanding. However, any holder may increase

such percentage to any other percentage not in excess of 9.99%,

provided that any increase in such percentage shall not be

effective until 61 days after such notice to us. Otherwise, the

Pre-Funded Warrants will be immediately exercisable and may be

exercised at any time until exercised in full.

For

each Pre-Funded Unit we sell, the number of Units we are offering

will be decreased on a one-for-one basis. Units and the Pre-Funded

Units will not be issued or certificated. The Common Stock or

Pre-Funded Warrants, as the case may be, and the Common Warrants

included in the Units or the Pre-Funded Units, can only be

purchased together in this offering, but the securities contained

in the Units or Pre-Funded Units will be issued separately and will

be immediately separable upon issuance. The shares of Common Stock

issuable from time to time upon exercise of the Common Warrants and

the Pre-Funded Warrants are also being offered by this prospectus.

We refer to the shares of Common Stock issued or issuable upon

exercise of the Common Warrants and Pre-Funded Warrants, and the

shares of Common Stock, the Common Warrants and Pre-Funded Warrants

being offered hereby, collectively, as the

“securities.”

Our

Common Stock is presently quoted on the OTCQB, one of the OTC

Markets Group over-the-counter markets, under the trading symbol

“GTBP.” On January 29, 2021, the closing

sale price for our Common Stock was $0.470. We

have applied to list our Common Stock on the Nasdaq

Capital Market under the symbol “GTBP.” No assurance

can be given that our application will be approved or that the

trading prices of our Common Stock on the OTCQB market will be

indicative of the prices of our Common Stock if our Common Stock

were traded on the Nasdaq Capital Market.

There

is no established public trading market for the Common Warrants or

the Pre-Funded Warrants, and we do not expect such a market to

develop. In addition, we do not intend to apply for a listing of

the Common Warrants or the Pre-Funded Warrants on any national

securities exchange or other nationally recognized trading

system.

Unless

otherwise noted and other than in our financial statements and the

notes thereto, the share and per share information in this

prospectus reflects a proposed reverse stock split of the

outstanding common stock and treasury stock of the Company at an

assumed 1-for-9 ratio to occur following the effective date but

prior to the closing of the offering.

Investing in our securities involves a

high degree of risk. You should carefully review and consider

“Risk Factors”

beginning on page 17 of this prospectus.

Neither the Securities and Exchange

Commission (the “SEC”) nor any state securities commission

has approved or disapproved of these securities or determined if

this prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

|

|

|

|

|

|

Public offering price

|

$

|

$

|

$

|

|

Underwriter discounts and commissions (1)

|

$

|

$

|

$

|

|

Proceeds, before expenses, to us

|

$

|

$

|

$

|

(1)

The underwriters will receive compensation in

addition to the underwriting discount and commissions. We have

agreed to issue upon the closing of this offering common stock

purchase warrants to the underwriters entitling them to purchase up

to 5% of the aggregate shares of the units sold in this offering.

The exercise price of such warrants is equal to 125% of the public

offering price of the units offered hereby. The warrants will be

exercisable commencing six months after the date of effectiveness

of this Registration Statement and will terminate five years after

the date of effectiveness of this Registration Statement. See

“Underwriting”

beginning on page 83 of this prospectus for additional information

regarding underwriting compensation.

(2)

The

public offering corresponds to an assumed public offering price per

share of common stock and per pre-funded warrant of

$ and an assumed

public offering price per warrant of $0.01.

We have granted the underwriters a 45-day option to

purchase additional Units up to 15% of the total number of Units to

be offered solely to cover over-allotments, if any, which may

be exercised for shares of common stock, warrants or both at the

election of the underwriters.

Delivery of the securities is expected to be made on or

about

, 2021, subject to customary closing

conditions.

Roth

Capital

Partners

Dawson James Securities,

Inc.

The date of this prospectus

is

, 2021.

TABLE OF CONTENTS

|

ABOUT THIS PROSPECTUS

|

v

|

|

PROSPECTUS SUMMARY

|

1

|

|

RISK FACTORS

|

17

|

| USE

OF PROCEEDS

|

42

|

|

UNDERWRITING

|

43

|

|

MARKET INFORMATION

|

45

|

|

CONSOLIDATED CAPITALIZATION

|

46

|

|

DILUTION

|

47

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

|

48

|

|

DESCRIPTION OF BUSINESS

|

57

|

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

68

|

|

EXECUTIVE COMPENSATION

|

70

|

|

VOTING SECURITIES AND PRINCIPAL HOLDERS

|

73

|

|

DESCRIPTION OF SECURITIES

|

76

|

|

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS TO NON-U.S.

HOLDERS

|

79

|

|

UNDERWRITING

|

85

|

|

LEGAL MATTERS

|

89

|

|

EXPERTS

|

89

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

89

|

|

INDEX TO FINANCIAL STATEMENTS

|

1

|

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Some of

the statements in this prospectus are “forward-looking

statements” within the meaning of the safe harbor from

liability established by the Private Securities Litigation Reform

Act of 1995. Forward-looking statements include statements

regarding our current beliefs, goals and expectations about matters

such as our expected financial position and operating results, our

business strategy and our financing plans. The forward-looking

statements in this prospectus are not based on historical facts,

but rather reflect the current expectations of our management

concerning future results and events. The forward-looking

statements generally can be identified by the use of terms such as

“believe,” “expect,”

“anticipate,” “intend,” “plan,”

“foresee,” “may,” “guidance,”

“estimate,” “potential,”

“outlook,” “target,”

“forecast,” “likely” or other similar words

or phrases. Similarly, statements that describe our objectives,

plans or goals are, or may be, forward-looking statements.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

performance or achievements to be different from any future

results, performance and achievements expressed or implied by these

statements. We cannot guarantee that our forward-looking statements

will turn out to be correct or that our beliefs and goals will not

change. Our actual results could be very different from and worse

than our expectations for various reasons. You should review

carefully all information, including the discussion under

“Risk Factors”

and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” in this prospectus or under similar

headings in any accompanying prospectus supplement. Any

forward-looking statements in this prospectus are made only as of

the date hereof and, except as may be required by law, we do not

have any obligation to publicly update any forward-looking

statements contained in this prospectus to reflect subsequent

events or circumstances.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1

that we filed with the SEC under the Securities Act. This

prospectus does not contain all of the information included in the

registration statement. For further information, we refer you to

the registration statement, including its exhibits, filed with the

SEC. Statements contained in this prospectus about the contents of

any document are not necessarily complete. If SEC rules require

that a document be filed as an exhibit to the registration

statement, please see such document for a complete description of

these matters. You should carefully read this prospectus, together

with the additional information described under the headings

“Where You Can Find More

Information.”

Neither we nor the underwriters have authorized anyone

to provide you with any information or to make any representations

other than that contained in this prospectus or in any free writing

prospectus we may authorize to be delivered or made available to

you. We take no responsibility for, and can provide no assurance as

to the reliability of, any other information that others may give

you. Neither we nor the underwriters are making an

offer to sell securities in any jurisdiction in which the offer or

sale is not permitted. The information in this prospectus is

accurate only as of the date on the front cover of this prospectus,

regardless of the time of delivery of this prospectus or of any

sale of our shares of common stock and the information in any free

writing prospectus that we may provide to you in connection with

this offering is accurate only as of the date of that free writing

prospectus. Our business, financial condition, results of

operations and prospects may have changed since those

dates.

For investors outside the United States: Neither we nor the underwriters have

done anything that would permit this offering, or possession or

distribution of this prospectus, in any jurisdiction where action

for that purpose is required, other than in the United States.

Persons who come into possession of this prospectus in

jurisdictions outside the United States are required to inform

themselves about and to observe any restrictions as to this

offering and the distribution of this prospectus applicable to

those jurisdictions.

Unless otherwise indicated, information contained in this

prospectus concerning our industry and the markets in which we

operate, including our general expectations and market position,

market opportunity and market share, is based on information from

our own management estimates and research, as well as from industry

and general publications and research, surveys and studies

conducted by third parties. Management estimates are derived from

publicly available information, our knowledge of our industry and

assumptions based on such information and knowledge, which we

believe to be reasonable. In addition, assumptions and estimates of

our and our industry’s future performance are necessarily

subject to a high degree of uncertainty and risk due to a variety

of factors, including those described in “Risk

Factors.” These and other

factors could cause our future performance to differ materially

from our assumptions and estimates. See “Cautionary Notice Regarding

Forward-Looking Statements.”

This prospectus contains summaries of certain provisions contained

in some of the documents described herein, but reference is made to

the actual documents for complete information. All of the summaries are qualified in their

entirety by the actual documents. Copies of some of the documents

referred to herein have been, or will be, filed or incorporated by

reference as exhibits to the registration statement of which this

prospectus is a part, and you may obtain copies of those documents

as described below under the heading “Where You Can Find More

Information.”

All product and

company names are trademarks of their

respective owners. Solely for convenience, trademarks and trade

names referred to in this prospectus, including logos, artwork and

other visual displays, may appear without the ® or

TM

symbols, but such references are not

intended to indicate, in any way, that their respective owners will

not assert, to the fullest extent under applicable law, their

rights thereto. We do not intend our use or display of other

companies’ trade names or

trademarks to imply a relationship with, or endorsement or

sponsorship of us by, any other companies.

Throughout this prospectus, the terms “we,”

“us,” “our,” and “our Company”

and “the Company” refer to GT Biopharma, Inc., a

Delaware corporation, and/or its related subsidiaries, as the

context may require.

|

|

|

|

|

|

PROSPECTUS

SUMMARY

This summary highlights certain

information about us, this offering and selected information

contained elsewhere in this prospectus. Because this is only a

summary, it does not contain all of the information that may be important to

you or that you should consider before investing in our

common stock. You should read the

entire prospectus carefully, especially the information under

“Risk Factors” set

forth in this prospectus and the information included in any

prospectus supplement or free writing prospectus that we have

authorized for use in connection with this offering. This

prospectus contains forward-looking statements, based on current

expectations and related to future events and our future financial

performance, that involve risks and uncertainties. Our actual

results may vary materially from those discussed in the

forward-looking statements as a result of various factors,

including, without limitation, those set forth under

“Risk Factors,” as

well as other matters described in this prospectus. See

“Cautionary Notice

Regarding Forward-Looking Statements.”

Overview

We are a clinical stage biopharmaceutical company focused on the development and

commercialization of novel immuno-therapeutic products based on our

proprietary Tri-specific Killer

Engager (TriKE™)

and Tetra-specific Killer

Engager (TetraKE™)

platform technologies. Our TriKE and TetraKE platforms generate proprietary

therapeutic candidates that are designed to harness and enhance the

immune response of a patient’s endogenous natural killer

cells (“NK cells”).

Once bound to an NK cell, our platform moieties are designed to

enhance the activity of NK cells, with targeted direction to one or

more proteins expressed on a specific type of cancer cell or virus

infected cell, ultimately resulting in targeted cell death.

We have constructed our TriKEs and

TetraKEs of recombinant fusion proteins that can be designed to

target a wide array of tumor antigen that may be located on

hematologic malignancies, sarcomas or solid tumors. Our TriKEs and

TetraKEs do not require patient-specific or autologous

customization.

We are using our TriKE and

TetraKE platforms with the intent to bring to market products that

treat a range of hematologic malignancies, sarcomas, solid tumors

and selected infectious diseases. Our platforms are scalable, and

in addition to our first clinical indication of our TriKE platform

in relapsed or refractory acute myelogenous leukemia

(“AML”), we are preparing investigational new drug

applications (“IND”) based on a specific

TriKE or TetraKE design. We intend to

continue to advance into the clinic, on our own or through

potential collaborations with larger companies, multiple TriKE or TetraKE product

candidates. We believe our TriKEs and TetraKEs may have the ability, if

approved for marketing, to be used as monotherapy, be dosed

concomitantly with current monoclonal antibody therapeutics, be

used in conjunction with more traditional cancer therapy, and

potentially overcome certain limitations of current chimeric

antigen receptor (“CAR-T”) therapy.

We are also using our TriKE and

TetraKE platforms to develop therapeutics for the treatment of

infectious diseases such as human immunodeficiency virus

(“HIV”) and COVID-19 infection. For example, while the

use of anti-retroviral drugs has substantially improved the

morbidity and mortality of individuals infected with HIV, these

drugs are designed to suppress virus replication and to help

modulate progression to AIDS and to limit further transmission of

the virus. Despite the use of anti-retroviral drugs, infected

individuals retain reservoirs of latent HIV-infected cells that,

upon cessation of anti-retroviral drug therapy, can reactivate and

reestablish an active HIV infection. Destruction of these latent

HIV infected cells is the primary objective of curative

therapy. Our HIV-TriKE contains

the antigen binding fragment (Fab) from a broadly-neutralizing antibody

targeting the HIV-Env protein.

The HIV-TriKE is designed to

target HIV while redirecting NK cell killing specifically to

actively replicating HIV infected cells. The HIV-TriKE induced NK cell proliferation and

demonstrated the ability in vitro to reactivate and kill

HIV-infected T-cells. These findings indicate a potential role for

the HIV-TriKE in the

reactivation and elimination of the latently infected HIV reservoir

cells by harnessing the NK cell’s ability to mediate the

antibody-directed cellular cytotoxicity

(“ADCC”).

We have licensed the exclusive rights from the University of

Minnesota to the TriKE and

TetraKE platforms.

|

|

|

|

|

|

|

|

|

|

|

|

Immuno-Oncology Product Candidates

GTB-3550

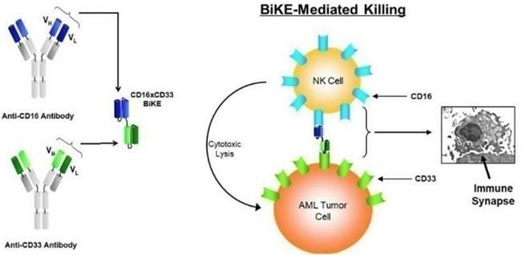

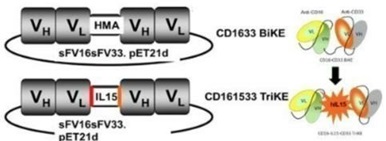

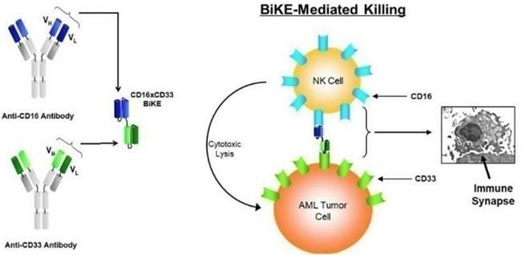

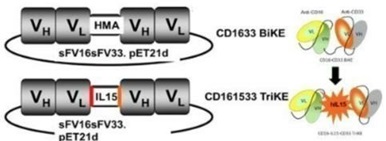

GTB-3550 is our first TriKE product

candidate. It is a tri-specific single-chain variable fragment

(“scFV”)

recombinant fusion protein conjugate composed of the variable

regions of the heavy and light chains of anti-CD16 and anti-CD33

antibodies and a modified form of IL-15, in a novel conformational

construct. We have commenced clinical trials of this

anti-CD16-IL-15-anti-CD33 TriKE

in CD33 positive leukemias, a marker expressed on tumor cells in

AML, and we intend to study this TriKE in myelodysplastic syndrome

(“MDS”) and other hematopoietic malignancies. CD33 is

primarily a myeloid differentiation antigen with endocytic

properties broadly expressed on AML blasts and, possibly, some

leukemic stem cells. CD33 or Siglec-3 (sialic acid binding Ig-like lectin 3, SIGLEC3, SIGLEC3, gp67, p67) is

a transmembrane receptor expressed on cells of myeloid lineage. It

is usually considered myeloid-specific, but it can also be found on

some lymphoid cells. The anti-CD33 antibody fragment was derived

from the M195 humanized anti-CD33 scFV and has been used in human clinical

studies. We believe the recent approval of the antibody-drug

conjugate gemtuzumab validates this targeted

approach.

Patients who are diagnosed with AML typically receive frontline

therapy—usually chemotherapy—including cytarabine and

an anthracycline, a therapy that has not changed in over 40 years.

Approximately 50% of patients will relapse and require alternative

therapies. In addition, MDS incidence rates in the U.S. have

dramatically increased from 3.3 per 100,000 individuals from

2001-2004 to 70 per 100,000 annually. MDS is especially prevalent

in elderly patients that have a median age of 76 years at

diagnosis. The survival of patients with MDS is poor due to

decreased eligibility, as a result of advanced age, for allogeneic

hematopoietic cell transplantation (Allo-HSCT), the only curative MDS treatment

(Cogle CR. Incidence and Burden

of the Myelodysplastic Syndromes. Curr Hematol Malig Rep. 2015;

10(3):272-281). We believe GTB-3550 could serve as a relatively

safe, cost-effective and easy-to-use therapy for

resistant/relapsing AML and could also be combined with

chemotherapy as frontline therapy thus targeting the larger

market.

We filed an IND amendment in June 2018 and announced on November 1,

2018 that we received notification from the FDA that the IND was

open and that the Company was authorized to initiate a

first-in-human Phase I clinical

trial with GTB-3550 in AML, MDS and severe mastocytosis. We

began our Phase I clinical

trial in January 2020.

GTB-C3550

GTB-C3550 is a next-generation, follow-on, to our lead

TriKE, GTB-3550. GTB-C3550 contains a

modified CD16 moiety which has improved binding characteristics and

enhanced tumorcidal activity based on functional assays and animal

models of AML. Using our platform technology, we substituted the

anti-CD16 scFv arm in GTB-3550 with a novel humanized

single-domain anti-CD16 antibody to create this second-generation

molecule which may have improved functionality. Single-domain

antibodies, such as GTB-C3550, typically have several advantages

including better stability and solubility, more resistance to pH

changes, can better recognize hidden antigenic sites, lack a VL

portion thus preventing VH/VL mispairing and are suitable for

construction of larger molecules. GTB-C3550 induced a potent

increase in NK cell degranulation, measured by CD107a expression against HL-60 AML tumor targets

when compared to our first-generation TriKE (70.75±3.65% vs. 30.75±5.05%). IFN

production was similarly enhanced (29.2±1.8% vs.

6.55±1.07%). GTB-C3550 also exhibited a robust increase in NK

cell proliferation (57.65±6.05% vs. 20.75±2.55%).

GTB-3550 studies will help inform the development of GTB-C3550

which we expect will de-risk the GTB-C3550 program as data will be

generated to make an informed decision on which, or both, will be

brought into later phase clinical trials.

GTB-1615

GTB-1615 is an example of our first-generation TetraKEs designed for the treatment of solid

tumors. It is a single-chain fusion protein composed of

CD16-IL15-EpCAM-CD133.

EpCAM is found on many solid tumor

cells of epithelial origin and CD133 is a marker for cancer stem

cells. This TetraKE is designed

to target not only the heterogeneous population of cancer cells

found in solid tumors but also the cancer stem cells that are

typically responsible for recurrences. We intend to initiate human

clinical trials for certain of our solid tumor product candidates later this

year.

|

|

|

|

|

|

|

|

|

|

|

|

Recent Developments

Collaboration Agreement

On March 10, 2020, we entered into a collaboration

agreement

with Cytovance®

Biologics, a USA-based contract development and manufacturing

organization and a subsidiary of the Shenzhen Hepalink

Pharmaceutical Group Co., Ltd. (“Hepalink”), to provide

development services for a TriKE therapeutic for

the treatment of the coronavirus infection. Under the terms of the

collaboration agreement, the

companies

will focus on preparing sufficient quantities of our

coronavirus TriKE drug

product for

preclinical evaluation using Cytovance’s E.

coli-based Keystone

Expression System™ and

subsequently, will scale-up production using Cytovance’s GMP

microbial manufacturing platform for evaluation of

TriKE in

humans to treat the coronavirus infection.

Financings

November 2020 Financing

In November, 2020, we entered into a securities purchase agreement

with three purchasers pursuant to which we issued convertible

debentures in an aggregate principal amount of $350,000 (the

“November 2020 Notes”).

The November 2020 Notes are convertible at any time, at the

holder’s option, into shares of our common stock at an

initial conversion price of $0.20 per share, subject to certain

beneficial ownership limitations (with a maximum ownership

limit of 9.99%). The conversion price is also subject to

adjustment due to certain events, including stock dividends, stock

splits and in connection with the issuance by the Company

of common stock or common stock equivalents at an

effective price per share lower than the conversion rate then in

effect. The November 2020 Notes will be subject to mandatory

conversion in the event of the completion of a future financing in

the amount of at least $15 million at a conversion price equal

to the lesser of (i) the conversion price in effect for the

November 2020 Notes on the date of completion of such financing or

(ii) 75% of the lowest per share price at which common stock

may be issued in connection with any conversion rights associated

with the financing, in each case, subject to the beneficial

ownership limitations described above.

The November 2020 Notes each have a term of six months and mature

in May, 2021, unless earlier converted or repurchased. The November

2020 Notes accrue interest at a rate of 10% per annum, subject to

increase to 18% per annum upon and during the occurrence of an

event of default. Interest is payable in cash or, at the

holder’s option, in shares of common stock based on

the conversion price then in effect. We may not prepay the

November 2020 Notes without the prior written consent of the

applicable holder.

September 2020 Financing

On September 16, 2020, we entered into a securities purchase

agreement with two purchasers pursuant to which we issued

convertible debentures in an aggregate principal amount of $250,000

(the “September 2020 Notes”).

The September 2020 Notes are convertible at any time, at the

holder’s option, into shares of our common stock at an

initial conversion price of $0.20 per share, subject to certain

beneficial ownership limitations (with a maximum ownership

limit of 9.99%). The conversion price is also subject to

adjustment due to certain events, including stock dividends, stock

splits and in connection with the issuance by the Company

of common stock or common stock equivalents at an

effective price per share lower than the conversion rate then in

effect. The September 2020 Notes will be subject to mandatory

conversion in the event of the completion of a future financing in

the amount of at least $15 million at a conversion price equal

to the lesser of (i) the conversion price in effect for the

September 2020 Notes on the date of completion of such financing or

(ii) 75% of the lowest per share price at which common stock

may be issued in connection with any conversion rights associated

with the financing, in each case, subject to the beneficial

ownership limitations described above.

The September 2020 Notes each have a term of six months and mature

on March 16, 2021, unless earlier converted or repurchased. The

September 2020 Notes accrue interest at a rate of 10% per annum,

subject to increase to 18% per annum upon and during the occurrence

of an event of default. Interest is payable in cash or, at the

holder’s option, in shares of common stock based on

the conversion price then in effect. We may not prepay the

September 2020 Notes without the prior written consent of the

applicable holder.

|

|

|

|

|

|

|

|

|

|

|

|

July 2020 Financing

On July 7, 2020, we entered into a securities purchase

agreement with ten purchasers pursuant to which we issued

convertible notes in an aggregate principal amount of

approximately $3.2 million (collectively, the “July 2020

Notes”).

The July 2020 Notes are convertible at any time, at the

holder’s option, into shares of our common stock at an

initial conversion price of $0.20 per share, subject to

certain beneficial ownership limitations (with a maximum

ownership limit of 9.99%). The conversion price is also

subject to adjustment due to certain events, including stock

dividends, stock splits and in connection with the issuance by the

Company of common stock or common stock equivalents at an

effective price per share lower than the conversion rate then in

effect. The July 2020 Notes will be subject to mandatory conversion

in the event of the completion of a future financing in the amount

of at least $15 million at a conversion price equal to the

lesser of (i) the conversion price in effect for the July 2020

Notes on the date of completion of such financing or (ii) 75% of

the lowest per share price at which common stock may be issued

in connection with any conversion rights associated with the

financing, in each case, subject to the beneficial ownership

limitations described above.

The July 2020 Notes each have a term of six months and mature on

January 7, 2021, unless earlier converted or repurchased. The July

2020 Notes accrue interest at a rate of 10% per annum, subject to

increase to 18% per annum upon and during the occurrence of an

event of default. Interest is payable in cash or, at the

holder’s option, in shares of common stock based on

the conversion price then in effect. We may not prepay the

July 2020 Notes without the prior written consent of the applicable

holder.

May 2020 Financing

Between April 20, 2020 and May 7, 2020, we entered into

securities purchase agreements with eight purchasers pursuant

to which we issued convertible notes in an aggregate principal

amount of approximately $2.0 million (collectively, the “May

2020 Notes”).

The May 2020 Notes are convertible at any time, at the

holder’s option, into shares of our common stock at an

initial conversion price of $0.20 per share, subject to

certain beneficial ownership limitations (with a maximum

ownership limit of 9.99%). The conversion price is also

subject to adjustment due to certain events, including stock

dividends, stock splits and in connection with the issuance by the

Company of common stock or common stock equivalents at an

effective price per share lower than the conversion rate then in

effect. The May 2020 Notes will be subject to mandatory conversion

in the event of the completion of a future financing in the amount

of at least $15 million at a conversion price equal to the

lesser of (i) the conversion price in effect for the May 2020

Notes on the date of completion of such financing or (ii) 75% of

the lowest per share price at which common stock may be issued

in connection with any conversion rights associated with the

financing, in each case, subject to the beneficial ownership

limitations described above.

The May 2020 Notes each have a term of six months and mature

between October 20, 2020 and November 7, 2020, unless earlier

converted or repurchased. The May 2020 Notes accrue interest at a

rate of 10% per annum, subject to increase to 18% per annum upon

and during the occurrence of an event of default. Interest is

payable in cash or, at the holder’s option, in shares

of common stock based on the conversion price then in

effect. We may not prepay the May 2020 Notes without the prior

written consent of the applicable holder.

January 2020 Financing

On January 30, 2020, we entered into a securities purchase

agreement with one purchaser pursuant to which

we issued

convertible notes in an aggregate principal amount of $0.2

million (the “January 2020 Notes”).

The

January 2020 Notes are convertible at any time, at the

holder’s option, into shares of our common stock at an

initial conversion price of $0.20 per share, subject to

certain beneficial ownership limitations (with a maximum

ownership limit of 9.99%). The conversion price is also

subject to adjustment due to certain events, including stock

dividends, stock splits and in connection with the issuance by the

Company of common stock or common stock equivalents at an

effective price per share lower than the conversion rate then in

effect.

|

|

|

|

|

|

|

|

|

|

|

|

The January 2020 Notes have a term of eight months and mature on

September 30, 2020, unless earlier converted or repurchased. The

January 2020 Notes accrue interest at a rate of 10% per annum,

subject to increase to 18% per annum upon and during the occurrence

of an event of default. Interest is payable in cash or, at the

holder’s option, in shares of common stock based on

the conversion price then in effect. We may not prepay the

January 2020 Notes without the prior written consent of the

holder.

The January 2020 Notes, together with the September 2020 Notes,

July 2020 Notes, the May 2020 Notes and the $0.2 million aggregate

principal amount of convertible notes issued in December 2019

(the “December 2019 Notes”) pursuant to a

securities purchase agreement, dated December 19, 2019,

between the Company and one purchaser, are referred to herein as

the “Bridge Notes.”

For additional information about our convertible notes and

debentures, see Note 2 to our unaudited financial

statements, Debt.

Forbearance Agreements

Effective as of June 23, 2020, we entered into Standstill and

Forbearance Agreements (as amended, collectively, the

“Forbearance Agreements”) with the holders of

approximately $13.2 million aggregate principal amount of our

outstanding convertible notes and

debentures

(including certain of the convertible notes issued pursuant to the

Bridge Financing) (collectively, the “Default Notes”),

which are currently in default. Pursuant to the Forbearance

Agreements, the holders of the Default Notes have agreed to forbear

from exercising their rights and remedies under the Default Notes

(including declaring such Default Notes (together with default

amounts and accrued and unpaid interest) immediately due and

payable) until the earlier of (i) the date that we complete a

future financing in the amount of at least $15 million and, in

connection therewith, commences listing on NASDAQ (collectively,

the “New Financing”) or (ii) February 15,

2021 (the “Termination

Date”).

Pursuant to the Forbearance Agreement, the holders of the Default

Notes have also agreed that the Default Notes (together with

default amounts and accrued and unpaid interest) will be converted

into common stock upon the

closing of a New Financing at a conversion price equal

to the lesser of (i) the conversion price in

effect for the Default Notes on the date of such New Financing or

(ii) 75% of the lowest per share price at which common stock is or may

be issued in connection with such New Financing, in each case,

subject to certain beneficial ownership limitations (with a maximum

ownership limit of 9.99%). Shares of our preferred

stock, which will be convertible into the Company’s

common

stock, will be issued in lieu of common stock to the

extent that conversion of the Default Notes is prohibited by such

beneficial ownership limitations.

For additional information regarding the terms of the Forbearance

Agreements, see "Indebtedness -

Forebearance Agreements" below.

Extensions of Certain Bridge Notes

Effective as of November 9, 2020, we entered into

extensions with the holders of approximately $1.2 million aggregate

principal amount of our outstanding convertible notes and

debentures to extend the maturity date thereof until the earlier of

(i) the date that we complete a future financing in the amount of

at least $15 million and, in connection therewith, commences

listing on NASDAQ (collectively, the “New Financing”)

or (ii) January 31, 2020 (the “Termination

Date”).

|

|

|

|

|

|

|

|

|

|

|

|

Settlement with Empery Funds

Settlement Agreement

On June 19, 2020, we entered into a settlement agreement (the

“Empery Settlement Agreement”) with Empery Asset Master

Ltd., Empery Tax Efficient, LP and Empery Tax Efficient II, LP

(collectively, the “Empery Funds”), Anthony Cataldo and

Paul Kessler resolving all remaining disputes

between the parties pertaining to certain convertible

notes (the

“Original Notes”) and warrants to

purchase common stock, par value

$0.001 per share, of the Company (the “common stock”)

(the “Original Warrants” and, together with the

Original Notes, the “Original Securities”) issued by

the Company to the Empery Funds in January 2018 pursuant to a

securities purchase agreement. As

previously disclosed, the Empery Funds made various allegations

regarding failures by the Company to take certain actions required

by the terms of the Original

Securities, all of which the

Company denied. See “Description

of Business—Legal Proceedings.”

As a result of the Empery

Settlement Agreement, the Company paid the Empery Funds cash

payments in an aggregate amount of $0.2 million. In addition,

pursuant to the Empery

Settlement Agreement, the Company issued to the Empery Funds,

solely in exchange for the outstanding Original Securities,

(i) an aggregate of 3.5 million shares of common stock (the

“Settlement Shares”), (ii) pre-funded

warrants to

purchase an aggregate of 5.5 million shares of common stock (the

“Settlement Warrants”) and (iii) senior

convertible notes in an aggregate

principal amount of $0.45 million (the “Empery

Settlement Notes” and,

together with the Settlement Shares and the Settlement

Notes, the

“Settlement Securities”).

Settlement Notes

The Empery

Settlement Notes are convertible at

any time, at the holder’s option, into shares of common stock

at an initial conversion rate of $0.20 per share, subject to

certain beneficial ownership limitations (with a maximum ownership

limit of 4.99%). The conversion price is also subject to adjustment

due to certain events, including stock dividends, stock splits and

in connection with the issuance by the Company of common stock or

common stock equivalents at an effective price per share lower than

the conversion rate then in effect.

By way of an

amendment to each Empery Settlement Note, effective as of December

22, 2020 (the “Empery Note Amendments”),

the maturity date of each Empery Settlement Note was extended to

March 19, 2021. The Empery Settlement Notes bear interest at a rate

of 10% per annum, subject to increase to 18% per annum upon and

during the occurrence of an event of default. Interest is payable

in cash or, at the holder’s option, in shares of common stock

based on the conversion price then in effect. As a result of the

Empery Note Amendments, the principal amount of each of the Empery

Settlement Notes was increased by fifteen percent (15%). The

current principal amount of the Empery Settlement Notes, after

giving effect to the Empery Note Amendments, is $517,500. By entry

into the Empery Note Amendments, the Empery Funds agreed to refrain

from selling, assigning or otherwise transferring or agreeing to

transfer any securities of the Company, until the earlier of

January 31, 2021 and the date that the Company completes the New

Financing.

Pursuant to the

terms of the Empery Settlement Notes, the Company is required to

make an offer to repurchase, at the holder’s option, the

Empery Settlement Notes at price in cash equal to 100% of the

aggregate principal amount of the Empery Settlement Note plus

accrued and unpaid interest, if any, to, but excluding, the date of

repurchase following the consummation by the Company of a capital

raising transactions, or a series of transactions, resulting in

aggregate gross proceeds to the Company in excess of $7.5 million.

The Company may not otherwise prepay the Empery Settlement Notes

without the prior written consent of the applicable Empery

Funds.

For additional

information regarding the terms of the Settlement Notes and

Settlement Agreement, see "Indebtedness - Convertible Notes and

Debentures" below.

Settlement Warrants

The Settlement Warrants provide for the purchase of up to an

aggregate of 5.5 million shares of common stock at an

exercise price of $0.20 per share, subject to adjustment in certain

circumstances, and expire on June 19, 2025. Exercise of the

warrant is

subject to certain additional terms and conditions, including

certain beneficial ownership limitations (with a maximum ownership limit of

4.99%).

Theorem Settlement

Settlement Agreement

On November 9,

2020, the Company, entered into a settlement agreement (the

“Theorem Settlement

Agreement”) with Adam Kasower (“Kasower”), East Ventures,

Inc., A British Virgin Islands company (“East Ventures”), SV Booth

Investments III, LLC, a Delaware limited liability company

(“SV

Booth”) and Theorem Group, LLC, a California limited

liability company (“Theorem Group” and,

collectively with Kasower, East Ventures and SV Booth, the

“Claimants”) resolving all

remaining disputes and claims between the parties pertaining to

certain securities purchase agreements pursuant to which the

Claimants purchased from the Company convertible warrants and

preferred stock.

|

|

|

|

|

|

|

|

|

|

|

|

As a result of the

Theorem Settlement Agreement, the Company has agreed to issue each

Claimant a convertible note in the following amounts (the

“Theorem Settlement

Notes”):

Theorem Group

$303,726.40

The Theorem

Settlement Agreement also contains certain representations and

warranties and covenants, including limitations on future variable

rate transactions and “at-the-market

offerings.”

Settlement Notes

The Theorem

Settlement Notes are convertible, at the option of the applicable

Claimant, at any time into shares of common stock at an initial

conversion rate of $0.20 per share, subject to certain beneficial

ownership limitations. The conversion price is also subject to

adjustment due to certain events, including stock dividends, stock

splits and in connection with the issuance by the Company of common

stock or common stock equivalents at an effective price per share

lower than the conversion rate then in effect. By way of an

amendment to each Theorem Settlement Note, effective as of January

31, 2021 (the “Theorem Note

Amendments”), the Theorem Settlement Notes maturity

date was extended to February 15, 2021. The Theorem Settlement

Notes bear interest at a rate of 10% per annum, subject to increase

to 18% per annum upon and during the occurrence of an event of

default. Interest is payable in cash or, at the holder’s

option, in shares of common stock based on the conversion price

then in effect. The Company may not prepay the Theorem Settlement

Notes without the prior written consent of the applicable

Claimant.

The Theorem

Settlement Notes contain a number of other affirmative and negative

covenants and events of default (including events of default

related to certain change of control and other fundamental change

transactions). Following an event of default, the Theorem

Settlement Notes will become immediately due and payable in cash at

a mandatory default amount equal to 130% of the outstanding

principal amount of the Theorem Settlement Notes plus all other

amounts, costs and expenses due in respect of the Theorem

Settlement Notes.

Alto B Settlement

Settlement Agreement

On December 22,

2020, the Company entered into a settlement agreement (the

“Alto B Settlement

Agreement”) and, together with the Empery Settlement

Agreement and the Theorem Settlement Agreement, the "Settlement

Agreements" with Alto Opportunity Master Fund, SPC - Segregated

Master Portfolio B (“Alto B”), Anthony Cataldo

and Paul Kessler resolving all remaining disputes and claims

between the parties pertaining to a certain note (the

“Original Alto B

Note”) and warrants to purchase common stock, par

value $0.001 per share (together with the Alto B Original Note, the

“Alto B Original

Securities”), of the Company issued by the Company to

Alto B in January 2018.

As a result of the

Alto B Settlement Agreement, the Company has agreed to pay Alto B a

cash payment in the amount of $180,000. In addition, pursuant to

the Alto B Settlement Agreement, the Company has agreed to issue

Alto B, solely in exchange for the outstanding Alto B Original

Securities, (i) 960,000 shares of common stock of the Company (the

“Alto B Settlement

Shares”) and (ii) a senior convertible note in an

aggregate principal amount of $500,00 (the “Alto B Settlement Note”

and together with the Alto B Settlement Shares, the

“Alto B Settlement

Securities”). In connection with the exchange, the

Alto B Original Securities will be cancelled and

extinguished.

The Alto B

Settlement Agreement also contains certain representations and

warranties and covenants, including limitations on future variable

rate transactions and “at-the-market

offerings.”

Settlement Notes

The Alto B

Settlement Note (referred to herein collectively with the Empery

Settlement Notes and the Theorem Settlement Notes, as the

“Settlement

Notes”) is convertible, at the option of Alto B, at

any time into shares of common stock of the Company at an initial

conversion rate of $0.20 per share, subject to certain beneficial

ownership limitations. The conversion price is also subject to

adjustment due to certain events, including stock dividends, stock

splits and in connection with the issuance by the Company of common

stock or common stock equivalents at an effective price per share

lower than the conversion rate then in effect. The

Alto B Settlement Note matures on January 31, 2021. The Alto

B Settlement Note bears interest at a rate of 10% per annum,

subject to increase to 18% per annum upon and during the occurrence

of an event of default. Interest is payable in cash or, at the

holder’s option, in shares of common stock based on the

conversion price then in effect.

Pursuant to the

terms of the Alto B Settlement Note, the Company is required to

make an offer to repurchase, at the option of Alto B, the Alto B

Settlement Note at price in cash equal to 100% of the aggregate

principal amount of the Alto B Settlement Note plus accrued and

unpaid interest, if any, to, but excluding, the date of repurchase

following the consummation by the Company of a capital raising

transactions, or a series of transactions, resulting in aggregate

gross proceeds to the Company in excess of $7.5 million. The

Company may not prepay the Alto B Settlement Note without the prior

written consent of Alto B.

The Alto B

Settlement Note contains a number of other affirmative and negative

covenants and events of default (including events of default

related to certain change of control and other fundamental change

transactions). Following an event of default, the Alto B Settlement

Note will become immediately due and payable in cash at a mandatory

default amount equal to 130% of the outstanding principal

amount of the Alto B Settlement Note plus all other amounts, costs

and expenses due in respect of the Alto B Settlement

Note.

|

|

|

|

|

|

|

|

|

|

|

|

Listing on the Nasdaq Capital Market

Our common stock is presently quoted on the OTCQB, one of the OTC

Markets Group over-the-counter markets, under the trading symbol

“GTBP.” In connection with this offering, we have

applied to list our common stock on the Nasdaq Capital

Market (“Nasdaq”) under the symbol “GTBP.” If our listing

application is approved, we expect to list our common stock upon

consummation of the offering, at which point our common stock will

cease to be traded on the OTCQB. No assurance can be given that our

listing application will be approved. This offering will occur only

if Nasdaq approves the listing of our common stock. Nasdaq listing

requirements include, among other things, a stock price threshold.

As a result, prior to effectiveness, we will need to take the

necessary steps to meet Nasdaq listing requirements, including but

not limited to a reverse split of our outstanding common stock. If

Nasdaq does not approve the listing of our common stock, we will

not proceed with this offering. There can be no assurance that our

common stock will be listed on the Nasdaq.

Reverse Stock Split

On January 14,

2021, our stockholders approved an amendment to

our restated certificate of incorporation to effect a reverse stock

split of our common stock at a ratio to be determined by our Board

prior to the effective time of the amendment of not less than

1-for-5 and not more than 1-for-30. The reverse stock

split will not impact the number of authorized shares of common

stock, which will remain at 750,000,000 shares. Unless

otherwise noted, the share and per share information in this

prospectus reflects, other than in our financial statements and the

notes thereto, a proposed reverse stock split of the outstanding

common stock and treasury stock of the Company at an assumed

1-for-9 ratio to occur

following the effective date, but prior to the closing

of the offering.

|

|

|

|

|

|

|

|

|

|

|

|

Summary Risk Factors

Participating in this offering involves

substantial risk. Our ability to execute our strategy is also

subject to certain risks. You should carefully consider all of the

information set forth in this prospectus and, in particular, should

evaluate the specific factors set forth under the heading

“Risk

Factors” in deciding

whether to invest in our securities. These risks include, but are

not limited to, the following:

●

Our

business is at an early stage of development and we may not develop

therapeutic products that can be commercialized.

●

We

have a history of operating losses and we expect to continue to

incur losses for the foreseeable future.

We may never generate revenue or achieve

profitability.

●

Our

independent auditor’s report for the years ended December 31,

2019 and 2018 is qualified as to our ability to continue as a going

concern.

●

We

will need additional capital to conduct our operations and develop

our products, and our ability to obtain the necessary funding is

uncertain.

●

Our

current and future indebtedness may impose significant operating

and financial restrictions on us and affect our ability to access

liquidity.

●

The

cost of our research and development programs may be significantly

higher than expected, and there is no assurance that

they will successful in a timely manner, or at all.

●

We

have identified material weaknesses in our internal controls over

financial reporting and have not yet remedied these weaknesses. If

we fail to maintain an effective system of internal control over

financial reporting, we may not be able to accurately report our

financial results or prevent fraud. As a result, stockholders could

lose confidence in our financial and other public reporting, which

would harm our business and the trading price of our common

stock.

●

If

our efforts to protect the proprietary nature of the intellectual

property related to our technologies are not adequate, we may not

be able to compete effectively in our market and our business would

be harmed.

●

Claims

that we infringe the intellectual property rights of others may

prevent or delay our drug discovery and development

efforts.

●

We

may desire, or be forced, to seek additional licenses to use

intellectual property owned by third parties, and such licenses may

not be available on commercially reasonable terms, or at

all.

●

If

we are unsuccessful in obtaining or maintaining patent protection

for intellectual property in development or licensed from third

parties, our business and competitive position would be

harmed.

●

If

we fail to meet our obligations under our license agreements, we

may lose our rights to key technologies on which our business

depends.

●

Our

reliance on the activities of our non-employee consultants,

research institutions and scientific contractors, whose activities

are not wholly within our control, may lead to delays in

development of our proposed products.

|

|

|

|

|

|

|

|

|

|

|

|

●

Clinical

drug development is costly, time-consuming and uncertain, and we

may suffer setbacks in our clinical development program that could

harm our business.

●

If

we experience delays or difficulties in the enrollment of patients

in clinical trials, those clinical trials could take longer than

expected to complete and our receipt of necessary regulatory

approvals could be delayed or prevented.

●

Obtaining

regulatory approval, even after clinical trials that

are believed to be successful, is an uncertain

process.

●

We

will continue to be subject to extensive FDA regulation following

any product approvals, and if we fail to comply with these

regulations, we may suffer a significant setback in our

business.

●

Many

of our business practices are subject to scrutiny and potential

investigation by regulatory and government enforcement authorities,

as well as to lawsuits brought by private citizens under federal

and state laws. We could become subject to investigations, and our

failure to comply with applicable law or an adverse decision in

lawsuits may result in adverse consequences to us. If we fail to

comply with U.S. healthcare laws, we could face substantial

penalties and financial exposure, and our business, operations and

financial condition could be adversely affected.

●

Our

product candidates may cause undesirable side effects or have other

properties that could delay or prevent their regulatory approval,

limit the commercial profile of an approved label, or result in

significant negative consequences following marketing approval, if

any.

●

We

may expend our limited resources to pursue a particular product

candidate or indication that does not produce any commercially

viable products and may fail to capitalize on product candidates or

indications that may be more profitable or for which there is a

greater likelihood of success.

●

Our

products may be expensive to manufacture, and they may not be

profitable if we are unable to control the costs to manufacture

them.

●

We

currently lack manufacturing capabilities to produce our

therapeutic product candidates at commercial-scale quantities and

do not have an alternate manufacturing supply, which would

negatively impact our ability to meet any demand for the

product.

●

Our

business is based on novel technologies that are inherently

expensive and risky and may not be understood by or accepted in the

marketplace, which could adversely affect our future

value.

●

We

could be subject to product liability lawsuits based on the use of

our product candidates in clinical testing or, if obtained,

following marketing approval and commercialization. If product

liability lawsuits are brought against us, we may incur substantial

liabilities and may be required to cease clinical testing or limit

commercialization of our product candidates.

●

We

rely on third parties to supply candidates for

clinical testing and to conduct preclinical and clinical trials of

our product candidates. If these third parties do not successfully

carry out their contractual duties or meet expected deadlines, we

may not be able to obtain regulatory approval for or commercialize

our product candidates. As a result, our business

could be substantially harmed.

Corporate Information

Our principal executive offices are located at 9350 Wilshire Blvd.

Suite 203, Beverly Hills, CA 90212, and our telephone number is

(800) 304¬9888. We maintain a website at www.gtbiopharma.com.

Information contained on or accessible through our website is not,

and should not be considered, part of, or incorporated by reference

into, this prospectus.

|

|

|

|

|

|

The Offering

|

Units

offered by us

|

Units, each consisting of (i) one share of common

stock and (ii) one Common Warrant to purchase

share of common stock. The Units will not be

certificated, and the share of common stock and Common Warrant

comprising each Unit are immediately separable and will be issued

separately in this offering.

This

prospectus also relates to the offering of shares of common stock

issuable upon the exercise of the Common Warrants included in the

Units.

|

|

Pre-Funded

Units offered by us

|

We

are also offering to those purchasers whose purchase of Units in

this offering would result in the purchaser, together with its

affiliates and certain related parties, beneficially owning more

than 4.99% (or, at the election of the purchaser, 9.99%) of our

outstanding common stock immediately following the consummation of

this offering, the opportunity to purchase, in lieu of Units that

would otherwise result in ownership in excess of 4.99% (or, at the

election of the purchaser, 9.99%) of our outstanding common

stock,

Pre-Funded Units. The purchase price of each Pre-Funded Unit will

equal the public offering price at which the Units are being sold

to the public in this offering, minus $0.001, and the exercise

price of each Pre-Funded Warrant included in each Pre-Funded Unit

will be $0.001 per Common Share.

Each Pre-Funded Unit will consist of (i) one

Pre-Funded Warrant to purchase one share of common stock and (ii)

one Common Warrant to purchase

shares of common

stock. The Pre-Funded Units will not be certificated and the

Pre-Funded Warrants and the Common Warrants comprising each

Pre-Funded Unit are immediately separable and will be issued

separately in this offering.

This

prospectus also relates to the offering of shares of common stock

issuable upon exercise of the Pre-Funded Warrants and the Common

Warrants included in the Pre-Funded Units.

|

|

Common

Warrants offered by us

|

Each Common Warrant will have an exercise price of

$

per share of common stock, will be exercisable at

any time after the date of issuance and will expire on the

anniversary of the date of issuance. To better

understand the terms of the Common Warrants, you should carefully

read the “Description of Securities We are Offering”

section of this prospectus.

|

|

Pre-Funded

Warrants offered by us

|

Each

Pre-Funded Warrant will have an exercise price of $0.001 per share

of common stock and will be exercisable any time after the date of

issuance and may be exercised at any time until exercised in full.

To better understand the terms of the Pre-Funded Warrants, you

should carefully read the “Description of Securities We are

Offering” section of this prospectus.

|

|

Offering

Price

|

The offering price is $

per Unit and $

per Pre-Funded Unit.

|

|

Total

shares of common stock outstanding immediately after this

offering

|

shares

of common stock, assuming that the maximum number of Units offered

by this prospectus is sold in this offering and no sale of any

Pre-Funded Units and assuming none of the Common Warrants or

Underwriter Warrants (as defined below) issued in this offering are

exercised.

|

|

Over

Allocation Option

|

Pursuant

to the underwriting agreement, we granted to the

underwriters an option, exercisable within 45 days

after the closing of this offering to acquire up to an additional

15% of the total Units to be offered, solely for the purpose of

covering over-allotments, if any, which may be exercised for

shares of common stock, warrants or both at the election of the

underwriters.

|

|

Use of

Proceeds

|

We intend to use the net proceeds of this offering

for general corporate purposes, which includes among other

purposes, the funding and expansion of our ongoing clinical trials

and the continued development of our pipeline of candidate

products. See “Use of

Proceeds.”

|

|

Existing

Trading Market

|

Our common stock is currently quoted on the OTCQB,

one of the OTC Markets Group over-the-counter markets, under the

trading symbol “GTBP.” In connection with this

offering, we have applied to have our shares of common stock listed

for trading on the Nasdaq Capital Market under the symbol

“GTBP.

”We do not intend to list the Common Warrants or

the Pre-Funded Warrants on any securities exchange or nationally

recognized trading system.

|

|

Reverse

Stock Split

|

On January 14, 2021 our stockholders

approved an amendment to our restated certificate of