UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For

the quarterly period ended

| Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from __________ to ____________.

Commission

File Number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

(Address not applicable1)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of exchange on which registered | ||

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller

reporting company | |

| Emerging

growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of November 10, 2024, the registrant had shares of common stock outstanding.

1

Effective as of July 1, 2024, the Company

became a fully remote company. We do not maintain a principal executive office. For purposes of compliance with applicable requirements

of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended, any stockholder communication required

to be sent to the Company’s principal executive offices may be directed to

GT Biopharma, Inc. and Subsidiaries

FORM 10-Q

For the Nine Months Ended September 30, 2024

Table of Contents

| 2 |

GT BIOPHARMA, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

| September 30, 2024 | December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Restricted cash | ||||||||

| Short-term investments | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Total Current Assets | ||||||||

| Operating lease right-of-use asset | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued expenses | ||||||||

| Current operating lease liability | ||||||||

| Warrant liability | ||||||||

| Total Current Liabilities | ||||||||

| Stockholders’ Equity | ||||||||

| Convertible Preferred stock, par value $, shares authorized Series C - shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | ||||||||

| Common stock, par value $, shares authorized, and shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | ||||||||

| Additional paid in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total Stockholders’ Equity | ||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 3 |

GT BIOPHARMA, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

| For The Three Months Ended | For the Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||

| Operating Expenses: | ||||||||||||||||

| Research and development | $ | $ | $ | $ | ||||||||||||

| Selling, general and administrative (including $ and $ from stock compensation granted to officers, directors, and employees and for services for the three months ended September 30, 2024 and 2023, respectively, and $ and $ for the nine months ended September 30, 2024 and 2023, respectively) | ||||||||||||||||

| Loss from Operations | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other Income (Expense) | ||||||||||||||||

| Interest income | ||||||||||||||||

| Interest expense | ( | ) | ||||||||||||||

| Change in fair value of warrant liability | ||||||||||||||||

| Gain on extinguishment of debt | ||||||||||||||||

| Unrealized gain on marketable securities | ||||||||||||||||

| Total Other Income, Net | ||||||||||||||||

| Net Loss | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Net Loss Per Share - Basic and Diluted | $ | ) | $ | ) | $ | ) | $ | ) | ||||||||

| Weighted average common shares outstanding - basic and diluted | ||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 4 |

GT BIOPHARMA, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For The Three and Nine Months Ended September 30, 2024 (Unaudited):

| Preferred Shares | Common Shares | Additional Paid in | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Total | ||||||||||||||||||||||

| Balance, June 30, 2024 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||

| Balance, September 30, 2024 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||

| Preferred Shares | Common Shares | Additional Paid in | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Total | ||||||||||||||||||||||

| Balance, December 31, 2023 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||

| Issuance of common stock and warrants for cash | - | |||||||||||||||||||||||||||

| Cancellation of common stock issued to prior CFO | - | ( | ) | |||||||||||||||||||||||||

| Issuance of common shares to settle vendor payable | - | |||||||||||||||||||||||||||

| Fair value of vested stock options | - | - | ||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||

| Balance, September 30, 2024 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 5 |

GT BIOPHARMA, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For The Three and Nine Months Ended September 30, 2023 (Unaudited):

| Preferred Shares | Common Shares | Additional Paid in | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Total | ||||||||||||||||||||||

| Balance, June 30, 2023 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||

| Issuance of common shares for services | - | |||||||||||||||||||||||||||

| Issuance of common shares to settle vendor payable | - | |||||||||||||||||||||||||||

| Fair value of vested stock options | - | - | ||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||

| Balance, September 30, 2023 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||

| Preferred Shares | Common Shares | Additional Paid in | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Total | ||||||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||

| Private placement of common stock | - | |||||||||||||||||||||||||||

| Issuance of common stock for exercise of prefunded warrants | - | |||||||||||||||||||||||||||

| Initial recognition of fair value of warrant liability | - | - | ( | ) | ( | ) | ||||||||||||||||||||||

| Issuance of common shares for services | - | |||||||||||||||||||||||||||

| Issuance of common shares to settle vendor payable | - | |||||||||||||||||||||||||||

| Fair value of vested stock options | - | - | ||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||

| Balance, September 30, 2023 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 6 |

GT BIOPHARMA, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

| For The Nine Months Ended | ||||||||

| September 30, | ||||||||

| 2024 | 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Stock based compensation – services | ||||||||

| Stock based compensation - officers, directors, and employees | ||||||||

| Change in fair value of warrant liability | ( | ) | ( | ) | ||||

| Gain on extinguishment of share settled debt | ( | ) | ||||||

| Change in operating lease right-of-use assets | ||||||||

| Unrealized loss (gain) on marketable securities | ( | ) | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Decrease in prepaid expenses | ( | ) | ||||||

| Increase (Decrease) in accounts payable and accrued expenses | ( | ) | ||||||

| (Decrease) in operating lease liability | ( | ) | ( | ) | ||||

| Net Cash Used in Operating Activities | ( | ) | ( | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Sale (Purchase) of investments | ( | ) | ||||||

| Net Cash Provided by (Used in) Investing Activities | ( | ) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Proceeds from issuance of common stock and warrants, net | ||||||||

| Net Cash Provided by Financing Activities | ||||||||

| Net Increase (Decrease) in Cash and Cash Equivalents and Restricted Cash | ( | ) | ||||||

| Cash and Cash Equivalents and Restricted Cash at Beginning of Period | ||||||||

| Cash and Cash Equivalents and Restricted Cash at End of Period | $ | $ | ||||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | ||||||||

| Cash paid during the year for: | ||||||||

| Interest | $ | $ | ||||||

| Income taxes | $ | $ | ||||||

| SUPPLEMENTAL DISCLOSURES OF NON-CASH INVESTING AND FINANCING ACTIVITIES | ||||||||

| Initial recognition of fair value of warrant liability | $ | $ | ||||||

| Fair value of common stock issued to a vendor to settle accounts payable | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 7 |

GT BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Nine Months Ended September 30, 2024 and 2023 (Unaudited)

Note 1 – Organization and Going Concern Analysis

Organization

The corporate predecessor of GT Biopharma, Inc, Diagnostic Data, Inc., was incorporated in the state of California in 1965. Diagnostic Data, Inc. changed its incorporation to the state of Delaware on December 21, 1972 and changed its name to DDI Pharmaceuticals, Inc. on March 11, 1985. On September 7, 1994, DDI Pharmaceuticals, Inc. merged with International BioClinical, Inc. and Bioxytech S.A. and changed its name to OXIS International, Inc. On July 17, 2017, OXIS International, Inc. changed its name to GT Biopharma, Inc.

Throughout this Quarterly Report on Form 10-Q, the terms “GTBP,” “we,” “us,” “our,” “the Company” and “our Company” refer to GT Biopharma, Inc.

The GT Biopharma logo, TriKE®, and other trademarks or service marks of GT Biopharma, Inc. appearing in this quarterly report are the property of the Company. This quarterly report on Form 10-Q also contains registered marks, trademarks and trade names of other companies. All other trademarks, registered marks and trade names appearing herein are the property of their respective holders.

The Company is a clinical stage biopharmaceutical company focused on the development and commercialization of novel immune-oncology products based on our proprietary Tri-specific Killer Engager (TriKE®), and Tetra-specific Killer Engager (Dual Targeting TriKE®) platforms. The Company’s TriKE® and Dual Targeting TriKE® platforms generate proprietary therapeutics designed to harness and enhance the cancer killing abilities of a patient’s own natural killer cells (NK cells).

Going Concern Analysis

The

accompanying unaudited condensed consolidated financial statements have been prepared assuming that the Company will continue as a going

concern. The Company does not have any product candidates approved for sale and has not generated any revenue from its product sales.

The Company has sustained operating losses since inception, and expects such losses to continue into the foreseeable future. Historically,

the Company has financed its operations through public and private sales of common stock, issuance of preferred and common stock, issuance

of convertible debt instruments, and strategic collaborations. For the nine months ended September 30, 2024, the Company recorded a net

loss of approximately $

The unaudited condensed consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern. Accordingly, the unaudited condensed consolidated financial statements have been prepared on a basis that assumes the Company will continue as a going concern and which contemplates the realization of assets and satisfaction of liabilities and commitments in the ordinary course of business.

The Company has evaluated the significance of the uncertainty regarding the Company’s financial condition in relation to its ability to meet its obligations, which has raised substantial doubt about the Company’s ability to continue as a going concern. While it is very difficult to estimate the Company’s future liquidity requirements, the Company believes if it is unable to obtain additional financing, existing cash resources will not be sufficient to enable it to fund the anticipated level of operations through one year from the date the accompanying unaudited condensed consolidated financial statements are issued. There can be no assurances that the Company will be able to secure additional financing on acceptable terms. In the event the Company does not secure additional financing, the Company will be forced to delay, reduce, or eliminate some or all of its discretionary spending, which could adversely affect the Company’s business prospects, ability to meet long-term liquidity needs and the ability to continue operations.

Note 2 – Summary of Significant Accounting Policies

Basis of Presentation and Principles of Consolidation

The condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Oxis Biotech, Inc. and Georgetown Translational Pharmaceuticals, Inc. All intercompany transactions and balances have been eliminated in consolidation.

| 8 |

The accompanying condensed consolidated financial statements are unaudited. These unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and applicable rules and regulations of the Securities and Exchange Commission (“SEC”) regarding interim financial reporting. Certain information and note disclosures normally included in the financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. Accordingly, these interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the SEC on March 26, 2024 (the “2023 Annual Report”). The consolidated balance sheet as of December 31, 2023 included herein, was derived from the audited consolidated financial statements as of that date.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements contain all adjustments necessary to fairly present the Company’s financial position and results of operations for the interim periods reflected. Except as noted, all adjustments contained herein are of a normal recurring nature. Results of operations for the fiscal periods presented herein are not necessarily indicative of fiscal year-end results.

Accounting Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates include management’s estimates for continued liquidity, accruals for potential liabilities, assumptions used in deriving the fair value of derivative liabilities, valuation of equity instruments issued for debt and services and realization of deferred tax assets.

Cash Equivalents and Short-Term Investments

The

Company considers highly liquid investments with maturities of three months or less at the date of acquisition as cash equivalents in

the accompanying unaudited condensed consolidated financial statements. At September 30, 2024 total cash equivalents which consist of

money market funds and US treasuries, amounted to approximately $

Management

generally determines the appropriate classification of its investments at the time of purchase. We classify these investments as short-term

investments, as part of current assets, based upon our ability and intent to use any and all of these investments as necessary to satisfy

liquidity requirements that may arise from our business. Investments are carried at fair value with the unrealized holding gains and

losses reported in the accompanying unaudited condensed consolidated statements of operations. At September 30, 2024 and December 31,

2023, total short-term investments which consist of US treasuries and US government agencies, amounted to approximately $ and $

Restricted Cash

As of September 30, 2024, the Company has classified certain cash balances as restricted cash in its unaudited condensed consolidated balance sheets. The Company’s restricted cash is deposited in a financial institution and held as a collateral for a credit card agreement with the same financial institution.

Fair Value of Financial Instruments

Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 820-10 requires entities to disclose the fair value of financial instruments, both assets and liabilities recognized and not recognized on the balance sheet for which it is practicable to estimate fair value. ASC 820-10 defines the fair value of a financial instrument as the amount at which the instrument could be exchanged in a current transaction between willing parties.

The three levels of the fair value hierarchy are as follows:

Level 1 Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities that the entity has the ability to access.

Level 2 Valuations based on quoted prices for similar assets or liabilities, quoted prices in markets that are not active, or other inputs that are observable or can be corroborated by observable data for substantially the full term of the assets or liabilities.

Level 3 Valuations based on inputs that are unobservable, supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

| 9 |

The carrying amounts of the Company’s other financial assets and liabilities, such as cash and cash equivalents, short term investments, prepaid expenses and other current assets, accounts payable, accrued expenses, approximate their fair values because of the short maturity of these instruments.

The

carrying amount of the Company’s warrant liability of $

Warrant Liability

The Company evaluates its financial instruments to determine if such instruments are derivatives or contain features that qualify as embedded derivatives in accordance with ASC Topic 815, “Derivatives and Hedging” (“ASC 815”). For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported in the statements of operations.

The Company’s use of derivative financial instruments is generally limited to warrants issued by the Company that do not meet the criteria for equity treatment and are recorded as liabilities. We do not use financial instruments or derivatives for any trading purposes.

Common Stock (February 2024 Reverse Stock Split)

As a result of the reverse stock-split, every thirty (30) shares of issued and outstanding common stock were automatically combined into one issued and outstanding share of common stock, without any change in the par value per share. No fractional shares will be issued in connection with the reverse stock split. Stockholders who otherwise would be entitled to receive fractional shares of common stock will be entitled to receive their pro-rata portion of the net proceeds obtained from the aggregation and sale by the exchange agent of the fractional shares resulting from the reverse stock-split (reduced by any customary brokerage fees, commission and other expenses). The reverse stock split reduced the number of shares of common stock outstanding on the effective date of the reverse stock-split from shares to shares, subject to minor adjustments due to the treatment of fractional shares. The number of authorized shares of common stock remains unchanged at shares.

Proportionate adjustments have been made to the per share exercise price and the number of shares of common stock that may be purchased upon exercise of outstanding stock options and warrants for the Company’s common stock, and to the number of shares of common stock reserved for future issuance pursuant to the Company’s 2022 Omnibus Incentive Plan.

All share and per share information within this report have been adjusted to retroactively reflect the reverse stock-split as of the earliest period presented.

Stock-Based Compensation

The Company periodically issues stock-based compensation to officers, directors, employees, and consultants for services rendered. Such issuances vest and expire according to terms established at the issuance date.

Stock-based payments to officers, directors, employees, and consultants in exchange for goods and services, which include grants of employee stock options, are recognized in the financial statements based on their grant date fair values in accordance with ASC 718, Compensation-Stock Compensation. Stock based payments to officers, directors, employees, and consultants, which are generally time vested, are measured at the grant date fair value and depending on the conditions associated with the vesting of the award, compensation cost is recognized on a straight-line or graded basis over the vesting period. Recognition of compensation expense for non-employees is in the same period and manner as if the Company had paid cash for the services. The fair value of stock options granted is estimated using the Black-Scholes option-pricing model, which uses certain assumptions related to risk-free interest rates, expected volatility, expected life, and future dividends. The assumptions used in the Black-Scholes option pricing model could materially affect compensation expense recorded in future periods.

Research and Development Expenses

Costs incurred for research and development are expensed as incurred. The salaries, benefits, and overhead costs of personnel conducting research and development of the Company’s products are included in research and development expenses. Purchased materials that do not have an alternative future use are also expensed.

| 10 |

Leases

The Company accounts for its lease in accordance with the guidance of ASC 842, Leases. The Company determines whether a contract is, or contains, a lease at inception. Right-of-use assets represent the Company’s right to use an underlying asset during the lease term, and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. Right-of-use assets and lease liabilities are recognized at lease commencement based upon the estimated present value of unpaid lease payments over the lease term. The Company uses its incremental borrowing rate based on the information available at lease commencement in determining the present value of unpaid lease payments.

In June 2024, the Company’s lease expired and was not renewed.

Basic earnings (loss) per share is computed using the weighted-average number of common shares outstanding during the period. Diluted earnings (loss) per share is computed using the weighted-average number of common shares and the dilutive effect of contingent shares outstanding during the period. Potentially dilutive contingent shares, which primarily consist of stock issuable upon exercise of stock options and warrants have been excluded from the diluted loss per share calculation because their effect is anti-dilutive.

September 30, 2024 (Unaudited) | September 30, 2023 (Unaudited) | |||||||

| Options to purchase common stock | ||||||||

| Warrants to purchase common stock | ||||||||

| Total anti-dilutive securities | ||||||||

Concentration

Cash

is deposited in one financial institution. The balances held at this financial institution at times may be in excess of Federal Deposit

Insurance Corporation (“FDIC”) insurance limits of up to $

The Company has a significant concentration of expenses incurred from and accounts payable and accrued expenses to Cytovance, a related party, and the University of Minnesota, see Note 4 – Accounts Payable and Related Party.

Segments

The Company determined its reporting units in accordance with “Segment Reporting” (“ASC 280”). Management evaluates a reporting unit by first identifying its operating segments under ASC 280. The Company then evaluates each operating segment to determine if it includes one or more components that constitute a business. If there are components within an operating segment that meet the definition of a business, the Company evaluates those components to determine if they must be aggregated into one or more reporting units. If applicable, when determining if it is appropriate to aggregate different operating segments, the Company determines if the segments are economically similar and, if so, the operating segments are aggregated.

Management has determined that the Company has one consolidated operating segment. The Company’s reporting segment reflects the manner in which its chief operating decision maker reviews results and allocates resources. The Company’s reporting segment meets the definition of an operating segment and does not include the aggregation of multiple operating segments. As a result no further segment information is presented in these consolidated financial statements.

Recent Accounting Pronouncements

In November 2023, the FASB issued ASU No. 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures” (“ASU 2023-07”), which introduces new reportable segment disclosure requirements related to significant segment expenses and also expands reportable segment disclosure requirements for interim reporting. The amendment will require public entities to disclose significant segment expenses that are regularly provided to the chief operating decision maker and are included within each reportable segment’s profits and losses. This standard became effective for the Company on January 1, 2024. The adoption of this standard did not have a material impact on the Company’s results of operations, financial position or cash flows.

The Company’s management has evaluated all the recently issued, but not yet effective, accounting standards and guidance that have been issued or proposed by the FASB or other standards-setting bodies through the filing date of these financial statements and does not believe the future adoption of any such pronouncements will have a material effect on the Company’s financial position and results of operations.

| 11 |

Note 3 – Fair Value of Financial Instruments

Financial Assets

The following table represents the estimated fair values of the Company’s financial instruments:

| September 30, 2024 (Unaudited) | ||||||||||||||||

| Unrealized | Unrealized | Fair | ||||||||||||||

| Cost | Gains | Losses | Value | |||||||||||||

| Short-term investments | $ | $ | $ | $ | ||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

| December 31, 2023 | ||||||||||||||||

| Unrealized | Unrealized | Fair | ||||||||||||||

| Cost | Gains | Losses | Value | |||||||||||||

| Short-term investments | $ | $ | $ | $ | ||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

The following table represents the Company’s fair value hierarchy for its financial assets (cash equivalents and investments):

| September 30, 2024 (Unaudited) | ||||||||||||||||

| Fair Value | Level 1 | Level 2 | Level 3 | |||||||||||||

| Cash equivalents: | ||||||||||||||||

| Money market funds | $ | $ | $ | $ | ||||||||||||

| US treasuries | ||||||||||||||||

| Short-term investments: | ||||||||||||||||

| US treasuries | ||||||||||||||||

| Total financial assets | $ | $ | $ | $ | ||||||||||||

| December 31, 2023 | ||||||||||||||||

| Fair Value | Level 1 | Level 2 | Level 3 | |||||||||||||

| Cash equivalents: | ||||||||||||||||

| Money market funds | $ | $ | $ | $ | ||||||||||||

| Short-term investments: | ||||||||||||||||

| US treasuries and US gov’t. agencies | ||||||||||||||||

| Total financial assets | $ | $ | $ | $ | ||||||||||||

Warrant Liability

For the details of warrant liability transactions see Note 5 – Warrant Liability.

Note 4 – Accounts Payable and Related Party

Accounts payable consists of the following:

| As of | As of | |||||||

| September 30, 2024 | December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| Accounts payable to Cytovance, a related party 1 | $ | $ | ||||||

| Accounts payable to University of Minnesota | ||||||||

| Other accounts payable | |

|

||||||

| Total accounts payable | $ | $ | ||||||

| 1 |

| 12 |

See Note 8 – Commitments and Contingencies, Significant Agreements.

The details of the Company’s accounts payable to Cytovance Biologics, Inc., were as follows:

| Nine Months Ending | ||||||||

| September 30, 2024 | September 30, 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Beginning balance | $ | $ | ||||||

| Invoices, net | ||||||||

| Payments in cash | ( | ) | ( | ) | ||||

| Payments in common stock, at fair value | ( | ) | ( | ) | ||||

| Ending balance | $ | $ | ||||||

University of Minnesota

See Note 8 – Commitments and Contingencies, Significant Agreements.

Note 5 – Warrant Liability

2023 Warrants

On

January 4, 2023, as part of the private placement offering, the Company issued common stock, warrants to purchase up to an aggregate

of

The 2023 Common Warrants and the 2023 Placement Agents Warrants (collectively the “2023 Warrants”), provide for a value calculation for the warrants using the Black Scholes model in the event of certain fundamental transactions. The fair value calculation provides for a floor on the volatility amount utilized in the value calculation at % or greater. The Company has determined this provision introduces leverage to the holders that could result in a value that would be greater than the settlement amount of a fixed-for-fixed option on the Company’s own equity shares. Therefore, pursuant to ASC 815, the Company has classified the 2023 Warrants as a liability in its consolidated balance sheet. The classification of the 2023 Warrants, including whether they should be recorded as liability or as equity, is evaluated at the end of each reporting period.

The

2023 Warrants were initially recorded at a fair value at $

The 2023 Warrant liability is valued using a Binomial pricing model with the following assumptions:

| 2023 Warrants | ||||||||

| September 30, 2024 | December 31, 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Stock price | $ | $ | ||||||

| Risk-free interest rate 1 | % | % | ||||||

| Expected volatility 2 | % | % | ||||||

| Expected life (in years) 3 | ||||||||

| Expected dividend yield 4 | ||||||||

| Fair value of warrants | $ | $ | ||||||

| 1 |

| 2 |

| 3 |

| 4 |

| 13 |

2020 Warrants

The Company issued warrants underlying shares of common stock during the year ended December 31, 2020 (the “2020 Warrants”), that contained a fundamental transaction provision that could give rise to an obligation to pay cash to the warrant holder upon occurrence of certain change in control type events. In accordance with ASC 480, the fair value of the 2020 Warrants is classified as a liability in the Company’s unaudited condensed consolidated balance sheets and will be re-measured at the end of every reporting period with the change in value reported in the unaudited condensed consolidated statements of operations until they are either exercised or expire.

The 2020 Warrant liability is valued using a Binomial pricing model with the following assumptions:

| 2020 Warrants | ||||||||

| September 30, 2024 | September 30, 2023 | |||||||

| (Unaudited) | ||||||||

| Stock price | $ | $ | ||||||

| Risk-free interest rate 1 | % | % | ||||||

| Expected volatility 2 | % | % | ||||||

| Expected life (in years) 3 | ||||||||

| Expected dividend yield 4 | ||||||||

| Fair value of warrants | $ | $ | ||||||

Warrant Liability

The details of warrant liability transactions were as follows:

| Nine Months Ending | ||||||||

| September 30, 2024 | September 30, 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Beginning balance | $ | $ | ||||||

| Issuance of warrants at fair value | ||||||||

| Change in fair value | ( | ) | ( | ) | ||||

| Extinguishment | ||||||||

| Ending balance | $ | $ | ||||||

Note 6 – Stockholders’ Equity

The Company’s authorized capital as of September 30, 2024 was shares of common stock, par value $ per share, and shares of preferred stock, par value $ per share.

Common Stock

2024 Common Stock Offering

On

May 23, 2024, the Company received gross proceeds of approximately $

Pursuant to the Purchase Agreement, the Company agreed, with certain exceptions, for a period of 60 days following the closing of the offering not to issue, enter into an agreement to issue or announce the issuance or proposed issuance of the 2024 Shares or any other securities convertible into, or exercisable or exchangeable for, shares of the Company’s common stock. The Company has also agreed for a period of one year following the closing date of the offering not to (i) issue or agree to issue equity or debt securities convertible into, or exercisable or exchangeable for, shares at a conversion price, exercise price or exchange price which floats with the trading price of the 2024 Shares or which may be adjusted after issuance upon the occurrence of certain events or (ii) enter into any agreement, including an equity line of credit, whereby the Company may issue securities at a future-determined price.

| 14 |

The Company determined that under ASC 815-40, the 2024 Common Warrants and the 2024 Placement Agent Warrants do not contain a clause that adjusts the exercise price based on circumstances not considered to be within the Company’s control and are considered indexed to the Company’s own stock and eligible for an exception from derivative accounting. Accordingly, the fair value of the 2024 Common Warrants and the 2024 Placement Agent Warrants are classified as equity.

2023 Private Placement of Common Stock

On

January 4, 2023, the Company received gross proceeds of $

The

2023 Common Warrants and the 2023 Placement Agents Warrants contained a clause not considered to be within the Company’s control.

The Company determined that the provision represented a variable that is not an input to the fair value of a “fixed-for-fixed”

option as defined under ASC 815-40, and thus the 2023 Common Warrants and the 2023 Placement Agent Warrants are not considered indexed

to the Company’s own stock and not eligible for an exception from derivative accounting. Accordingly, the 2023 Common Warrants

and the 2023 Placement Agent Warrants were classified as a warrant liability, and $

Common Stock Issued for Services

During

the nine months ended September 30, 2023, the Company issued shares of common stock with a fair value of $

Preferred Stock

Series C Preferred Stock

As of September 30, 2024 and December 31, 2023, there were shares of series C preferred stock, par value $ per share (the “Series C Preferred Stock”) issued and outstanding.

As a result of reverse stock splits in previous years and the agreement terms for adjusting the rights of the related shares, the shares of Series C Preferred Stock are not currently convertible, have no voting rights, and in the event of liquidation, the holders of the Series C Preferred Stock would not participate in any distribution of the assets or surplus funds of the Company. The holders of Series C Preferred Stock also are not currently entitled to any dividends if and when declared by the Board. No dividends to holders of the Series C Preferred Stock were declared or unpaid through September 30, 2024 and 2023, respectively.

Series K Preferred Stock

On February 16, 2021, the Board designated shares of Series K preferred stock, par value $ (the “Series K Preferred Stock”).

Shares of the Series K Preferred Stock are convertible at any time, at the option of the holders, into shares of the Company’s common stock at an effective conversion rate of shares of common stock for each share of Series K Preferred. Shares of the Series K Preferred Stock have the same voting rights as the shares of the Company’s common stock, with the holders of the Series K Preferred Stock entitled to vote on an as-converted-to-common stock basis, subject to the beneficial ownership limitation, together with the holders of the Company’s common stock on all matters presented to the Company’s stockholders. The Series K Preferred Stock are not entitled to any dividends (unless specifically declared by the Board) but will participate on an as-converted-to-common-stock basis in any dividends to the holders of the Company’s common stock. In the event of the Company’s dissolution, liquidation or winding up, the holders of the Series K Preferred Stock will be on parity with the holders of the Company’s common stock and will participate, on a on an as-converted-to-common stock basis, in any distribution to holders of the Company’s common stock.

As of September 30, 2024 and December 31, 2023, there were shares of Series K Preferred stock issued and outstanding.

| 15 |

Note 7 – Common Stock Warrants and Options

Common Stock Warrants

Stock warrant transactions for the six months ended September 30, 2024 were as follows:

| Nine Months Ended September 30, 2024 | ||||||||

| Number of | Weighted Average | |||||||

| Warrants | Exercise Price | |||||||

| Warrants outstanding at December 31, 2023 | $ | |||||||

| Granted | ||||||||

| Forfeited/cancelled | ||||||||

| Exercised | ||||||||

| Warrants outstanding at September 30, 2024 | $ | |||||||

| Warrants exercisable at September 30, 2024 | $ | |||||||

As of September 30, 2024, all outstanding warrants are fully vested and had an exercise price greater than the market price of the Company’s common stock, which resulted in intrinsic value.

Warrants outstanding as of September 30, 2024 are exercisable as follows:

| Warrants Outstanding and Exercisable as of September 30, 2024 | ||||||||||||||

Range of Exercise Price | Number Outstanding | Weighted Average Remaining Contractual Life (Years) | Weighted Average Exercise Price | |||||||||||

| $ | $ | |||||||||||||

Common Stock Options

In April 2022 the Company established the 2022 Omnibus Incentive Plan (the “Plan”). The Plan was approved by our Board and stockholders. The purpose of the Plan is to grant stock and options to purchase our common stock, and other incentive awards, to our employees, directors, and key consultants. The maximum number of shares of common stock that may be issued pursuant to awards granted under the Plan is . The shares of our common stock underlying cancelled and forfeited awards issued under the Plan may again become available for grant under the Plan. As of September 30, 2024, there were shares available for grant under the Plan.

| Nine Months Ended September 30, 2024 | ||||||||

| Number of | Weighted Average | |||||||

| Options | Exercise Price | |||||||

| Options outstanding at December 31, 2023 | $ | |||||||

| Granted | ||||||||

| Forfeited/cancelled | ( | ) | ||||||

| Exercised | ||||||||

| Options outstanding at September 30, 2024 | $ | |||||||

| Options exercisable at September 30, 2024 | $ | |||||||

| 16 |

The weighted average remaining contractual life of all options outstanding, and all options vested and exercisable as of September 30, 2024 was years. Furthermore, all options outstanding and all options vested and exercisable as of September 30, 2024 had an exercise price greater than the market price of the Company’s common stock, which resulted in no intrinsic value.

The total fair value of options that vested during the nine months ended September 30, 2024 and 2023, was $ and $, respectively, and is included in selling, general and administrative expense in the accompanying unaudited condensed consolidated statements of operations. As of September 30, 2024, all outstanding stock options were fully vested and exercisable and there was no unvested compensation expense.

On May 15, 2023, the Company granted stock options to a member of the Board to purchase shares of common stock. The stock options are exercisable at $ per share, expire in years, vest over twelve months and have a fair value of $ on at the date of grant which will be amortized over the vesting period.

On January 27, 2023, the Company granted stock options to employees and members of the Board to purchase an aggregate of shares of common stock. The stock options are exercisable at $ per share, expire in years, vest over twelve months and have a fair value of $ million at the date of grant which will be amortized over the vesting period.

| Stock Options Outstanding and Exercisable as of September 30, 2024 | ||||||||||||||

Range of Exercise Price |

Number Outstanding |

Weighted Average Remaining Contractual Life (Years) |

Weighted Average Exercise Price |

|||||||||||

| $ | $ | |||||||||||||

Note 8 – Commitments and Contingencies

Litigation

The Company is involved in certain legal proceedings that arise from time to time in the ordinary course of our business. Except for income tax contingencies, we record accruals for contingencies to the extent that our management concludes that the occurrence is probable and that the related amounts of loss can be reasonably estimated. Legal expenses associated with the contingency are expensed as incurred. There is no current or pending litigation of any significance with the exception of the matters identified below that have arisen under, and are being handled in, the normal course of business:

Ohri Matter

On July 22, 2024, the Company filed an AAA Arbitration Demand against Manu Ohri, its former Chief Financial Officer. In the Demand, the Company asserts claims against Mr. Ohri for breach of his fiduciary duties and breach of contract and seeks a declaratory judgment providing that the Company may characterize Mr. Ohri’s termination as “for cause” under his Employment Agreement, and that the Company may revoke the Separation Agreement entered into between the Company and Mr. Ohri prior to the Company learning of Mr. Ohri’s breaches. In addition to the declaratory judgment, the Company seeks damages arising from Mr. Ohri’s violations, and attorneys’ fees and any forum and arbitration fees. On September 3, 2024, Mr. Ohri filed both a general denial of the Company’s claims against him and counterclaims for breach of his Employment Agreement and Separation Agreement. At this early stage in the proceedings the Company is not able to determine the probability of the outcome of this matter or a range of reasonably expected losses, if any.

Berk Matter

On November 14, 2023, former interim Chief Executive Officer, Dr. Gregory Berk filed a lawsuit in the US District Court for the District of Massachusetts alleging that the Company discriminated and retaliated against Dr. Berk for engaging in protected whistleblowing activity in violation of the Sarbanes Oxley Act (“SOX”). The Company vigorously defended this matter and believes it to be without merit; however, the parties have agreed to resolve the matter and the Company expects the lawsuit to be dismissed shortly. The Company believes it has recorded appropriate accruals for the matter.

| 17 |

TWF Global Matter

On May 24, 2023, TWF Global, LLC (“TWF”) filed a Complaint in the California Superior Court for the County of Los Angeles naming the Company as defendant. The Complaint alleges that TWF is the holder of two Convertible Promissory Notes (“Notes”) and that the Company did not deliver shares of common stock due on conversion in February 2021. TWF was seeking per diem liquidated damages based on the terms of alleged Notes. On July 14, 2023, the Company filed a motion to dismiss for improper forum because the terms of the Notes, as alleged, require disputes to be filed in New York state and federal courts. TWF voluntarily dismissed its Complaint before the California Superior Court of Los Angeles without prejudice. The Company subsequently filed a Summons and Complaint for Interpleader against TWF and Z-One LLC before the Supreme Court of the State of New York County of New York, asking the Supreme Court to determine if the Company’s shares of common stock are properly registered to TWF or Z-One LLC, as both of these entities have made conflicting demands for registration of the shares of common stock. On February 5, 2024, the Company filed a motion for entry of default against TWF, seeking an order directing the Company to register the shares of common stock in the name of Z-One and that the Company be released from all associated liability and claims. The Court denied the motion without prejudice and will reconsider the motion without further briefing upon the filing of a supplemental party affidavit. On May 9, 2024, Z-One filed a motion for summary judgement seeking dismissal of the action, representing that Z-One and TWF have settled their dispute over the entitlement to the Company’s shares of common stock and there is no remaining dispute before the Court. On May 21, 2024, the Company filed a supplemental affidavit in support of its motion for entry of default. The Court has set a hearing on Z-One’s motion for November 14, 2024. The Company believes that any claims related to the Notes are without merit and will continue to defend vigorously against these claims.

Significant Agreements

Cytovance Biologics, Inc., a Related Party

In October 2020, the Company entered into a Master Services Agreement with Cytovance Biologics, Inc. (“Cytovance”), to perform biologic development and manufacturing services, and to produce and test compounds used in the Company’s potential product candidates. The Company subsequently executed numerous Statements of Work (“SOWs”) for the research and development of products for use in clinical trials.

On

August 24, 2022, the Company entered into a Settlement and Investment Agreement with Cytovance that amended existing SOWs and allowed

for future invoices to be settled in in a combination of cash and issuance of the Company’s common stock. The Agreement also set

Cytovance’s beneficial ownership limitation at

On

April 25, 2024, the Company entered into an Amendment to the Settlement and Investment Agreement with Cytovance that increased Cytovance’s

beneficial ownership limitation to

During

the nine months ended September 30, 2024 and 2023, the Company recognized research and development expenses of $

On

June 30, 2024, Cytovance became a related party as their beneficial ownership exceeded

As

of September 30, 2024 the Company’s commitments in relation to unbilled and unaccrued SOWs and any related Change Orders from Cytovance

for services that have not yet been rendered as of September 30, 2024, amounted to approximately $

University of Minnesota

2021 Scientific Research Agreement

Effective

June 16, 2021, the Company entered into a scientific research agreement with the Regents of the University of Minnesota, expiring on

June 30, 2023. Payments totaling approximately $

The

Company recorded an expense classified as research and development of approximately $

As

of September 30, 2024 the Company’s commitments in relation to unbilled and unaccrued amounts from the University of Minnesota

pursuant to the 2021 Scientific Research Agreement for services that have not yet been rendered as of September 30, 2024, amounted to

$

| 18 |

2023 Sponsored Research Agreement

On

May 20, 2024, the Company entered into a sponsored research agreement with the Regents of the University of Minnesota (the “2016

Exclusive Patent License Agreement”), effective July 1, 2023, and expiring on July 1, 2025. Payments totaling approximately $

The

Company recorded an expense classified as research and development of approximately $

As

of September 30, 2024 the Company’s commitments in relation to unbilled and unaccrued amounts from the University of Minnesota

pursuant to the 2023 Sponsored Research Agreement for services that have not yet been rendered as of September 30, 2024, amounted to

approximately $

2016 Exclusive Patent License Agreement

Effective

July 18, 2016, the Company entered into an exclusive patent license agreement with the Regents of the University of Minnesota (as

amended, the “2016 Exclusive Patent License Agreement”), to further develop and commercialize cancer therapies using

TriKE® technology developed by researchers at the University of Minnesota to target NK cells to cancer. Under the

terms of the agreement, the Company receives exclusive rights to conduct research and to develop, make, use, sell, and import

TriKE® technology worldwide for the treatment of any disease, state, or condition in humans. The Company is

responsible for obtaining all permits, licenses, authorizations, registrations, and regulatory approvals required or granted by any

governmental authority anywhere in the world that is responsible for the regulation of products such as the TriKE®

technology, including without limitation the FDA and the European Agency for the Evaluation of Medicinal Products in the European

Union. The agreement requires an upfront payment of $

Effective

May 13, 2024, the Company entered into an amended and restated exclusive patent license agreement with the Regents of the University

of Minnesota. The amendment requires an upfront payment of $

The

Company recorded an expense classified as research and development of $

2021 Exclusive License Agreement

Effective

March 26, 2021, the Company entered into an exclusive license agreement with the Regents of the University of Minnesota (the “2021

Exclusive Patent License Agreement”), specific to the B7H3 targeted TriKE®. The agreement requires an upfront payment

of $

The Company did not incur any expenses pursuant to the 2021 Exclusive License Agreement, for the nine months ended September 30, 2024 and 2023, respectively.

Note 9 – Subsequent Events

On October 17, 2024, the Company granted stock options to an officer to purchase an aggregate of shares of common stock. The stock options are exercisable at $ per share, expire in years, vest over and have a fair value of approximately $ at the date of grant which will be amortized over the vesting period.

| 19 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this Quarterly Report on Form 10-Q are “forward-looking statements” within the meaning of the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements regarding our current beliefs, goals and expectations about matters such as our expected financial position and operating results, our business strategy and our financing plans. The forward-looking statements in this report are not based on historical facts, but rather reflect the current expectations of our management concerning future results and events. The forward-looking statements generally can be identified by the use of terms such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “foresee,” “may,” “guidance,” “estimate,” “potential,” “outlook,” “target,” “forecast,” “likely” or other similar words or phrases. Similarly, statements that describe our objectives, plans or goals are, or may be, forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be different from any future results, performance and achievements expressed or implied by these statements. We cannot guarantee that our forward-looking statements will turn out to be correct or that our beliefs and goals will not change. Our actual results could be very different from and worse than our expectations for various reasons. You should carefully review all information, including the discussion of risk factors under “Part I. Item 1A: Risk Factors” and “Part II. Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Form 10-K for the year ended December 31, 2023. Any forward-looking statements in the Form 10-Q are made only as of the date hereof and, except as may be required by law, we do not have any obligation to publicly update any forward-looking statements contained in this Form 10-Q to reflect subsequent events or circumstances.

Organization

The corporate predecessor of GT Biopharma, Inc, Diagnostic Data, Inc., was incorporated in the state of California in 1965. Diagnostic Data, Inc. changed its incorporation to the state of Delaware on December 21, 1972 and changed its name to DDI Pharmaceuticals, Inc. on March 11, 1985. On September 7, 1994, DDI Pharmaceuticals, Inc. merged with International BioClinical, Inc. and Bioxytech S.A. and changed its name to OXIS International, Inc. On July 17, 2017, OXIS International, Inc. changed its name to GT Biopharma, Inc.

Overview

We are a clinical stage biopharmaceutical company focused on the development and commercialization of novel immuno-oncology products based on our proprietary Tri-specific Killer Engager (TriKE®), and Tetra-specific Killer Engager (Dual Targeting TriKE®) fusion protein immune cell engager technology platforms. Our TriKE® and Dual Targeting TriKE® platforms generates proprietary therapeutics designed to harness and enhance the cancer killing abilities of a patient’s own natural killer cells, or NK cells. Once bound to an NK cell, our moieties are designed to enhance the NK cell, and precisely direct it to one or more specifically targeted proteins expressed on a specific type of cancer cell or virus infected cell, resulting in the targeted cell’s death. TriKE®s can be designed to target any number of tumor antigens on hematologic malignancies or solid tumors and do not require patient-specific customization.

We are using our TriKE® platform with the intent to bring to market immuno-oncology products that can treat a range of hematologic malignancies, solid tumors, and potentially autoimmune disorders. The platform is scalable, and we are putting processes in place to be able to produce investigational new drug (IND) ready moieties in a timely manner after a specific TriKE® conceptual design. Specific drug candidates can then be advanced into the clinic on our own or through potential collaborations with partnering companies. We believe our TriKE®s may have the ability, if approved for marketing, to be used as both monotherapy and in combination with other standard-of-care therapies.

Our initial work was conducted in collaboration with the Masonic Cancer Center at the University of Minnesota under a program led by Dr. Jeffrey Miller, Professor of Medicine, and the Deputy Director at the Center. Dr. Miller is a recognized key opinion leader in the field of NK cell and IL-15 biology and their therapeutic potential. We have exclusive rights to the TriKE® platform and are generating additional intellectual property for specific moieties.

| 20 |

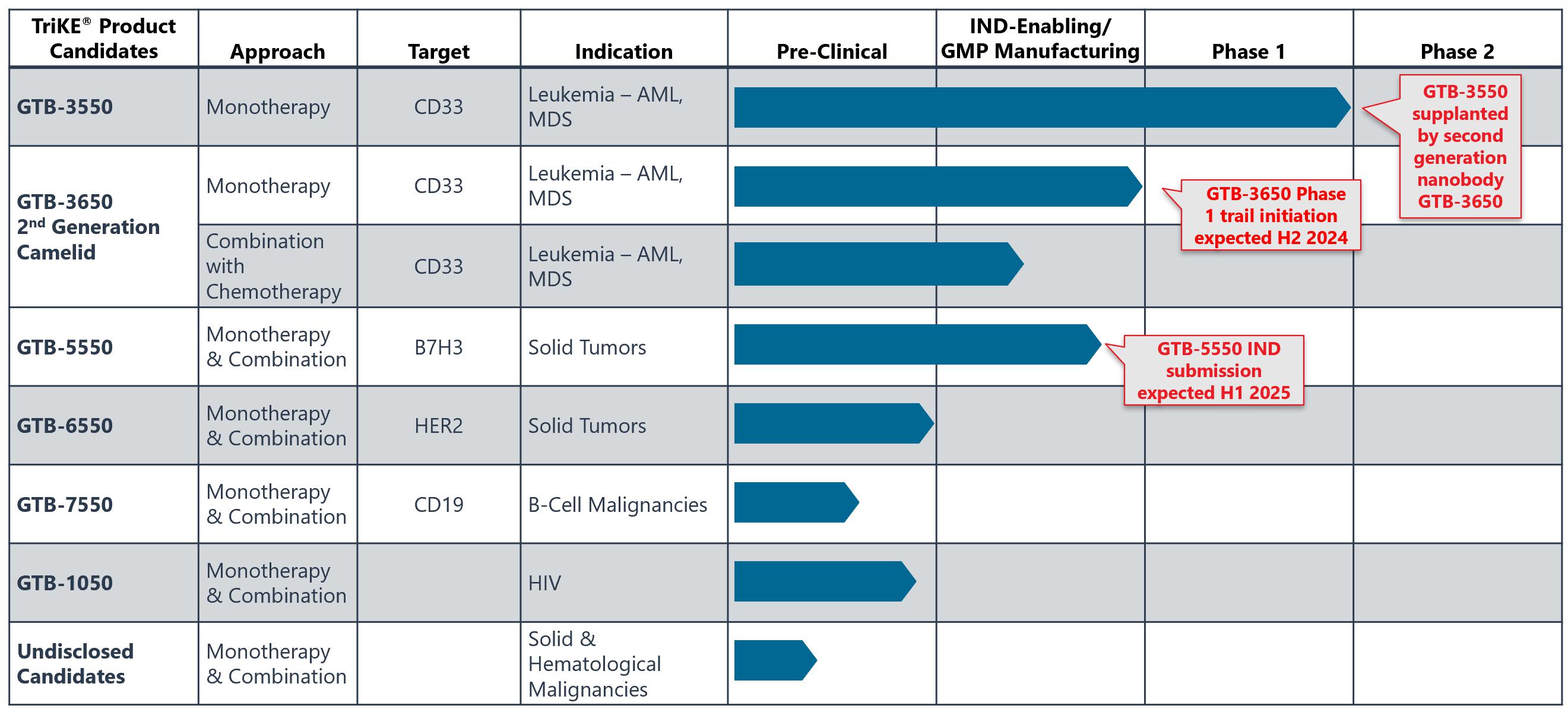

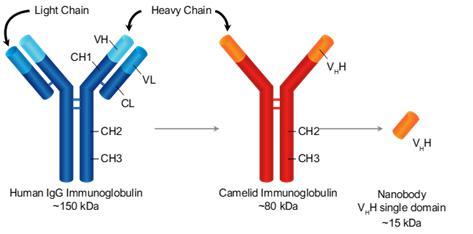

Our product pipeline as of September 30, 2024 is presented below:

GTB-3550

GTB-3550 was our first TriKE® product candidate. It reflected our first-generation TriKE® platform. It is a single-chain, tri-specific scFv recombinant fusion protein conjugate composed of the variable regions of the heavy and light chains of anti-CD16 and anti-CD33 antibodies and a modified form of IL-15. We studied this anti-CD16-IL-15-anti-CD33 TriKE® in CD33 positive leukemias, a marker expressed on tumor cells in acute myelogenous leukemia, or AML, and myelodysplastic syndrome, or MDS. CD33 is primarily a myeloid differentiation antigen with endocytic properties broadly expressed on AML blasts and, possibly, some leukemic stem cells. CD33 or Siglec-3 (sialic acid binding Ig-like lectin 3, SIGLEC3, SIGLEC3, gp67, p67) is a transmembrane receptor expressed on cells of myeloid lineage. It is usually considered myeloid-specific, but it can also be found on some lymphoid cells. The anti-CD33 antibody fragment used for these studies was derived from the M195 humanized anti-CD33 scFv and has been used in multiple human clinical studies. It has been exploited as a target for therapeutic antibodies for many years. We believe the approval of the antibody-drug conjugate gemtuzumab validates this targeted approach.

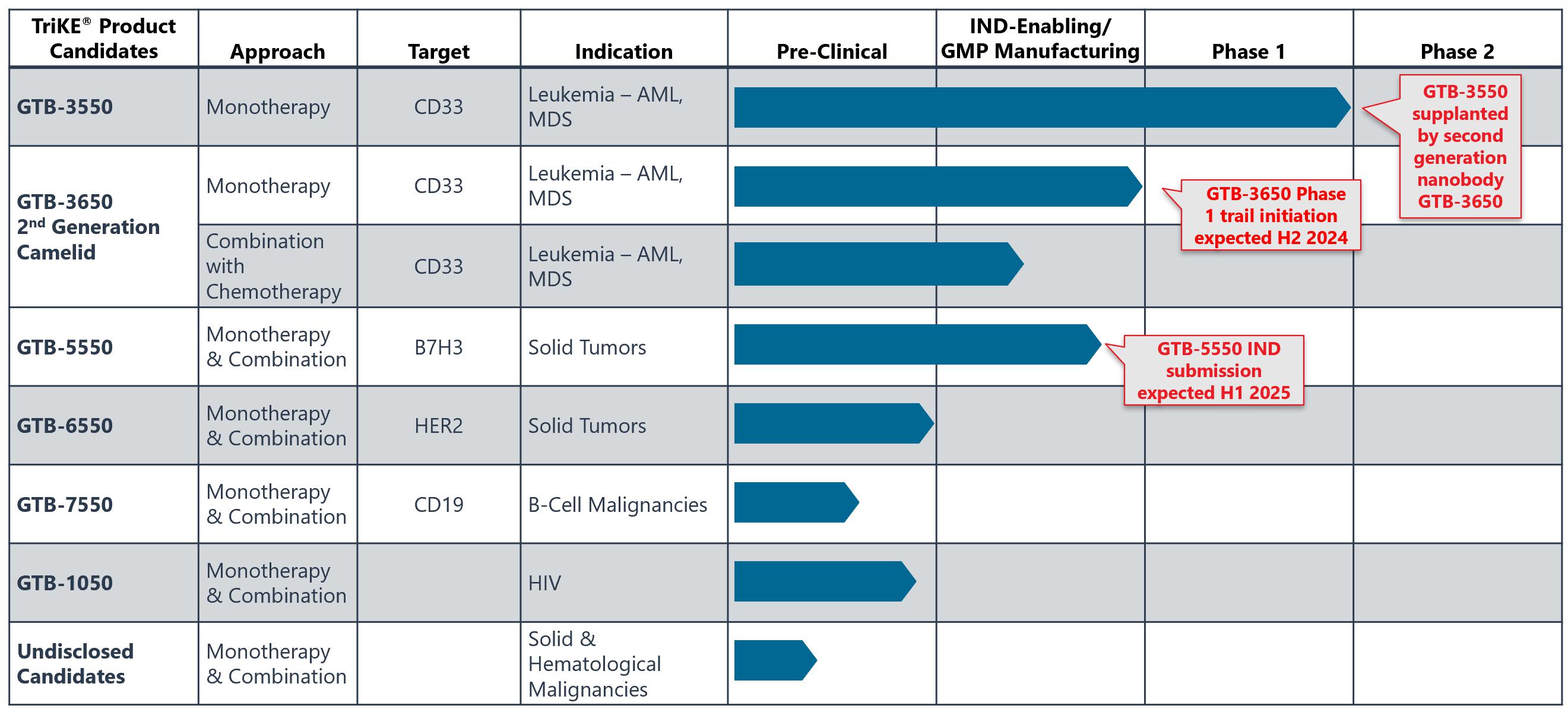

GTB-3550 was replaced by a more potent next-generation camelid nanobody TriKE®, GTB-3650, both targeting CD33 on relapsed/refractory AML and high-risk MDS. The pivot from GTB-3550 to GTB-3650 in our clinical development was based on a solid preclinical foundation that showed markedly enhanced potency of the camelid modification of the first-generation TriKE®. This is illustrated below by better tumor control of AML bearing animals with GTB-3650 (purple dots) compared to GTB-3550 (blue dots). This provided the rationale for pausing further development of GTB-3550 and moving over to solely develop the second-generation TriKE® platform.

| 21 |

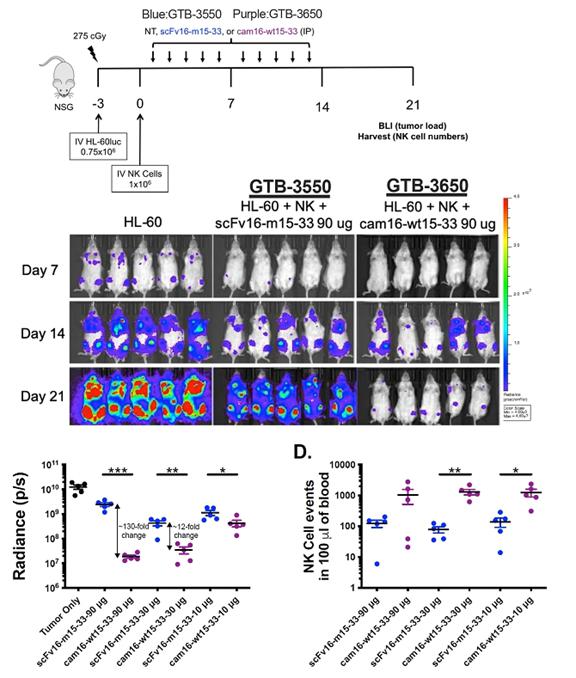

Second Generation TriKE®s Utilize Camelid Nanobody Technology

Our goal is to be a leader in immuno-oncology therapies targeting a broad range of indications including hematological malignancies and solid tumors. A key element of our strategy includes introducing a next-generation camelid nanobody platform. Camelid antibodies (often referred as nanobodies) are smaller than human immunoglobulin and consist of two heavy chains. These nanobodies have the potential to have greater affinity to target antigens, potentially resulting in greater potency. We are utilizing this camelid antibody structure for all of our new TriKE® product candidates.

| 22 |

To develop second generation TriKE®s, we designed a new humanized CD16 engager derived from a single-domain antibody. While scFvs consist of a heavy and a light variable chain joined by a linker, single-domain antibodies consist of a single variable heavy chain capable of engaging without the need of a light chain counterpart (see figure below).

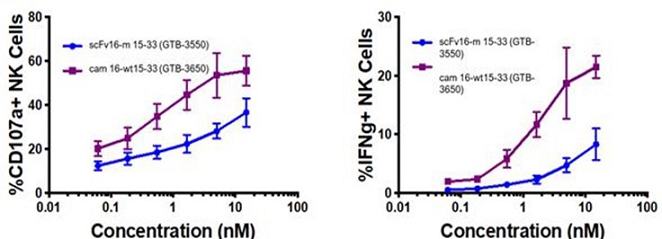

These single-domain antibodies are thought to have certain attractive features for antibody engineering, including physical stability, ability to bind deep grooves, and increased production yields, amongst others. Pre-clinical studies demonstrated increased NK cell activation against CD33+ targets including enhanced NK cell degranulation (% CD107a+) and IFNg with the single-domain CD16 TriKE® (cam 16-wt15-33; GTB-3650) compared to the original TriKE® (scFv16-m 15-33; GTB-3550) (see figure below). This data was published by Dr. Felices M et al (2020) in Cancer Immunol Res.

CD33+ HL60 Targets in Killing Assays

The purple line represents the GTB-3650 and the blue line represents GTB-3550.

GTB-3650

GTB-3650 is a CD33 targeted TriKE® which targets CD33 on the surface of myeloid leukemias and an agonistic camelid engager to the potent activating receptor on NK cells, CD16. Use of this engager enhances the activity of wild type IL-15 included in GTB-3650, no longer needing the mutant IL-15 included in GTB-3550. The TriKE® approach provides a novel way to specifically target these tumors by leveraging NK cells, which have been shown to mediate relapse protection in this setting, in an anti-CD33-targeted fashion. We are moving GTB-3650 clinically based on pre-clinical data showing a marked increase in potency compared to GTB-3550, which we anticipate could lead to an enhanced efficacy signal in AML and MDS. We have advanced GTB-3650 through preclinical studies and filed an Investigational New Drug (IND) application with the U.S. Food and Drug Administration (FDA) in December 2023. In late June 2024, we received clearance from the FDA with respect to our IND Application in relation to GTB 3650. We further anticipate approval to start study enrollment targeting patients with relapsed/refractory AML and high grade MDS in the second half of 2024. This initial study will test GTB-3650 as monotherapy testing administration 2 weeks on and two weeks off (to prevent NK cell exhaustion) for at least 2 cycles of therapy. The design of the trial has been agreed on with the FDA.

| 23 |

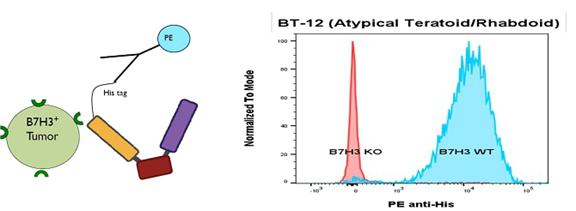

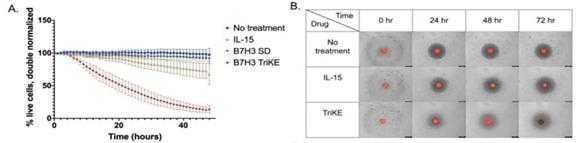

GTB-5550

GTB-5550 is a B7-H3 targeted TriKE® which targets B7-H3 on the surface of advanced solid tumors (figure above). B7-H3 is an exciting target as it displays specific expression on a broad spectrum of solid tumor malignancies, allowing our team to target these malignancies through GTB-5550. Pre-clinical work has shown that this molecule has NK-cell targeted activity against a variety of solid tumor settings, including head and neck cancer squamous cell carcinoma (figure below), prostate cancer, breast cancer, ovarian cancer, glioblastoma, and lung cancer (amongst others). We are advancing GTB-5550 through preclinical studies and initiated a GMP manufacturing campaign in anticipation of filing an IND in the first half of 2025. A pre-IND packet was submitted to the FDA in October 2023 with a written response from the FDA in December 2023. The main question from the FDA was regarding pre-clinical toxicology and a pivot to subcutaneous dosing. The initial trial expected in 2025 is designed as a basket trial for patients with B7-H3+ solid tumors using Monday through Friday dosing (2 weeks on and 2 weeks off to prevent immune exhaustion), and is dependent on manufacturing of clinical materials.

GTB-7550

GTB-7550 TriKE® is a product candidate in development for the treatment of lupus and other autoimmune disorders. GTB-7550 TriKE® is a tri-specific molecule composed of a camelid nanobody that binds the CD16 receptor on NK cells, a scFv engager against CD19 on malignant and normal B cells, and a human IL-15 sequence between them.

Critical Accounting Policies and Estimates

The preparation of our consolidated financial statements in conformity with accounting principles generally accepted in the United States, or GAAP, requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. When making these estimates and assumptions, we consider our historical experience, our knowledge of economic and market factors and various other factors that we believe to be reasonable under the circumstances. Actual results may differ under different estimates and assumptions. The accounting estimates and assumptions discussed in this section are those that we consider to be the most critical to gain an understanding of our financial statements because they inherently involve significant judgments and uncertainties.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates include accruals for potential liabilities, assumptions used in deriving the fair value of warrant liabilities, valuation of equity instruments issued for services, and valuation of deferred tax assets. Actual results could differ from those estimates.

| 24 |

Warrant Liability

We evaluate our financial instruments to determine if such instruments are derivatives or contain features that qualify as embedded derivatives in accordance with ASC Topic 815, “Derivatives and Hedging”. For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported in the statements of operations.

Our use of derivative financial instruments is generally limited to warrants issued by us that do not meet the criteria for equity treatment and are recorded as liabilities. We do not use financial instruments or derivatives for any trading purposes.

Stock-Based Compensation

We periodically issue stock-based compensation to officers, directors, employees, and consultants for services rendered. Such issuances vest and expire according to terms established at the issuance date.

Stock-based payments made to officers, directors, employees, and consultants in exchange for goods and services, including grants of employee stock options, are recognized in the financial statements based on their grant date fair values in accordance with ASC 718, Compensation-Stock Compensation. Stock based payments to officers, directors, employees, and consultants, which are generally time vested, are measured at the grant date fair value and depending on the conditions associated with the vesting of the award, compensation cost is recognized on a straight-line or graded basis over the vesting period. Recognition of compensation expense for non-employees is in the same period and manner as if we had paid cash for the services. The fair value of stock options granted is estimated using the Black-Scholes option-pricing model, which uses certain assumptions related to risk-free interest rates, expected volatility, expected life, and future dividends. The assumptions used in the Black-Scholes option pricing model could materially affect compensation expense recorded in future periods.

Results of Operations

Comparison of the Three and Nine Months Ended September 30, 2024 and 2023

Operating Expenses

| Three Months Ended September 30, | ||||||||||||||||

| 2024 | 2023 | $ Change | % Change | |||||||||||||

| Operating Expenses: | ||||||||||||||||

| Research and development | $ | 1,307,000 | $ | 1,364,000 | $ | (57,000 | ) | (4 | )% | |||||||

| Selling, general and administrative | 2,297,000 | 1,211,000 | 1,086,000 | 90 | % | |||||||||||

| Stock compensation | — | 547,000 | (547,000 | ) | (100 | )% | ||||||||||

| Total Operating Expenses | $ | 3,604,000 | $ | 3,122,000 | $ | 482,000 | 15 | % | ||||||||

| Nine Months Ended September 30, | ||||||||||||||||

| 2024 | 2023 | $ Change | % Change | |||||||||||||

| Operating Expenses: | ||||||||||||||||

| Research and development | $ | 3,868,000 | $ | 5,109,000 | $ | (1,241,000 | ) | (24 | )% | |||||||

| Selling, general and administrative | 6,511,000 | 3,532,000 | 2,979,000 | 84 | % | |||||||||||

| Stock compensation | 222,000 | 1,767,000 | (1,545,000 | ) | (87 | )% | ||||||||||

| Total Operating Expenses | $ | 10,601,000 | $ | 10,408,000 | $ | 193,000 | 2 | % | ||||||||

Research and Development Expenses

Research and development expenses decreased by $57,000 and approximately $1.2 million, for the three and nine months ended September 30, 2024 and 2023, respectively, primarily due to a decrease in project materials costs, partially offset by an increase in scientific research costs.

Research and development expenses relate to our continued development and production of our most advanced TriKE® product candidates GTB-3650 and GTB-5550 along with the progression on other promising candidates. In late June 2024, we received clearance from the FDA with respect to our IND Application in relation to GTB 3650. We anticipate our direct clinical and preclinical expenses to increase in the second half of 2024 as we plan to advance our next generation GTB-3650 camelid nanobody product into the clinic, enroll patients, and perform tests for data collection. We also plan to complete the product development of GTB-5550 and anticipate submission of IND application for GTB-5550 in the first half of 2025. We do not, however, anticipate an increase in related R&D licensing and administrative costs.

| 25 |

Selling, General, and Administrative Expenses

Selling, general, and administrative expenses increased by approximately $1.1 million and $3.0 million, for the three and nine months ended September 30, 2024 and 2023, respectively, primarily due to an increase in legal and professional fees and an accrual for the probable settlement of a legal matter where the amount of the settlement can be reasonably estimated.

Other Income (Expense)

| Three Months Ended September 30, | ||||||||||||||||

| 2024 | 2023 | $ Change | % Change | |||||||||||||

| Other Income (Expense): | ||||||||||||||||

| Interest income | $ | 96,000 | $ | 216,000 | $ | (120,000 | ) | (56 | )% | |||||||

| Change in fair value of warrant liability | 95,000 | 485,000 | (390,000 | ) | (80 | )% | ||||||||||

| Unrealized gain (loss) on marketable securities | 2,000 | 5,000 | (3,000 | ) | (60 | )% | ||||||||||

| Total Other Income (Expense) | $ | 193,000 | $ | 706,000 | $ | (513,000 | ) | (73 | )% | |||||||

| Nine Months Ended September 30, | ||||||||||||||||

| 2024 | 2023 | $ Change | % Change | |||||||||||||

| Other Income (Expense): | ||||||||||||||||

| Interest income | $ | 343,000 | $ | 600,000 | $ | (257,000 | ) | (43 | )% | |||||||

| Interest expense | — | (213,000 | ) | 213,000 | 100 | % | ||||||||||

| Change in fair value of warrant liability | 870,000 | 4,796,000 | (3,926,000 | ) | (82 | )% | ||||||||||

| Gain on extinguishment of debt | — | 547,000 | (547,000 | ) | (100 | )% | ||||||||||

| Unrealized gain (loss) on marketable securities | 1,000 | 43,000 | (42,000 | ) | (98 | )% | ||||||||||

| Total Other Income (Expense) | $ | 1,214,000 | $ | 5,773,000 | $ | (4,559,000 | ) | (79 | )% | |||||||

Interest Income

Interest income decreased by $120,000 and $257,000 for the three and nine months ended September 30, 2024 compared to the same prior year periods, respectively, primarily due to lower short term investment balances.

Interest Expense

Interest expense decreased by $213,000 for the nine months ended September 30, 2024 compared to the same prior year period, respectively, due to the financing costs incurred associated with warrants accounted as warrant liability, there were no similar transactions during the current period.

Change in Fair Value of Warrant Liability

The change in fair value of warrant liability decreased by approximately $390,000 and $3.9 million for the three and nine months ended September 30, 2024 compared to the same prior year periods, respectively, resulting from a reduction in our warrant liability due to the decline in the Company’s stock price at September 30, 2024 as compared to the prior comparable periods.

Gain on Extinguishment of Debt

Gain on extinguishment of debt decreased by $547,000 for the six months ended September 30, 2024 compared to the same prior year period, respectively, and resulted from share settlements of a greater amount of vendor accounts payable than the fair value of the shares on the date of settlement, there were no similar transactions during the current period.

Net Loss

| Three Months Ended September 30, | ||||||||||||||||

| 2024 | 2023 | $ Change | % Change | |||||||||||||

| Net Loss | $ | (3,411,000 | ) | $ | (2,416,000 | ) | $ | 995,000 | 41 | % | ||||||

| Nine Months Ended September 30, | ||||||||||||||||

| 2024 | 2023 | $ Change | % Change | |||||||||||||

| Net Loss | $ | (9,387,000 | ) | $ | (4,635,000 | ) | $ | 4,752,000 | 103 | % | ||||||

| 26 |

Net loss increased $995,000 for the three months ended September 30, 2024, primarily due to an increase in legal and professional fees and an accrual for the probable settlement of a legal matter, and the decrease in the change in fair value of warrant liability, all as described above.

Net loss increased $4,752,000 for the nine months ended September 30, 2024, primarily due to the decrease in the change in fair value of warrant liability, an increase in legal and professional fees and an accrual for the probable settlement of a legal matter, and the decrease in the gain on extinguishment of debt, all as described above.

Liquidity and Going Concern Analysis

The accompanying unaudited condensed consolidated financial statements have been prepared assuming that we will continue as a going concern. We do not have any product candidates approved for sale and have not generated any revenue from our product sales. We have sustained operating losses since inception, and we expect such losses to continue into the foreseeable future. Historically, we have financed our operations through public and private sales of common stock, issuance of preferred and common stock, issuance of convertible debt instruments, and strategic collaborations. For the nine months ended September 30, 2024, we recorded a net loss of approximately $9.4 million and used cash in operations of approximately $10.4 million. These factors raise substantial doubt about our ability to continue as a going concern within one year of the date that the financial statements are issued.

The unaudited condensed consolidated financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern. Accordingly, the unaudited condensed consolidated financial statements have been prepared on a basis that assumes we will continue as a going concern, and which contemplates the realization of assets and satisfaction of liabilities and commitments in the ordinary course of business.

We have evaluated the significance of the uncertainty regarding our financial condition in relation to our ability to meet our obligations, which has raised substantial doubt about our ability to continue as a going concern. While it is very difficult to estimate our future liquidity requirements we believe if we are unable to obtain additional financing, existing cash resources will not be sufficient to enable us to fund the anticipated level of operations through one year from the date the accompanying unaudited condensed consolidated financial statements are issued. There can be no assurances that we will be able to secure additional financing on acceptable terms. In the event that we do not secure additional financing, we will be forced to delay, reduce, or eliminate some or all of our discretionary spending, which could adversely affect our business prospects, ability to meet long-term liquidity needs and the ability to continue operations.

Cash Flows