UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

| Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For

the quarterly period ended

| Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from __________ to ____________.

Commission

File Number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

(Address of principal executive offices and zip code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of exchange on which registered | ||

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller

reporting company | |

| Emerging

growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of May 15, 2024, the registrant had shares of common stock outstanding.

GT Biopharma, Inc. and Subsidiaries

FORM 10-Q

For the Three Months Ended March 31, 2024

Table of Contents

| 2 |

GT BIOPHARMA, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(in thousands, except shares and par value)

| March 31, 2024 | December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Short-term investments | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Total Current Assets | ||||||||

| Operating lease right-of-use asset | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued expenses | ||||||||

| Current operating lease liability | ||||||||

| Warrant liability | ||||||||

| Total Current Liabilities | ||||||||

| Total Liabilities | $ | $ | ||||||

| Stockholders’ Equity | ||||||||

| Convertible Preferred stock, par value $, shares authorized Series C - shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | ||||||||

| Common stock, par value $, shares authorized, shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | ||||||||

| Additional paid in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total Stockholders’ Equity | ||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 3 |

GT BIOPHARMA, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

| For The Three Months Ended | ||||||||

| March 31, | ||||||||

| 2024 | 2023 | |||||||

| (unaudited) | (unaudited) | |||||||

| Revenues | $ | $ | ||||||

| Operating Expenses: | ||||||||

| Research and development | ||||||||

| Selling, general and administrative (including $ and $ from stock compensation granted to officers, directors and employees during the three months ended March 31, 2024 and 2023, respectively) | ||||||||

| Loss from Operations | ||||||||

| Other (Income) Expense | ||||||||

| Interest income | ( | ) | ( | ) | ||||

| Interest expense | ||||||||

| Change in fair value of warrant liability | ( | ) | ( | ) | ||||

| Gain on extinguishment of debt | ( | ) | ||||||

| Unrealized loss (gain) on marketable securities | ( | ) | ||||||

| Other | ( | ) | ||||||

| Total Other (Income) Expense | ( | ) | ( | ) | ||||

| Net Loss | $ | ( | ) | $ | ( | ) | ||

| Net Loss Per Share - Basic and Diluted | $ | ) | $ | ) | ||||

| Weighted average common shares outstanding - basic and diluted | ||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 4 |

GT BIOPHARMA, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands)

| For The Three Months Ended March 31, 2024 (Unaudited) | ||||||||||||||||||||||||||||

| Preferred Shares | Common Shares | Additional Paid in | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Total | ||||||||||||||||||||||

| Balance, December 31, 2023 | $ | | $ | | $ | $ | ( | ) | $ | |||||||||||||||||||

| Fair value of vested stock options | - | - | ||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||

| Balance, March 31, 2024 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||

| For The Three Months Ended March 31, 2023 (Unaudited) | ||||||||||||||||||||||||||||

| Preferred Shares | Common Shares | Additional Paid in | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Deficit | Total | ||||||||||||||||||||||

| Balance, December 31, 2022 | $ | | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||

| Private placement of common stock | - | |||||||||||||||||||||||||||

| Initial recognition of fair value of warrant liability | - | - | ( | ) | ( | ) | ||||||||||||||||||||||

| Fair value of vested stock options | - | - | ||||||||||||||||||||||||||

| Issuance of common shares for services | - | |||||||||||||||||||||||||||

| Issuance of common shares in settlement of vendors payable | - | |||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||

| Balance, March 31, 2023 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 5 |

GT BIOPHARMA, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(in thousands)

| For The Three Months Ended | ||||||||

| March 31, | ||||||||

| 2024 | 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Stock based compensation - services | ||||||||

| Stock based compensation - officers, employees and board of directors | ||||||||

| Change in fair value of warrant liability | ( | ) | ( | ) | ||||

| Gain on extinguishment of share settled debt | ( | ) | ||||||

| Change in operating lease right-of-use assets | ||||||||

| Unrealized loss (gain) on marketable securities | ( | ) | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Decrease in prepaid expenses | ||||||||

| (Decrease) in accounts payable and accrued expenses | ( | ) | ( | ) | ||||

| (Decrease) in operating lease liability | ( | ) | ( | ) | ||||

| Net Cash Used in Operating Activities | ( | ) | ( | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Sale (purchase) of investments | ( | ) | ||||||

| Net Cash Provided by (Used in) Investing Activities | ( | ) | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Proceeds from issuance of common stock and prefunded warrants | ||||||||

| Net Cash Provided by Financing Activities | ||||||||

| Net Increase (Decrease) in Cash | ( | ) | ||||||

| Cash at Beginning of Period | ||||||||

| Cash at End of Period | $ | $ | ||||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | ||||||||

| Cash paid during the year for: | ||||||||

| Interest | $ | $ | ||||||

| Income taxes | $ | $ | ||||||

| SUPPLEMENTAL DISCLOSURES OF NON-CASH INVESTING AND FINANCING ACTIVITIES | ||||||||

| Initial recognition of fair value of warrant liability | $ | $ | ||||||

| Fair value of common stock issued to a vendor to settle accounts payable | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 6 |

GT BIOPHARMA, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2024 and 2023

Note 1 – Organization and Operations

The corporate predecessor of GT Biopharma, Inc, Diagnostic Data, Inc., was incorporated in the state of California in 1965. Diagnostic Data, Inc. changed its incorporation to the state of Delaware on December 21, 1972 and changed its name to DDI Pharmaceuticals, Inc. on March 11, 1985. On September 7, 1994, DDI Pharmaceuticals, Inc. merged with International BioClinical, Inc. and Bioxytech S.A. and changed its name to OXIS International, Inc. On July 17, 2017, OXIS International, Inc. changed its name to GT Biopharma, Inc. (the “Company”).

The Company is a clinical stage biopharmaceutical company focused on the development and commercialization of novel immune-oncology products based on our proprietary Tri-specific Killer Engager (TriKE®), and Tetra-specific Killer Engager (Dual Targeting TriKE®) platforms. The Company’s TriKE® and Dual Targeting TriKE® platforms generate proprietary therapeutics designed to harness and enhance the cancer killing abilities of a patient’s own natural killer cells (NK cells).

Reverse Stock Split

As a result of the reverse stock-split, every thirty (30) shares of issued and outstanding common stock were automatically combined into one issued and outstanding share of common stock, without any change in the par value per share. No fractional shares will be issued in connection with the reverse stock split. Stockholders who otherwise would be entitled to receive fractional shares of common stock will be entitled to receive their pro-rata portion of the net proceeds obtained from the aggregation and sale by the exchange agent of the fractional shares resulting from the reverse stock-split (reduced by any customary brokerage fees, commission and other expenses). The reverse stock split reduced the number of shares of common stock outstanding on the effective date of the reverse stock-split from shares to shares, subject to minor adjustments due to the treatment of fractional shares. The number of authorized shares of common stock remains unchanged at shares.

Proportionate adjustments will be made to the per share exercise price and the number of shares of common stock that may be purchased upon exercise of outstanding stock options for the Company’s common stock and to the number of shares of common stock reserved for future issuance pursuant to the GT Biopharma, Inc. 2022 Omnibus Incentive Plan.

All share and per share information within this report have been adjusted to retroactively reflect the reverse stock-split as of the earliest period presented.

Note 2 – Summary of Significant Accounting Policies

Basis of Presentation and Principles of Consolidation

The condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Oxis Biotech, Inc. and Georgetown Translational Pharmaceuticals, Inc. All intercompany transactions and balances have been eliminated in consolidation.

The accompanying condensed consolidated financial statements are unaudited. These unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and applicable rules and regulations of the Securities and Exchange Commission (“SEC”) regarding interim financial reporting. Certain information and note disclosures normally included in the financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. Accordingly, these interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the SEC on March 26, 2024 (the “2023 Annual Report”). The consolidated balance sheet as of December 31, 2023 included herein, was derived from the audited consolidated financial statements as of that date.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements contain all adjustments necessary to fairly present the Company’s financial position and results of operations for the interim periods reflected. Except as noted, all adjustments contained herein are of a normal recurring nature. Results of operations for the fiscal periods presented herein are not necessarily indicative of fiscal year-end results.

Liquidity

The

accompanying condensed consolidated financial statements have been prepared under the assumption that the Company will continue as a

going concern. Such assumption contemplates the realization of assets and satisfaction of liabilities in the normal course of

business. For the three months ended March 31, 2024, the Company recorded a net loss of $

Historically, the Company has financed its operations through public and private sales of common stock, issuance of preferred and common stock, issuance of convertible debt instruments, and strategic collaborations. There can be no assurances that the Company will be able to secure additional financing on acceptable terms. In the event the Company does not generate sufficient cash flows from investing and financing activities, the Company will be forced to delay, reduce, or eliminate some or all of its discretionary spending, which could adversely affect the Company’s business prospects, ability to meet long-term liquidity needs or ability to continue operations.

| 7 |

Accounting Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates include management’s estimates for continued liquidity, accruals for potential liabilities, assumptions used in deriving the fair value of derivative liabilities, valuation of equity instruments issued for services and realization of deferred tax assets. Actual results could differ from those estimates.

Cash Equivalents and Short-Term Investments

The

Company considers highly liquid investments with maturities of three months or less at the date of acquisition as cash equivalents in

the accompanying condensed consolidated financial statements. Total cash equivalents, which consist of money market funds, amounted to

approximately $

The

Company also invested its excess cash in commercial paper and corporate notes and bonds. Management generally determines the appropriate

classification of its investments at the time of purchase. We classify these investments as short-term investments, as part of current

assets, based upon our ability and intent to use any and all of these investments as necessary to satisfy liquidity requirements that

may arise from our business. Investments are carried at fair value with the unrealized holding gains and losses reported in the accompanying

condensed consolidated statements of operations. Total short-term investments amounted to approximately $

Fair Value of Financial Instruments

Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 820-10 requires entities to disclose the fair value of financial instruments, both assets and liabilities recognized and not recognized on the balance sheet for which it is practicable to estimate fair value. ASC 820-10 defines the fair value of a financial instrument as the amount at which the instrument could be exchanged in a current transaction between willing parties.

The three levels of the fair value hierarchy are as follows:

Level 1 Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities that the entity has the ability to access.

Level 2 Valuations based on quoted prices for similar assets or liabilities, quoted prices in markets that are not active, or other inputs that are observable or can be corroborated by observable data for substantially the full term of the assets or liabilities.

Level 3 Valuations based on inputs that are unobservable, supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

The

carrying amount of the Company’s warrant liability of $

The carrying amounts of the Company’s other financial assets and liabilities, such as cash and cash equivalents, short term investments, prepaid expenses and other current assets, accounts payable, accrued expenses, approximate their fair values because of the short maturity of these instruments.

Warrant Liability

The Company evaluates its financial instruments to determine if such instruments are derivatives or contain features that qualify as embedded derivatives in accordance with ASC Topic 815, “Derivatives and Hedging” (“ASC 815”). For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported in the statements of operations.

The Company’s use of derivative financial instruments is generally limited to warrants issued by the Company that do not meet the criteria for equity treatment and are recorded as liabilities. We do not use financial instruments or derivatives for any trading purposes.

Stock-Based Compensation

The Company periodically issues stock-based compensation to officers, directors, employees and consultants for services rendered. Such issuances vest and expire according to terms established at the issuance date.

Stock-based payments to officers, directors, employees and consultants for acquiring goods and services from non-employees, which include grants of employee stock options, are recognized in the financial statements based on their grant date fair values in accordance with ASC 718, Compensation-Stock Compensation. Stock based payments to officers, directors, employees and consultants, which are generally time vested, are measured at the grant date fair value and depending on the conditions associated with the vesting of the award, compensation cost is recognized on a straight-line or graded basis over the vesting period. Recognition of compensation expense for non-employees is in the same period and manner as if the Company had paid cash for the services. The fair value of stock options granted is estimated using the Black-Scholes option-pricing model, which uses certain assumptions related to risk-free interest rates, expected volatility, expected life, and future dividends. The assumptions used in the Black-Scholes option pricing model could materially affect compensation expense recorded in future periods.

| 8 |

Research and Development Costs

Costs incurred for research and development are expensed as incurred. The salaries, benefits, and overhead costs of personnel conducting research and development of the Company’s products are included in research and development expenses. Purchased materials that do not have an alternative future use are also expensed.

Leases

The Company accounts for its lease in accordance with the guidance of ASC 842, Leases. The Company determines whether a contract is, or contains, a lease at inception. Right-of-use assets represent the Company’s right to use an underlying asset during the lease term, and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. Right-of-use assets and lease liabilities are recognized at lease commencement based upon the estimated present value of unpaid lease payments over the lease term. The Company uses its incremental borrowing rate based on the information available at lease commencement in determining the present value of unpaid lease payments.

Basic earnings (loss) per share is computed using the weighted-average number of common shares outstanding during the period. Diluted earnings (loss) per share is computed using the weighted-average number of common shares and the dilutive effect of contingent shares outstanding during the period. Potentially dilutive contingent shares, which primarily consist of stock issuable upon exercise of stock options and warrants have been excluded from the diluted loss per share calculation because their effect is anti-dilutive.

March 31, 2024 (Unaudited) | March 31, 2023 (Unaudited) | |||||||

| Options to purchase common stock | ||||||||

| Warrants to purchase common stock | ||||||||

| Total anti-dilutive securities | ||||||||

Concentration

Cash

is deposited in one financial institution. The balances held at this financial institution at times may be in excess of Federal Deposit

Insurance Corporation (“FDIC”) insurance limits of up to $

The Company has a significant concentration of expenses incurred and accounts payable from a single vendor, see Note 4 – Accounts Payable.

Segments

The Company determined its reporting units in accordance with “Segment Reporting” (“ASC 280”). Management evaluates a reporting unit by first identifying its operating segments under ASC 280. The Company then evaluates each operating segment to determine if it includes one or more components that constitute a business. If there are components within an operating segment that meet the definition of a business, the Company evaluates those components to determine if they must be aggregated into one or more reporting units. If applicable, when determining if it is appropriate to aggregate different operating segments, the Company determines if the segments are economically similar and, if so, the operating segments are aggregated.

Management has determined that the Company has one consolidated operating segment. The Company’s reporting segment reflects the manner in which its chief operating decision maker reviews results and allocates resources. The Company’s reporting segment meets the definition of an operating segment and does not include the aggregation of multiple operating segments.

Recent Accounting Pronouncements

In November 2023, the FASB issued ASU No. 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures” (“ASU 2023-07”), which introduces new reportable segment disclosure requirements related to significant segment expenses and also expands reportable segment disclosure requirements for interim reporting. The amendment will require public entities to disclose significant segment expenses that are regularly provided to the chief operating decision maker and are included within each reportable segment’s profits and losses. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. We are in the process of evaluating the impact that ASU 2023-07 will have on our segment related disclosures.

The Company’s management has evaluated all the recently issued, but not yet effective, accounting standards and guidance that have been issued or proposed by the FASB or other standards-setting bodies through the filing date of these financial statements and does not believe the future adoption of any such pronouncements will have a material effect on the Company’s financial position and results of operations.

| 9 |

Note 3 – Fair Value of Financial Instruments

The estimated fair values of financial instruments outstanding were as follows (in thousands):

| March 31, 2024 (Unaudited) | ||||||||||||||||

| Unrealized | Unrealized | Fair | ||||||||||||||

| Cost | Gains | Losses | Value | |||||||||||||

| Short-term investments | $ | $ | $ | ( | ) | $ | ||||||||||

| Total | $ | $ | $ | ( | ) | $ | ||||||||||

| December 31, 2023 | ||||||||||||||||

| Unrealized | Unrealized | Fair | ||||||||||||||

| Cost | Gains | Losses | Value | |||||||||||||

| Short-term investments | $ | $ | | $ | $ | |||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

The following table represents the Company’s fair value hierarchy for its financial assets (cash equivalents and investments) (in thousands):

| March 31, 2024 (Unaudited) | ||||||||||||||||

| Fair Value | Level 1 | Level 2 | Level 3 | |||||||||||||

| Money market funds | $ | $ | $ | $ | ||||||||||||

| Corporate notes and commercial paper | ||||||||||||||||

| Total financial assets | $ | $ | $ | $ | ||||||||||||

| December 31, 2023 | ||||||||||||||||

| Fair Value | Level 1 | Level 2 | Level 3 | |||||||||||||

| Money market funds | $ | $ | $ | $ | ||||||||||||

| Corporate notes and commercial paper | ||||||||||||||||

| Total financial assets | $ | $ | $ | $ | ||||||||||||

As

of March 31, 2024, the fair value of the warrant liability was $

| Three Months Ending | ||||||||

| March 31, 2024 | March 31, 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Beginning balance | $ | $ | ||||||

| Issuance of warrants at fair value | ||||||||

| Change in fair value | ( | ) | ( | ) | ||||

| Extinguishment | ||||||||

| Ending balance | $ | $ | ||||||

| 10 |

Note 4 – Accounts Payable

Accounts payable consisted of the following (in thousands):

March 31, 2024 | December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| Accounts payable to a third-party manufacturer | $ | $ | ||||||

| Other accounts payable | | | ||||||

| Total accounts payable | $ | $ | ||||||

The Company relies on a third-party contract manufacturing operation to produce and/or test our compounds used in our potential product candidates.

In

October 2020, the Company entered into a Master Services Agreement with a third-party product manufacturer to perform biologic development

and manufacturing services on behalf of the Company. Associated with this, the Company has subsequently executed a number of Statements

of Work for the research and development of products for use in clinical trials. The Company’s commitments in relation to these

SOWs and any related Change Orders totaled approximately $

On

August 24, 2022, existing agreements with the third-party product manufacturer were amended. As part of the amendment, the third-party

manufacturer agreed that services to be rendered in future periods, will be paid or settled at the Company’s discretion, in a combination

of cash and issuance of the Company’s common stock. The amendment also eliminated future financial commitments of the Company.

As of December 31, 2023, outstanding accounts payable balance to the third-party product manufacturer amounted to $

During

the three months ended March 31, 2024, the Company recorded research and development expenses of $

Note 5 – Warrant Liability

2023 Warrants

On

January 4, 2023, as part of the private placement offering, the Company issued common stock, warrants to purchase up to an aggregate

of

The

Purchase Warrant provides for a value calculation for the Purchase Warrant using the Black Scholes model in the event of certain fundamental

transactions. The fair value calculation provides for a floor on the volatility amount utilized in the value calculation at % or greater.

The Company has determined this provision introduces leverage to the holders of the Purchase Warrant that could result in a value that

would be greater than the settlement amount of a fixed-for-fixed option on the Company’s own equity shares. Therefore, pursuant

to ASC 815, the Company has classified the Purchase Warrant as a liability in its consolidated balance sheet. The classification of the

Purchase Warrant, including whether the Purchase Warrant should be recorded as liability or as equity, is evaluated at the end of each

reporting period with changes in the fair value reported in other income (expense) in the consolidated statements of operations and comprehensive

loss. The Purchase Warrant was initially recorded at a fair value at $

As

of March 31, 2024, the fair value of the warrant liability was reduced to $

All changes in the fair value of the warrant liabilities are recognized as a change in fair value of warrant liability in the Company’s condensed consolidated statements of operations until they are either exercised or expire.

The warrant liabilities for the Common Warrants and the Placement Agents Warrants were valued using a Binomial pricing model with the following assumptions:

Common Warrants and Placement Agents Warrants | ||||||||

| March 31, 2024 | December 31, 2023 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Stock price | $ | $ | ||||||

| Risk-free interest rate | % | % | ||||||

| Expected volatility | % | % | ||||||

| Expected average life (in years) | ||||||||

| Expected dividend yield | ||||||||

| Fair value of warrants (in thousands) | $ | $ | ||||||

| 11 |

2020 Warrants

The Company issued certain warrants during the year ended December 31, 2020 that contained a fundamental transaction provision that could give rise to an obligation to pay cash to the warrant holder upon occurrence of certain change in control type events. In accordance with ASC 480, the fair value of these warrants is classified as a liability in the Condensed Consolidated Balance Sheets and will be re-measured at the end of every reporting period with the change in value reported in the Condensed Consolidated Statements of Operations.

The warrant liabilities for the 2020 warrants were valued using a Binomial pricing model with the following assumptions:

| March 31, 2024 | December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| Stock price | $ | $ | | |||||

| Risk-free interest rate | | % | % | |||||

| Expected volatility | % | % | ||||||

| Expected life (in years) | ||||||||

| Expected dividend yield | ||||||||

| Fair value of warrants (in thousands) | $ | $ | ||||||

The risk-free interest rate was based on rates established by the Federal Reserve Bank. The Company uses the historical volatility of its common stock to estimate the future volatility for its common stock. The expected life of the derivative securities was determined by the remaining contractual life of the derivative instrument. For derivative instruments that already matured, the Company used the estimated life. The expected dividend yield was based on the fact that the Company has not paid dividends to its common stockholders in the past and does not expect to pay dividends to its common stockholders in the future.

The

Company recognized a gain of $

Note 6 – Stockholders’ Equity

The Company’s authorized capital as of March 31, 2024 was shares of common stock, par value $ per share, and shares of preferred stock, par value $ per share.

Common Stock

Private Placement of Common Stock

On

January 4, 2023, GT Biopharma received gross proceeds of $

The

Common Warrants and the Placement Agents Warrants contained a clause not considered to be within the Company’s control. The Company

determined that the provision represented a variable that is not an input to the fair value of a “fixed-for-fixed” option

as defined under ASC 815-40, and thus the Common Warrants and the Placement Agent Warrants are not considered indexed to the Company’s

own stock and not eligible for an exception from derivative accounting. Accordingly, the Common Warrants and the Placement Agent Warrants

were classified as a warrant liability, and $

Common Stock Issued for Services

During

the three months ended March 31, 2023, and pursuant to the vesting term of a 2021 agreement, the Company issued shares of common

stock with a fair value of $

Common Stock Issued for Vendor Payable

On

March 13, 2023, the Company issued shares of common stock with a fair value of $ as settlement of accounts payable of $

| 12 |

Preferred Stock

Series C Preferred Stock

At March 31, 2024 and December 31, 2023, there were shares of series C preferred stock, par value $ per share (the “Series C Preferred Stock”) issued and outstanding.

As a result of reverse stock splits in previous years and the agreement terms for adjusting the rights of the related shares, the shares of Series C Preferred Stock are not currently convertible, have no voting rights, and in the event of liquidation, the holders of the Series C Preferred Stock would not participate in any distribution of the assets or surplus funds of the Company. The holders of Series C Preferred Stock also are not currently entitled to any dividends if and when declared by the Company’s board of directors (the “Board”). No dividends to holders of the Series C Preferred Stock were declared or unpaid through March 31, 2024 and 2023, respectively.

Series K Preferred Stock

On February 16, 2021, the Board designated shares of Series K preferred stock, par value $ (the “Series K Preferred Stock”).

Shares of the Series K Preferred Stock are convertible at any time, at the option of the holders, into shares of the Company’s common stock at an effective conversion rate of shares of common stock for each share of Series K Preferred. Shares of the Series K Preferred Stock have the same voting rights as the shares of the Company’s common stock, with the holders of the Series K Preferred Stock entitled to vote on an as-converted-to-common stock basis, subject to the beneficial ownership limitation, together with the holders of the Company’s common stock on all matters presented to the Company’s stockholders. The Series K Preferred Stock are not entitled to any dividends (unless specifically declared by the Board) but will participate on an as-converted-to-common-stock basis in any dividends to the holders of the Company’s common stock. In the event of the Company’s dissolution, liquidation or winding up, the holders of the Series K Preferred Stock will be on parity with the holders of the Company’s common stock and will participate, on a on an as-converted-to-common stock basis, in any distribution to holders of the Company’s common stock.

As of March 31, 2024 and December 31, 2023, there were shares of Series K Preferred stock issued and outstanding.

Warrants and Options

Common Stock Warrants

Stock warrant transactions for the three months ended March 31, 2024 were as follows:

| Number of | Weighted Average | |||||||

| Warrants | Exercise Price | |||||||

| Warrants outstanding at December 31, 2023 | $ | |||||||

| Granted | ||||||||

| Forfeited/cancelled | ||||||||

| Exercised | ||||||||

| Warrants outstanding at March 31, 2024 | $ | |||||||

| Warrants exercisable at March 31, 2024 | $ | |||||||

As of March 31, 2024, all issued and outstanding warrants are fully vested. The warrants had an exercise price greater than the market price, which resulted in intrinsic value.

Warrants outstanding as of March 31, 2024 are exercisable as follows:

| Warrants Outstanding | Warrants Exercisable | |||||||||||||||||||||

Range of Exercise Price | Number Outstanding | Weighted Average Remaining Contractual Life (Years) | Weighted Average Exercise Price | Number Exercisable | Weighted Average Exercise Price | |||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||

| – | ||||||||||||||||||||||

| 13 |

Common Stock Options

| Number of | Weighted Average | |||||||

| Options | Exercise Price | |||||||

| Options outstanding at December 31, 2023 | $ | |||||||

| Granted | ||||||||

| Forfeited/cancelled | ||||||||

| Exercised | ||||||||

| Options outstanding at March 31, 2024 | $ | |||||||

| Options exercisable at March 31, 2024 | $ | |||||||

The Company is recognizing the corresponding stock compensation expense for options granted to certain consultants, employees, officers and directors based upon their vesting term.

On January 27, 2023, the Company granted stock options to employees and members of its board of directors to purchase an aggregate of shares of common stock. The stock options are exercisable at $ per share, expires in years, vest over twelve months and had a fair value of $million at the date of grant. determined using the Black-Scholes Option Pricing model with the following assumptions:

| Stock price | $ | |||

| Risk-free interest rate | % | |||

| Expected volatility | % | |||

| Expected life (in years) | ||||

| Expected dividend yield |

For the three months ended March 31, 2024, the Company recognized stock compensation expense related to the vesting options of $. For the three months ended March 31, 2023, the Company recognized stock compensation expense relating to the vesting of options granted on January 27, 2023 and prior years of $.

| Options Outstanding | Options Exercisable | |||||||||||||||||||||

Range of Exercise Price | Number Outstanding | Weighted Average Remaining Contractual Life (Years) | Weighted Average Exercise Price | Number Exercisable | Weighted Average Exercise Price | |||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||

At March 31, 2024 and 2023, there were and unvested options with a grant date fair value of $and $ million, respectively, which will be recognized as stock compensation expense in future periods based upon the remaining vesting term of the applicable grants.

There was no intrinsic value of the outstanding options as of March 31, 2024 as the exercise price of these options was greater than the market price.

| 14 |

Note 7 – Commitments and Contingencies

Litigation

The Company is involved in certain legal proceedings that arise from time to time in the ordinary course of our business. Except for income tax contingencies, we record accruals for contingencies to the extent that our management concludes that the occurrence is probable and that the related amounts of loss can be reasonably estimated. Legal expenses associated with the contingency are expensed as incurred. There is no current or pending litigation of any significance with the exception of the matters that have arisen under, and are being handled in, the normal course of business.

| ● | On November 14, 2023, former interim Chief Executive Officer, Dr. Greg Berk filed a lawsuit alleging that GT Biopharma discriminated and retaliated against Berk for engaging in protected whistleblowing activity in violation of the Sarbanes Oxley Act ("SOX"). The Parties are proceeding with litigating Berk's SOX claim. GT Biopharma is vigorously defending this matter and believe it to be without merit. At this early stage in the proceedings, GT Biopharma is not able to determine the probability of the outcome of this matter or a range of reasonably expected losses, if any. | |

| ● | On

May 13, 2022, the Company made an arbitration demand upon Michael Handelman, its former Chief Financial Officer, asserting that he

breached his fiduciary duty by misappropriating Company funds and shares of common stock, among other things. The Company seeks among

other relief, monetary damages estimated at $ | |

| ● | On May 24, 2023, TWF Global, LLC (“TWF”) filed a Complaint in the California Superior Court for the County of Los Angeles naming the Company as defendant. The Complaint alleges that TWF is the holder of two Convertible Promissory Notes (“Notes”) and that the Company did not deliver shares of common stock due on conversion in February 2021. TWF was seeking per diem liquidated damages based on the terms of alleged Notes. On July 14, 2023, the Company filed a motion to dismiss for improper forum because the terms of the Notes, as alleged, require disputes to be filed in New York state and federal courts. TWF voluntarily dismissed its Complaint before the California Superior Court of Los Angeles without prejudice. The Company subsequently filed a Summons and Complaint for Interpleader against TWF and Z One LLC before the Supreme Court of the State of New York County of New York, asking the Supreme Court to determine if the Company’s shares of common stock are properly registered to TWF or Z One LLC, as both of these entities have made conflicting demands for registration of the shares of common stock. On February 5, 2024, the Company filed a motion for entry of default against TWF, seeking an order directing the Company to register the shares of common stock in the name of Z-One and that the Company be released from all associated liability and claims. The Court has not yet ruled on the Company’s motion. The Company believes that any claims related to the Notes are without merit and will continue to defend vigorously against these claims. The Court denied the motion without prejudice, and will reconsider the motion without further briefing upon the filing of a party affidavit. Z-One has filed a concurrent motion to dismiss of the action, representing that Z-One and TWF have settled their dispute over the entitlement to GT Biopharma shares. The Company believes that any claims related to the Notes are without merit and will continue to defend vigorously against these claims. |

| 15 |

Significant Agreements

Research and Development Agreements

The Company is a party to a scientific research agreement with the Regents of the University of Minnesota (“UofMN”), effective June 16, 2021. This scientific research agreement aims to work with the Company with three major goals in mind: (1) support the Company’s TriKE® product development and GMP manufacturing efforts; (2) TriKE® pharmacokinetics optimization in humans; and (3) investigation of the patient’s native NK cell population based on insights obtained from the analysis of the human data generated during our GTB-3550 clinical trial. The major deliverables proposed here are: (1) creation of IND enabling data for TriKE® constructs in support of our product development and GMP manufacturing efforts; (2) TriKE® platform drug delivery changes to allow transition to alternative drug delivery means and extended PK in humans; and (3) gain an increased understanding of changes in the patient’s native NK cell population as a result of TriKE® therapy. Most studies will use TriKE® DNA/amino acid sequences created by us under current UMN/GTB licensing terms. This agreement expired on June 30, 2023. The Company and UofMN are negotiating the terms of a new scientific research agreement and expect to finalize it in the first half of 2024.

The

Company recorded an expense of $

Patent and License Agreements

2016 Exclusive Patent License Agreement

The

Company is party to an exclusive worldwide license agreement with the Regents of the University of Minnesota, (“UofMN”),

to further develop and commercialize cancer therapies using TriKE® technology developed by researchers at the UofMN to

target NK cells to cancer. Under the terms of the 2016 agreement, the Company receives exclusive rights to conduct research and to develop,

make, use, sell, and import TriKE® technology worldwide for the treatment of any disease, state, or condition in humans.

The Company is responsible for obtaining all permits, licenses, authorizations, registrations, and regulatory approvals required or granted

by any governmental authority anywhere in the world that is responsible for the regulation of products such as the TriKE®

technology, including without limitation the FDA and the European Agency for the Evaluation of Medicinal Products in the European Union.

Under the agreement, the UofMN received an upfront payment of $

The

Company did

2021 Patent License Agreement

On

March 26, 2021, the Company signed an agreement specific to the B7H3 targeted TriKE®. Under the agreement, the UofMN received

an upfront license fee of $

| 16 |

The

Company did

Note 8 – Operating Leases

Leases with an initial term of 12 months or less are not recorded on the balance sheet. The Company accounts for the lease and non-lease components of its leases as a single lease component. Rent expense is recognized on a straight-line basis over the lease term. Operating lease Right-of-Use (“ROU”) assets and liabilities are recognized at the lease commencement date based on the present value of lease payments over the lease term. ROU assets represent the Company’s right to use an underlying asset for the lease term and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. Generally, the implicit rate of interest in arrangements is not readily determinable and the Company utilizes its incremental borrowing rate in determining the present value of lease payments. The Company’s incremental borrowing rate is a hypothetical collateralized borrowing rate based on its understanding of what its credit rating would be. The operating lease ROU asset includes any lease payments made and excludes lease incentives.

On

November 19, 2021, the Company entered into a sublease with a third party for

On

February 8, 2022, the Company entered into a copier lease which will end on February 7, 2025. As a result, the Company recognized additional

ROU asset and liability of $

As

a result of these lease agreements, the Company recognized ROU asset and liability in the aggregate of $

The

total rent expense related to these leases reflected on the Company’s Condensed Consolidated Statements of Operations totaled $

Other information related to leases and future minimum lease payments under non-cancellable operating leases were as follows:

| March 31, 2024 (Unaudited) | March 31, 2023 (Unaudited) | |||||||

| Cash paid for amounts included in the measurement of lease liabilities: | ||||||||

| Operating cash flows from operating leases | $ | | $ | |||||

| Weighted-average remaining lease term (in years): | ||||||||

| Operating leases | ||||||||

| Weighted-average discount rate: | ||||||||

| Operating leases | % | % | ||||||

| 17 |

Future minimum lease payments under non-cancellable operating leases were as follows (in thousands):

| March 31, 2024 (Unaudited) | ||||

| Within one year | $ | |||

| After one year and within two years | ||||

| After two years and within three years | ||||

| Thereafter | ||||

| Total future minimum lease payments | ||||

| Less – Discount | ( | ) | ||

| Lease liability | $ | |||

Note 9 – Subsequent Event

On

April 30, 2024, the Company issued shares of common stock to settle $

| 18 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this Quarterly Report on Form 10-Q are “forward-looking statements” within the meaning of the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements regarding our current beliefs, goals and expectations about matters such as our expected financial position and operating results, our business strategy and our financing plans. The forward-looking statements in this report are not based on historical facts, but rather reflect the current expectations of our management concerning future results and events. The forward-looking statements generally can be identified by the use of terms such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “foresee,” “may,” “guidance,” “estimate,” “potential,” “outlook,” “target,” “forecast,” “likely” or other similar words or phrases. Similarly, statements that describe our objectives, plans or goals are, or may be, forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be different from any future results, performance and achievements expressed or implied by these statements. We cannot guarantee that our forward-looking statements will turn out to be correct or that our beliefs and goals will not change. Our actual results could be very different from and worse than our expectations for various reasons. You should carefully review all information, including the discussion of risk factors under “Part I. Item 1A: Risk Factors” and “Part II. Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations” of the Form 10-K for the year ended December 31, 2023. Any forward-looking statements in the Form 10-Q are made only as of the date hereof and, except as may be required by law, we do not have any obligation to publicly update any forward-looking statements contained in this Form 10-Q to reflect subsequent events or circumstances.

Throughout this Quarterly Report on Form 10-Q, the terms “GTBP,” “we,” “us,” “our,” “the Company” and “our Company” refer to GT Biopharma, Inc., a Delaware corporation formerly known as Oxis International, Inc., DDI Pharmaceuticals, Inc. and Diagnostic Data, Inc, together with our subsidiaries.

| 19 |

Overview

We are a clinical stage biopharmaceutical company focused on the development and commercialization of novel immuno-oncology products based on our proprietary Tri-specific Killer Engager (TriKE®) fusion protein immune cell engager technology platform. Our TriKE® platform generates proprietary therapeutics designed to harness and enhance the cancer killing abilities of a patient’s own natural killer cells, or NK cells. Once bound to an NK cell, our moieties are designed to enhance the NK cell, and precisely direct it to one or more specifically targeted proteins expressed on a specific type of cancer cell or virus infected cell, resulting in the targeted cell’s death. TriKE®s can be designed to target any number of tumor antigens on hematologic malignancies or solid tumors and do not require patient-specific customization.

We are using our TriKE® platform with the intent to bring to market immuno-oncology products that can treat a range of hematologic malignancies and solid tumors. The platform is scalable, and we are putting processes in place to be able to produce investigational new drug (IND) ready moieties in a timely manner after a specific TriKE® conceptual design. Specific drug candidates can then be advanced into the clinic on our own or through potential collaborations with partnering companies. We believe our TriKE®s may have the ability, if approved for marketing, to be used as both monotherapy and in combination with other standard-of-care therapies.

We are also using our TriKE® platform to develop therapeutics useful for the treatment of infectious disease such as for the treatment of patients infected by the human immunodeficiency virus (HIV). While the use of anti-retroviral drugs has substantially improved the health and increased the longevity of individuals infected with HIV, these drugs are designed to suppress virus replication to help modulate progression to acquired immunodeficiency syndrome (AIDS) and to limit further transmission of the virus. Despite the use of anti-retroviral drugs, infected individuals retain reservoirs of latent HIV-infected cells that, upon cessation of anti-retroviral drug therapy, can reactivate and re- establish an active HIV infection. For a curative therapy, destruction of these latent HIV infected cells must take place. The HIV-TriKE® contains the antigen binding fragment (Fab) from a broadly neutralizing antibody targeting the HIV-Env protein or a protein that binds infected CD4+ T cells. The HIV-TriKE® is designed to target HIV while redirecting NK cell killing specifically to actively replicating HIV infected cells. The HIV-TriKE® induced NK cell proliferation and demonstrated the ability in vitro to reactivate and kill HIV-infected T-cells. These findings indicate a potential role for the HIV-TriKE® in the reactivation and elimination of the latently infected HIV reservoir cells by harnessing the NK cell’s ability to mediate the antibody-directed cellular cytotoxicity (ADCC).

Our initial work was conducted in collaboration with the Masonic Cancer Center at the University of Minnesota under a program led by Dr. Jeffrey Miller, Professor of Medicine, and the Deputy Director at the Center. Dr. Miller is a recognized key opinion leader in the field of NK cell and IL-15 biology and their therapeutic potential. We have exclusive rights to the TriKE® platform and are generating additional intellectual property for specific moieties.

GTB-3550

GTB-3550 was our first TriKE® product candidate. It reflected our first-generation TriKE® platform. It is a single-chain, tri-specific scFv recombinant fusion protein conjugate composed of the variable regions of the heavy and light chains of anti-CD16 and anti-CD33 antibodies and a modified form of IL-15. We studied this anti-CD16-IL-15-anti-CD33 TriKE® in CD33 positive leukemias, a marker expressed on tumor cells in acute myelogenous leukemia, or AML, and myelodysplastic syndrome, or MDS. CD33 is primarily a myeloid differentiation antigen with endocytic properties broadly expressed on AML blasts and, possibly, some leukemic stem cells. CD33 or Siglec-3 (sialic acid binding Ig-like lectin 3, SIGLEC3, SIGLEC3, gp67, p67) is a transmembrane receptor expressed on cells of myeloid lineage. It is usually considered myeloid-specific, but it can also be found on some lymphoid cells. The anti-CD33 antibody fragment used for these studies was derived from the M195 humanized anti-CD33 scFv and has been used in multiple human clinical studies. It has been exploited as a target for therapeutic antibodies for many years. We believe the approval of the antibody-drug conjugate gemtuzumab validates this targeted approach.

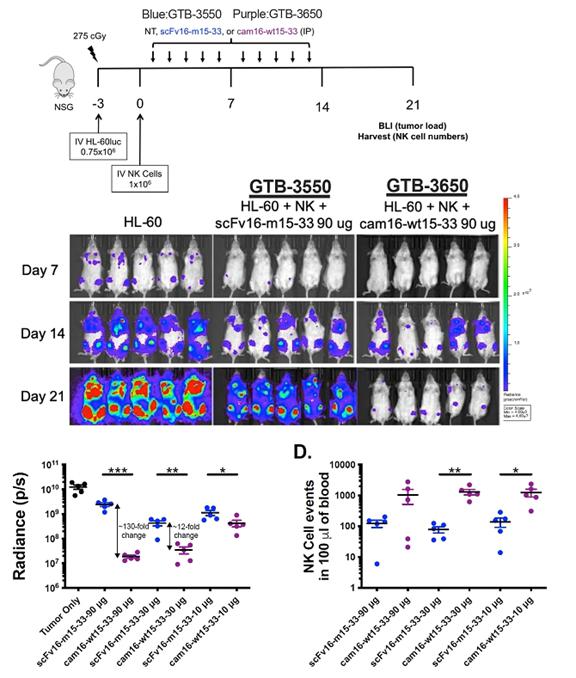

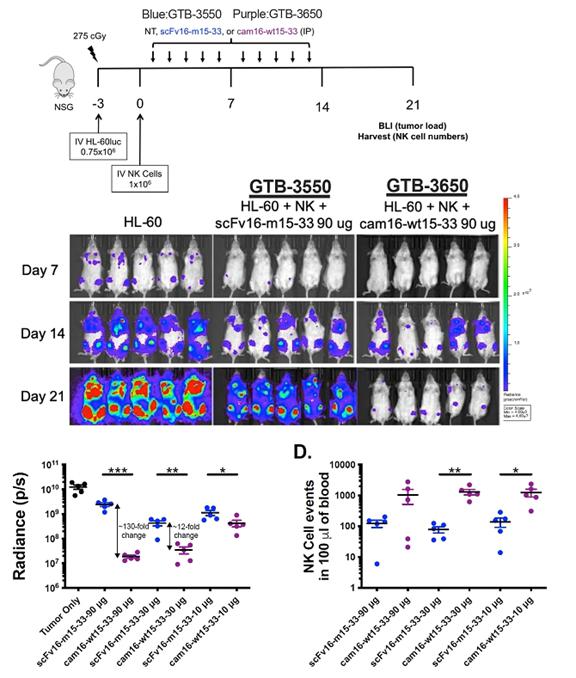

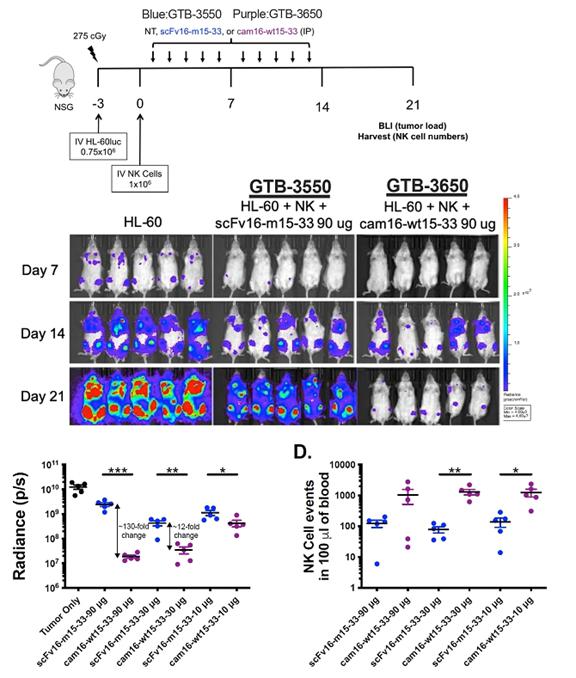

GTB-3550 was replaced by a more potent next-generation camelid nanobody TriKE®, GTB-3650, both targeting CD33 on relapsed/refractory Acute Myeloid Leukemia (AML) and high-risk Myelodysplastic Syndromes (MDS). The pivot from GTB-3550 to GTB-3650 in our clinical development was based on a solid preclinical foundation that showed markedly enhanced potency of the camelid modification of the first-generation TriKE. This is illustrated below by better tumor control of AML bearing animals with GTB-3650 (purple dots) compared to GTB-3550 (blue dots). This provided the rationale for pausing further development of GTB-3550 and moving over to solely develop the 2nd generation TriKE platform.

| 20 |

The Next Generation of Camelid Nanobody TriKE®s

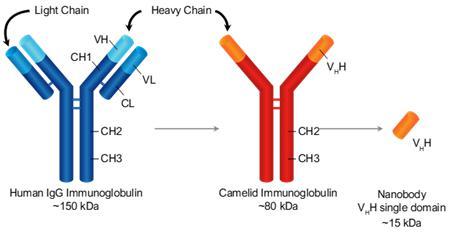

Our goal is to be a leader in immuno-oncology therapies targeting a broad range of indications including hematological malignancies and solid tumors. A key element of our strategy includes introducing a next-generation camelid nanobody platform. Camelid antibodies (often referred as nanobodies) are smaller than human immunoglobulin and consist of two heavy chains. These nanobodies have the potential to have greater affinity to target antigens, potentially resulting in greater potency. GT Biopharma is utilizing this camelid antibody structure for all its new TriKE® product candidates.

Generation of humanized single-domain antibody targeting CD16 for incorporation into the TriKE® platform

To develop second generation TriKE®s, we designed a new humanized CD16 engager derived from a single-domain antibody. While scFvs consist of a heavy and a light variable chain joined by a linker, single-domain antibodies consist of a single variable heavy chain capable of engaging without the need of a light chain counterpart (see figure below).

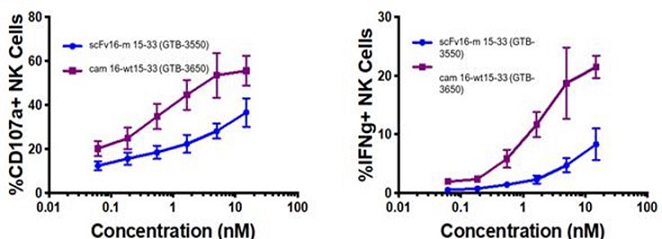

These single-domain antibodies are thought to have certain attractive features for antibody engineering, including physical stability, ability to bind deep grooves, and increased production yields, amongst others. Pre-clinical studies demonstrated increased NK cell activation against CD33+ targets including enhanced NK cell degranulation (% CD107a+) and IFNg with the single-domain CD16 TriKE® (cam 16-wt15-33; GTB-3650) compared to the original TriKE® (scFv16-m 15-33; GTB-3550) (see figure below). This data was published by Dr. Felices M et al (2020) in Cancer Immunol Res.

| 21 |

CD33+ HL60 Targets in Killing Assays

(Purple line represents the GTB-3650 and Blue line represents GTB-3550)

GTB-3650

GTB-3650 is a CD33 targeted TriKE® which targets CD33 on the surface of myeloid leukemias and an agonistic camelid engager to the potent activating receptor on NK cells, CD16. Use of this engager enhances the activity of wild type IL-15 included in GTB-3650, no longer needing the mutant IL-15 included in GTB-3550. The TriKE® approach provides a novel way to specifically target these tumors by leveraging NK cells, which have been shown to mediate relapse protection in this setting, in an anti-CD33-targeted fashion. We are moving GTB-3650 clinically based on pre-clinical data showing a marked increase in potency compared to GTB-3550, which we anticipate could lead to an enhanced efficacy signal in AML and MDS. We are advancing GTB-3650 through preclinical studies and have filed an Investigational New Drug (IND) application with the FDA in December 2023. The Company continues to be in a productive dialogue with the FDA with respect to its IND Application in relation to GTB 3650. We further anticipate approval to start study enrollment targeting patients with relapsed/refractory AML and high grade MDS by the second half of 2024. This initial study will test GTB-3650 as monotherapy testing administration 2 weeks on and two weeks off (to prevent NK cell exhaustion) for at least 2 cycles of therapy. The design of the trial has been agreed on with the FDA.

| 22 |

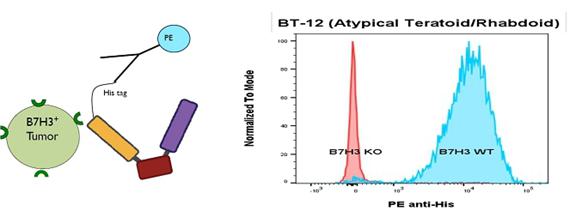

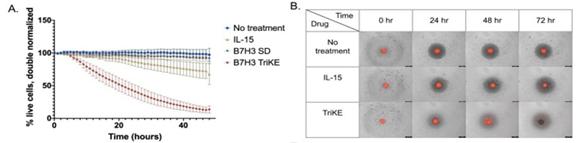

GTB-5550

GTB-5550 is a B7-H3 targeted TriKE® which targets B7-H3 on the surface of advanced solid tumors (figure above). B7-H3 is an exciting target as it displays specific expression on a broad spectrum of solid tumor malignancies, allowing our team to target these malignancies through GTB-5550. Pre-clinical work has shown that this molecule has NK-cell targeted activity against a variety of solid tumor settings, including head and neck cancer squamous cell carcinoma (figure below), prostate cancer, breast cancer, ovarian cancer, glioblastoma, and lung cancer (amongst others). We are advancing GTB-5550 through preclinical studies and have initiated a GMP manufacturing campaign in anticipation of filing an IND in the late second half of 2024. A pre-IND packet was submitted to the FDA in October 2023 with a written response from the FDA in December 2023. The main question to the FDA was regarding pre-clinical toxicology and a pivot to subcutaneous dosing. The initial trial is designed as a basket trial for patients with B7-H3+ solid tumors using Monday through Friday dosing (2 weeks on and 2 weeks off to prevent immune exhaustion). This is dependent on manufacturing of clinical materials. We expect a study targeting patients with B7-H3 positive solid tumors in the first half of 2025.

Reverse Stock Split

On February 1, 2024, the Company announced a reverse stock-split of its common stock, par value $0.001 per share, at a ratio of 1 for 30. The reverse stock-split became effective on February 2, 2024. The Company’s common stock began trading on a reverse stock-split-adjusted basis on The Nasdaq Capital Market on February 5, 2024, under our existing trading symbol “GTBP.”

| 23 |

As a result of the reverse stock-split, every thirty (30) shares of issued and outstanding common stock were automatically combined into one issued and outstanding share of common stock, without any change in the par value per share. No fractional shares were issued in connection with the reverse stock split. Stockholders who otherwise would be entitled to receive fractional shares of common stock will be entitled to receive their pro-rata portion of the net proceeds obtained from the aggregation and sale by the exchange agent of the fractional shares resulting from the reverse stock-split (reduced by any customary brokerage fees, commission and other expenses).

Proportionate adjustments were made to the per share exercise price and the number of shares of common stock that may be purchased upon exercise of outstanding stock options for the Company’s common stock and to the number of shares of common stock reserved for future issuance pursuant to the GT Biopharma, Inc. 2022 Omnibus Incentive Plan.

All share and per share information within this report have been adjusted to retroactively reflect the reverse stock-split as of the earliest period presented.

Economic Disruption

While we make our strategic planning decisions based on the assumption that the markets we are targeting will grow in the long term, our business is dependent, in large part on, and directly affected by, business cycles and other factors affecting the economy generally. Our industry depends on general economic conditions and other factors, including consumer spending and preferences, changes in inflation rates, supply chain issues and impediments should they arise for us, as the U.S. and various other major economies are now experiencing, consumer confidence, fuel costs, fuel availability, environmental impact, governmental incentives and regulatory requirements, and political volatility.

In addition, the outbreak of full-scale wars between Russia and Ukraine and Israel and Palestine (“Conflicts”) and global reactions thereto have increased U.S. domestic and global energy prices. Oil supply disruptions related to the Conflicts, and sanctions and other measures taken by the U.S. and its allies, could lead to higher costs for gas, food, and goods in the U.S. and other geographies and exacerbate the inflationary pressures on the worldwide economy, with potentially adverse impacts on our business, results of operations and financial condition.

Results of Operations

Comparison of the Three Months Ended March 31, 2024 and 2023

Research and Development Expenses (“R&D”)

During the three months ended March 31, 2024 and 2023, we incurred $777,000 and $1.65 million of R&D expenses, respectively. R & D expenses relate to our continued development and production of our most advanced TriKE® product candidates GTB-3650 and GTB-5550 along with the progression on other promising candidates. R&D expenses decreased by $873,000 primarily due to reduction in raw material purchases of $657,000 as we benefit from the near completion of product development for GTB 3650 and continue to advance our progression to the new stage of our product development of GTB 5550, and reduction of $216,000 in consulting fees due to better management of other research and development costs. We anticipate our direct clinical and preclinical expenses to continue to increase in 2024 as we plan to advance our next generation GTB-3650 camelid nanobody product into the clinic and enroll patients, perform tests for data collection, complete the product development of GTB-5550 and anticipate submission of IND application for GTB-5550 in the fourth quarter of 2024. We do not, however, anticipate an increase in related R&D licensing and administrative costs.

Selling, General and Administrative Expenses (“SG&A”)

Selling, general and administrative expense (“SG&A”) was $2.31 million and $2.02 million for the three months ended March 31, 2024 and 2023, respectively. SG&A expenses increased by $299,000 as compared to the prior year comparable period, primarily due to reduction in stock-based compensation expense for officers, employees and board of directors by $616,000, offset by an increase in legal and professional fees of $794,000 and an increase in costs of filing regulatory fees and other SG&A expenses of $121,000.

Interest Income

We recorded interest income of $142,000 and $164,000 for the three months ended March 31, 2024 and 2023, respectively. The decrease in interest income was due to lower short term investment balances during the three months ended March 31, 2024 as compared to prior year comparable period.

| 24 |

Interest Expense

We recorded interest expense of $0 and $212,000 for the three months ended March 31, 2024 and 2023, respectively. The interest expense for the three months ended March 31, 2023 was due to the financing costs incurred associated with warrants accounted as warrant liability sold during the three months ended March 31, 2023 which did not recur in the current year.

Change in Fair Value of Warrant Liability

We recorded a gain of $658,000 due to a change in fair value of warrant liability for the three months ended March 31, 2024, compared to a gain of $2.92 million for the three months ending March 31, 2023. The decrease in gain resulted due to a reduction in our warrant liability because of the decline in the Company’s stock price at March 31, 2024 as compared to the prior comparable period.

Gain on Extinguishment of Debt

We recorded a gain on extinguishment of debt of $0 and $533,000 for the three months ended March 31, 2024 and 2023, respectively. The gain in the three months ended March 31, 2023 was as a result of share settlement of a greater amount of vendor accounts payable than the fair value of the shares on the date of settlement. There was no similar transaction during the current period.

Unrealized (Gain) Loss on Marketable Securities

We recorded an unrealized loss on marketable securities of $2,000 for the three months ended March 31, 2024 as compared to an unrealized gain on marketable securities of $29,000 for the three months ended March 31, 2023. This resulted from lower investments balances for the three months ended March 31, 2024 as compared to prior year comparable period.

As a result of the above, the Company recorded a net loss of $2.27 million for the three months ended March 31, 2024 as compared to a loss of $227,000 for the same comparable period in 2023.

Liquidity and Capital Resources

The Company’s current operations have focused on business planning, raising capital, establishing an intellectual property portfolio, hiring, and conducting preclinical studies. The Company does not have any product candidates approved for sale and has not generated any revenue from its product sales. The Company has sustained operating losses since inception and expects such losses to continue into the foreseeable future. We anticipate that cash utilized in the twelve months following this filing date for selling, general and administrative expenses will range between $3.0 and $3.5 million, and used for research and development expenses will range between $3.5 and $4.0 million.

The Company reported cash and cash equivalents of $1.95 million and short-term investments of $7.86 million as of March 31, 2024. Management believes that the Company has sufficient cash and cash equivalents, and short-term investments to fund its operations for more than twelve months from the date of this filing.

Management is currently evaluating different strategies to obtain the required funding for future operations. These strategies may include but are not limited to public offerings of equity and/or debt securities, payments from potential strategic research and development, licensing and/or marketing arrangements with pharmaceutical companies.

Critical Accounting Policies

We consider the following accounting policies to be critical given they involve estimates and judgments made by management and are important for our investors’ understanding of our operating results and financial condition.

| 25 |

Basis of Presentation and Principles of Consolidation

The accompanying condensed consolidated financial statements have been prepared in accordance with GAAP. These condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Oxis Biotech, Inc. and Georgetown Translational Pharmaceuticals, Inc. Intercompany transactions and balances have been eliminated in consolidation.

Accounting Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates include accruals for potential liabilities, assumptions used in deriving the fair value of warrant liabilities, valuation of equity instruments issued for services, and valuation of deferred tax assets. Actual results could differ from those estimates.

Stock-Based Compensation

The Company accounts for share-based awards to employees, nonemployees and consultants in accordance with the provisions of Accounting Standards Codification 718, Compensation-Stock Compensation. Stock-based compensation cost is measured at fair value on the grant date and that fair value is recognized as expense over the requisite service, or vesting period.

The Company values its equity awards using the Black-Scholes option pricing model, and accounts for forfeitures when they occur. Use of the Black-Scholes option pricing model requires the input of subjective assumptions including expected volatility, expected term, and a risk-free interest rate. The Company estimates volatility using its own historical stock price volatility. The expected term of the instrument is estimated by using the simplified method to estimate expected term. The risk-free interest rate is estimated using comparable published federal funds rates.

Inflation

We believe that inflation has not had a material adverse impact on our business or operating results during the periods presented other than the impact of inflation on the general economy. However, there is a risk that the Company’s operating costs could become subject to inflationary pressures in the future, which would have the effect of increasing the Company’s operating costs, and which would put additional stress on the Company’s working capital resources.

Off-balance Sheet Arrangements

We have no off-balance sheet arrangements as of March 31, 2024.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Our Company qualifies as a smaller reporting company, as defined in 17 C.F.R. §229.10(f)(1) and is not required to provide information for this Item.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Our Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer evaluated the effectiveness of our “disclosure controls and procedures” (as such term is defined in Rules 13a-15(e) and 15d-15(e) of the United States Securities Exchange Act of 1934, as amended), as of March 31, 2024. Based on that evaluation, we have concluded that our disclosure controls and procedures were effective as of March 31, 2024.

| 26 |

Management’s Report on Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Securities Exchange Act of 1934, as amended, as a process designed by, or under the supervision of, a company’s principal executive and principal accounting officers and effected by a company’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

| ● | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company | |

| ● | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of consolidated financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and | |

| ● | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s assets that could have a material effect on the consolidated financial statements. |

All internal control systems, no matter how well designed, have inherent limitations and can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within our company have been detected. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation.

As of March 31, 2024, our management, including our interim Chief Executive Officer and Chief Financial Officer conducted an assessment of the effectiveness of the Company’s internal control over financial reporting. In making this assessment, we used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission in internal control integrated framework. Based upon our evaluation, we concluded that our internal controls over financial reporting were operating effectively with a significant level of precision as of March 31, 2024.

Changes in Internal Control Over Financial Reporting

No changes in our internal controls over financial reporting were made during our most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II. OTHER INFORMATION

Item 1. Legal Proceedings

| ● | On May 24, 2023, TWF Global, LLC (“TWF”) filed a Complaint in the California Superior Court for the County of Los Angeles naming the Company as defendant. The Complaint alleges that TWF is the holder of two Convertible Promissory Notes (“Notes”) and that the Company did not deliver shares of common stock due on conversion in February 2021. TWF was seeking per diem liquidated damages based on the terms of alleged Notes. On July 14, 2023, the Company filed a motion to dismiss for improper forum because the terms of the Notes, as alleged, require disputes to be filed in New York state and federal courts. TWF voluntarily dismissed its Complaint before the California Superior Court of Los Angeles without prejudice. The Company subsequently filed a Summons and Complaint for Interpleader against TWF and Z One LLC before the Supreme Court of the State of New York County of New York, asking the Supreme Court to determine if the Company’s shares of common stock are properly registered to TWF or Z One LLC, as both of these entities have made conflicting demands for registration of the shares of common stock. On February 5, 2024, the Company filed a motion for entry of default against TWF, seeking an order directing the Company to register the shares of common stock in the name of Z-One and that the Company be released from all associated liability and claims. The Court has not yet ruled on the Company’s motion. The Company believes that any claims related to the Notes are without merit and will continue to defend vigorously against these claims. The Court denied the motion without prejudice, and will reconsider the motion without further briefing upon the filing of a party affidavit. Z-One has filed a concurrent motion to dismiss of the action, representing that Z-One and TWF have settled their dispute over the entitlement to GT Biopharma shares. The Company believes that any claims related to the Notes are without merit and will continue to defend vigorously against these claims. | |