UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. 1)

| Filed by the registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | ☐ | Confidential, For Use | |

| ☒ | Definitive Proxy Statement | of the Commission Only | ||

| ☐ | Definitive Additional Materials | (as permitted by Rule | ||

| ☐ | Soliciting Material under Rule 14a-12 | 14a-6(e)(2)) |

GT BIOPHARMA, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No Fee Required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

EXPLANATORY NOTE

This Amendment No. 1 amends and restates in its entirety the definitive proxy statement filed by GT Biopharma, Inc. (the “Company”) with the Securities and Exchange Commission on May 1, 2023 (the “Original Definitive Proxy Statement”) in connection with its annual meeting of stockholders.

This Amendment No. 1 is being filed primarily for the purposes of (i) correcting the number of outstanding shares of common stock as of the record date for the annual meeting, (ii) updating the anticipated mailing date for the Company’s proxy materials (along with associated dates for the submission of stockholder proposals), (iii) updating the biographical information of the Company’s directors and officers, (iv) updating the proxy card for use in connection with the annual meeting, and (v) correcting minor typographical errors in the Original Definitive Proxy Statement.

GT BIOPHARMA, INC.

8000 Marina Boulevard, Suite 100

Brisbane, California 94005

(415) 919-4040

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 28, 2023

TO THE STOCKHOLDERS OF GT BIOPHARMA, INC.:

You are cordially invited to attend the Annual Meeting of Stockholders of GT Biopharma, Inc., a Delaware corporation (the “Company”), to be held on June 28, 2023, at 11:00 A.M. Pacific time, for the following purposes as more fully described in the accompanying proxy statement:

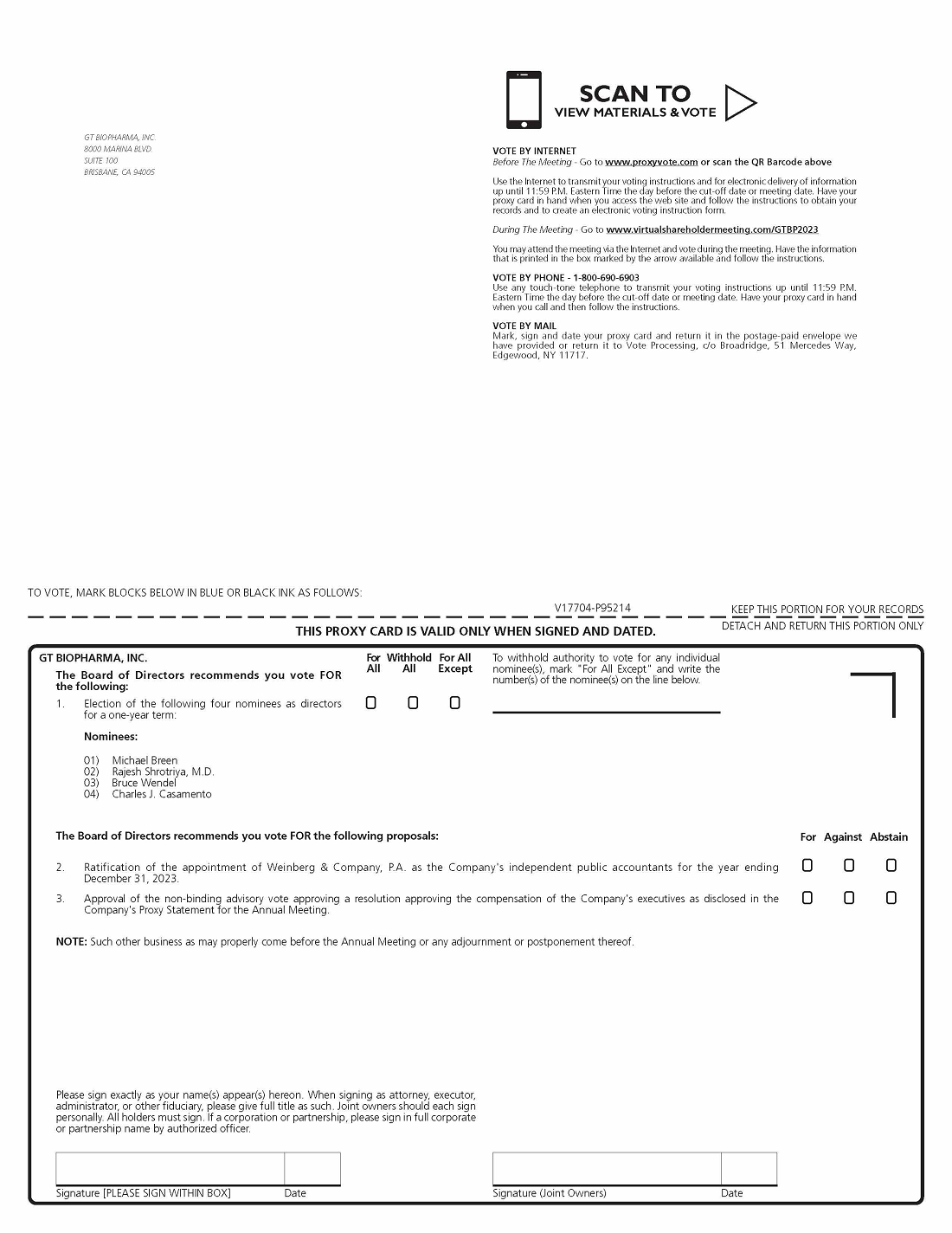

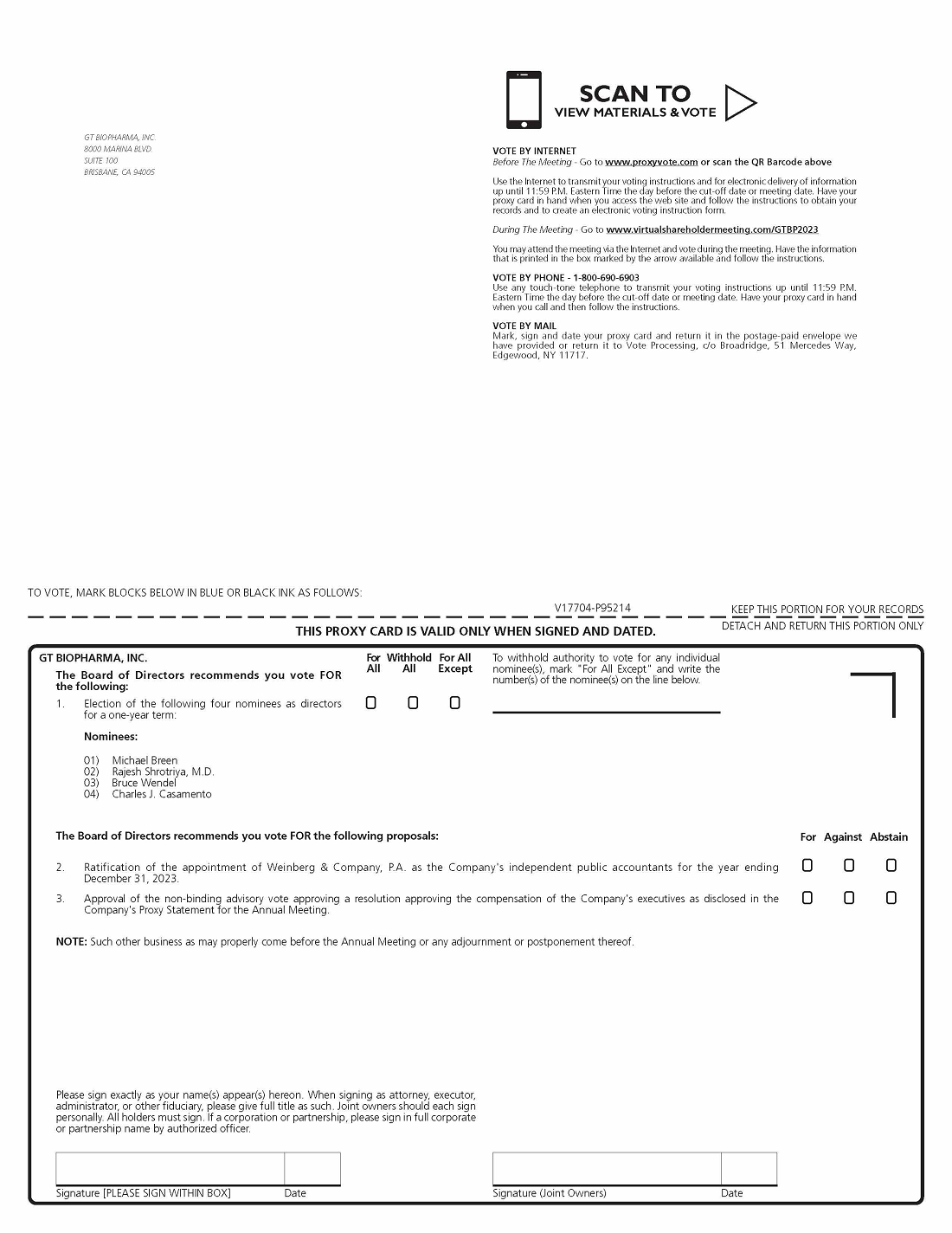

| 1. | To elect four directors to serve until the 2024 annual meeting of stockholders or until their successors are duly elected and qualified; | |

| 2. | To ratify the appointment of Weinberg & Company, P.A. as the Company’s independent accountants for the fiscal year ending December 31, 2023; | |

| 3. | To hold an advisory vote on executive compensation; and | |

| 4. | To transact other business properly presented at the meeting or any postponement or adjournment thereof. |

This year, the Annual Meeting will be a completely virtual meeting of stockholders, conducted solely via a live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/GTBP2023. You will also be able to vote your shares electronically at the Annual Meeting.

This year, we have elected to use the Internet as our primary means of providing our proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send to our stockholders a Notice of Internet Availability of Proxy Materials, which contains instructions on how to access our proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2022. The Notice of Internet Availability of Proxy Materials also includes instructions on how you can vote using the Internet, by telephone or at the virtual Annual Meeting via live webcast, and how you can request and receive, free of charge, a printed copy of our proxy materials. All stockholders who do not receive a Notice of Internet Availability of Proxy Materials will receive a paper copy of the proxy materials by mail.

Our Board of Directors has fixed May 1, 2023 as the record date for the determination of stockholders entitled to notice and to vote at the Annual Meeting and any postponement or adjournment thereof, and only stockholders of record at the close of business on that date are entitled to notice and to vote at the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available at the Annual Meeting and at the offices of the Company for 10 days prior to the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting via live webcast, please vote by telephone or the Internet by following the voting procedures described in the Proxy Materials. If you received printed proxy materials and wish to vote by mail, promptly complete, date and sign the enclosed proxy card and return it in the accompanying envelope.

| May 1, 2023 | By Order of the Board of Directors | |

| Michael Breen | ||

|

Executive Chairman of the Board and Interim Chief Executive Officer |

GT BIOPHARMA, INC.

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 28, 2023

INFORMATION CONCERNING VOTING AND SOLICITATION OF PROXIES

Our Board of Directors solicits your proxy for the 2023 Annual Meeting of Stockholders (the “Annual Meeting”), and for any postponement or adjournment of the Annual Meeting, for the purposes described in the “Notice of Annual Meeting of Stockholders.” The table below shows some important details about the Annual Meeting and voting. Additional information is available in the “Frequently Asked Questions” section of the proxy statement immediately below the table. We use the terms “GT Biopharma,” “the Company,” “we,” “our” and “us” in this proxy statement to refer to GT Biopharma, Inc., a Delaware corporation.

The Notice of Annual Meeting, proxy statement, proxy card and copy of our Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Annual Report”) are first being made available to our stockholders on or about May 12, 2023.

Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting

This proxy statement and the 2023 Annual Report are available for viewing, printing and downloading at www.proxyvote.com and on the “Investors” section of our website at www.gtbiopharma.com. Certain documents referenced in the proxy statement are available on our website. However, we are not including the information contained on our website, or any information that may be accessed by links on our website, as part of, or incorporating it by reference into, this proxy statement.

| Meeting Details | June 28, 2023, 11:00 a.m. Pacific Time | |

| Virtual Meeting | To participate in the Annual Meeting virtually via the Internet, please visit: www.virtualshareholdermeeting.com/GTBP2023. To access the Annual Meeting you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, included on your proxy card, or provided through your broker. Stockholders will be able to vote and submit questions during the Annual Meeting. | |

| Record Date | May 1, 2023 | |

| Shares Outstanding | There were 37,493,065 shares of common stock outstanding and entitled to vote as of the Record Date. | |

| Eligibility to Vote | Holders of our common stock at the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting. Each stockholder is entitled to one vote for each share held as of the Record Date. | |

| Quorum | A majority of the shares of common stock outstanding and entitled to vote, by proxy or via live webcast, as of the Record Date constitutes a quorum. A quorum is required to transact business at the Annual Meeting. | |

| Voting Methods | Stockholders whose shares are registered in their names with Computershare, our transfer agent (referred to as “Stockholders of Record”) may vote by proxy via the Internet, phone, or mail by following the instructions on the accompanying proxy card. Stockholders of Record may also vote at the virtual Annual Meeting. Stockholders whose shares are held in “street name” by a broker, bank or other nominee (referred to as “Beneficial Owners”) must follow the voting instructions provided by their brokers or other nominees. See “What is the difference between holding shares as a Stockholder of Record and as a Beneficial Owner?” and “How do I vote and what are the voting deadlines?” below for additional information. | |

| Inspector of Elections | We will appoint an independent Inspector of Elections to determine whether a quorum is present, and to tabulate the votes cast by proxy or at the Annual Meeting via live webcast. | |

| Voting Results | We will announce preliminary results at the Annual Meeting. We will report final results on a Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) as soon as practicable after the Annual Meeting. | |

| Proxy Solicitation Costs | We will bear the costs of soliciting proxies from our stockholders. These costs include preparing, assembling, printing, mailing and distributing notices, proxy statements, proxy cards and Annual Reports. Our directors, officers and other employees may solicit proxies personally or by telephone, e-mail or other means of communication, and we will reimburse them for any related expenses. We will also reimburse brokers and other nominees for their reasonable out-of-pocket expenses for forwarding proxy materials to the Beneficial Owners of the shares that the nominees hold in their names. |

| 2 |

FREQUENTLY ASKED QUESTIONS

What matters am I voting on?

You will be voting on:

| ● | The election of four directors to hold office until the 2024 annual meeting of stockholders (the “2024 Annual Meeting”) or until their successors are duly elected and qualified; | |

| ● | A proposal to ratify the appointment of Weinberg & Company, P.A. as our independent registered public accounting firm for the fiscal year ending December 31, 2023; | |

| ● | An advisory vote on executive compensation; and | |

| ● | Any other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

How does our Board of Directors recommend that I vote?

Our Board of Directors recommends that you vote:

| ● | FOR the election of the four directors nominated by our Board of Directors and named in this proxy statement as directors to serve for one-year terms; | |

| ● | FOR the ratification of the appointment of Weinberg & Company, P.A. as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and | |

| ● | FOR endorsement of the compensation of our executive officers. |

Why did I receive a notice in the mail regarding the Internet availability of proxy materials?

Instead of mailing printed copies to each of our stockholders, we have elected to provide access to our proxy materials over the Internet under the SEC’s “notice and access” rules. These rules allow us to make our stockholders aware of the Annual Meeting and the availability of our proxy materials by sending the Notice of Internet Availability of Proxy Materials, or the Notice, which provides instructions for how to access the full set of proxy materials through the Internet or make a request to have printed proxy materials delivered by mail. Accordingly, on or about May 12, 2023, we mailed the Notice to each of our stockholders. The Notice contains instructions on how to access our proxy materials, including our Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, each of which is available at www.proxyvote.com. The Notice also provides instructions on how to vote your shares through the Internet, by telephone, by mail or virtually at the Annual Meeting.

What is the purpose of complying with the SEC’s “notice and access” rules?

We believe compliance with the SEC’s “notice and access” rules allows us to provide our stockholders with the materials they need to make informed decisions, while lowering the costs of printing and delivering those materials and reducing the environmental impact of our Annual Meeting. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials electronically unless you elect otherwise.

Will there be any other items of business on the agenda?

If any other items of business or other matters are properly brought before the Annual Meeting, your proxy gives discretionary authority to the persons named on the proxy card with respect to those items of business or other matters. The persons named on the proxy card intend to vote the proxy in accordance with their best judgment. Our Board of Directors does not intend to bring any other matters to be voted on at the Annual Meeting, and we are not currently aware of any matters that may be properly presented by others for action at the Annual Meeting.

Who is entitled to vote at the Annual Meeting?

Holders of our common stock at the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting. Each stockholder is entitled to one vote for each share of our common stock held as of the Record Date. Cumulative voting is not permitted with respect to the election of directors.

| 3 |

A complete list of the stockholders entitled to vote at the Annual Meeting will be available at our headquarters, located at 8000 Marina Boulevard, Suite 100, Brisbane, California 94005, during regular business hours for the ten days prior to the Annual Meeting. This list will also be available during the Annual Meeting at this location. Stockholders may examine the list for any legally valid purpose related to the Annual Meeting.

What is the difference between holding shares as a Stockholder of Record and as a Beneficial Owner?

Stockholders of Record. If, at the close of business on the Record Date, your shares are registered directly in your name with Computershare, our transfer agent, you are considered the Stockholder of Record with respect to those shares. As the Stockholder of Record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote at the Annual Meeting via live webcast.

Beneficial Owners. If your shares are held in a stock brokerage account or by a bank or other nominee on your behalf, you are considered the Beneficial Owner of shares held in “street name.” As the Beneficial Owner, you have the right to direct your broker or nominee how to vote your shares by following the voting instructions your broker or other nominee provides. In general, if you do not provide your broker or nominee with instructions on how to vote your shares, your broker or nominee may, in its discretion, vote your shares with respect to routine matters (e.g., the ratification of the appointment of our independent auditor), but may not vote your shares with respect to any non-routine matters (e.g., the election of directors). Please see “What if I do not specify how my shares are to be voted?” for additional information.

How can I participate in the Annual Meeting?

Our stockholders may participate in the Annual Meeting by visiting the following website: www.virtualshareholdermeeting.com/GTBP2023. You will need the 16-digit control number included on your proxy card to attend and vote at the Annual Meeting. If you are the Beneficial Owner of your shares, your 16-digit control number may be included in the voting instructions form that accompanied your proxy materials. If your nominee did not provide you with a 16-digit control number in the voting instructions form that accompanied your proxy materials, you may be able to log onto the website of your nominee prior to the start of the Annual Meeting, which will automatically populate your 16-digit control number in the virtual Annual Meeting interface. Stockholders who have obtained a 16-digit control number as described above may vote or submit questions while participating in the live webcast of the Annual Meeting. However, even if you plan to attend the Annual Meeting virtually, we recommend that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Annual Meeting via live webcast.

How do I vote and what are the voting deadlines?

Stockholders of Record. Stockholders of Record can vote by proxy or by attending the Annual Meeting virtually by visiting www.virtualshareholdermeeting.com/GTBP2023, where votes can be submitted via live webcast. If you vote by proxy, you can vote by Internet, telephone or by mail as described below.

| ● | You may vote via the Internet or by telephone. To vote via the Internet or by telephone, follow the instructions provided in the Notice or in the proxy card that accompanies this proxy statement. If you vote via the Internet or by telephone, you do not need to return a proxy card by mail. Internet and telephone voting are available 24 hours a day. Votes submitted through the Internet or by telephone must be received by 11:59 p.m. Eastern Time on June 27, 2023. Alternatively, you may request a printed proxy card by following the instructions provided in the Notice. | |

| ● | You may vote by mail. If you would like to vote by mail, you need to complete, date and sign the proxy card that accompanies this proxy statement and promptly mail it in the enclosed postage-paid envelope so that it is received no later than June 27, 2023. You do not need to put a stamp on the enclosed envelope if you mail it from within the United States. The persons named on the proxy card will vote the shares you own in accordance with your instructions on the proxy card you mail. If you return the proxy card, but do not give any instructions on a particular matter to be voted on at the Annual Meeting, the persons named on the proxy card will vote the shares you own in accordance with the recommendations of our Board of Directors. Our Board of Directors recommends that you vote FOR each of Proposals No. One, Two and Three. | |

| ● | You may vote at the Annual Meeting. If you choose to vote at the Annual Meeting virtually, you will need the 16-digit control number included on your Notice or on your proxy card. If you are the beneficial owner of your shares, your 16-digit control number may be included in the voting instructions form that accompanied your proxy materials. If your nominee did not provide you with a 16-digit control number in the voting instructions form that accompanied your proxy materials, you may be able to log onto the website of your nominee prior to the start of the Annual Meeting, on which you will need to select the stockholder communications mailbox link through to the Annual Meeting, which will automatically populate your 16-digit control number in the virtual Annual Meeting interface. The method you use to vote will not limit your right to vote at the virtual Annual Meeting. All shares that have been properly voted and not revoked will be voted at the Annual Meeting. |

| 4 |

Beneficial Owners. If you are the Beneficial Owner of shares held of record by a broker or other nominee, you will receive voting instructions from your broker or other nominee. You must follow the voting instructions provided by your broker or other nominee in order to instruct your broker or other nominee how to vote your shares. The availability of telephone and Internet voting options will depend on the voting process of your broker or other nominee. As discussed above, if you received your 16-digit control number in the voting instructions form that accompanied your Notice or your proxy materials, or if you are able to link through to the Annual Meeting from the website of your nominee and populate your 16-digit control number in the virtual Annual Meeting interface, you will be able to vote virtually at the Annual Meeting.

May I change my vote or revoke my proxy?

Stockholders of Record. If you are a Stockholder of Record, you may revoke your proxy or change your proxy instructions at any time before your proxy is voted at the Annual Meeting by:

| ● | entering a new vote by Internet or telephone; | |

| ● | signing and returning a new proxy card with a later date; | |

| ● | delivering a written revocation to our Secretary at the address listed on the front page of this proxy statement; or | |

| ● | attending the Annual Meeting and voting via live webcast. |

Beneficial Owners. If you are the beneficial owner of your shares, you must contact the broker or other nominee holding your shares and follow their instructions to change your vote or revoke your proxy.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our Board of Directors. The persons named on the proxy card have been designated as proxy holders by our Board of Directors. When a proxy is properly dated, executed and returned, the shares represented by the proxy will be voted at the Annual Meeting in accordance with the instruction of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board of Directors (as shown on the first page of the proxy statement). If any matters not described in the proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is postponed or adjourned, the proxy holders can vote your shares on the new meeting date, unless you have properly revoked your proxy, as described above.

What if I do not specify how my shares are to be voted?

Stockholders of Record. If you are a Stockholder of Record and you submit a proxy but you do not provide voting instructions, your shares will be voted:

| ● | FOR the election of the four directors nominated by our Board of Directors and named in this proxy statement as directors to serve for one-year terms; | |

| ● | FOR the ratification of the appointment of Weinberg & Company, P.A. as our independent registered public accounting firm for the fiscal year ending December 31, 2023; | |

| ● | FOR endorsement of the compensation of our executive officers; and | |

| ● | In the discretion of the named proxy holders regarding any other matters properly presented for a vote at the Annual Meeting. |

| 5 |

Beneficial Owners. If you are a Beneficial Owner and you do not provide your broker or other nominee that holds your shares with voting instructions, your broker or other nominee will determine if it has discretion to vote on each matter. In general, brokers and other nominees do not have discretion to vote on non-routine matters. Each of Proposal No. One (election of directors) and Proposal No. Three (endorsement of executive compensation) is a non-routine matter, while Proposal No. Two (ratification of appointment of independent registered public accounting firm) is a routine matter. As a result, if you do not provide voting instructions to your broker or other nominee, your broker or other nominee cannot vote your shares with respect to Proposal Nos. One and Three, which would result in a “broker non-vote,” but may, in its discretion, vote your shares with respect to Proposal No. Two. For additional information regarding broker non-votes, see “What are the effects of abstentions and broker non-votes?” below.

What is a quorum?

A quorum is the minimum number of shares required to be present at the Annual Meeting for the meeting to be properly held under our Amended and Restated Bylaws and Delaware law. A majority of the shares of common stock outstanding and entitled to vote, by proxy or at the Annual Meeting via live webcast, constitutes a quorum for the transaction of business at the Annual Meeting. As noted above, as of the Record Date, there were a total of 37,493,065 shares of common stock outstanding, which means that 18,746,533 shares of common stock must be represented by proxy or virtually via live webcast at the Annual Meeting to have a quorum. If there is no quorum, a majority of the shares present at the Annual Meeting may adjourn the meeting to a later date.

What are the effects of abstentions and broker non-votes?

An abstention represents a stockholder’s affirmative choice to decline to vote on a proposal. Under Delaware law, abstentions are considered present and entitled to vote at the Annual Meeting. As a result, abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against a proposal in cases where approval of the proposal requires the affirmative vote of a majority of the shares present and entitled to vote at the Annual Meeting (Proposal Nos. Two and Three). However, because the outcome of Proposal No. One (election of directors) will be determined by a plurality of the voting power of the shares present and entitled to vote at the Annual Meeting, abstentions will have no impact on the outcome of the proposal as long as a quorum exists.

A broker non-vote occurs when a broker or other nominee holding shares for a Beneficial Owner does not vote on a particular proposal because the broker or other nominee does not have discretionary voting power with respect to such proposal and has not received voting instructions from the Beneficial Owner of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting, but will not be counted for purposes of determining the number of votes cast. Therefore, a broker non-vote will make a quorum more readily attainable but will not affect the outcome of the vote on Proposal Nos. Two and Three.

How many votes are needed for approval of each proposal?

| Proposal | Vote Required | Broker Discretionary Voting Allowed? | ||

| Proposal No. One – Election of directors | Plurality of voting power of shares present and entitled to vote | No | ||

| Proposal No. Two – Ratification of the appointment of the independent registered accounting firm | Majority of voting power of shares present and entitled to vote | Yes | ||

| Proposal No. Three – Endorsement of the compensation of executive officers | Majority of voting power of shares present and entitled to vote | No |

With respect to Proposal No. One, you may vote (i) FOR all nominees, (ii) WITHHOLD your vote as to all nominees, or (iii) vote FOR all nominees except for those specific nominees from whom you WITHHOLD your vote. The four nominees receiving the most FOR votes will be elected. Cumulative voting is not permitted with respect to the election of directors. If you WITHHOLD your vote as to all nominees, your vote will be treated as if you had ABSTAINED from voting on Proposal No. One, and your abstention will have no effect on the outcome of the vote.

| 6 |

With respect to Proposal Nos. Two and Three, you may vote FOR, AGAINST or ABSTAIN. If you ABSTAIN from voting on any of these proposals, the abstention will have the same effect as a vote AGAINST the proposal.

How are proxies solicited for the Annual Meeting and who is paying for the solicitation?

Our Board of Directors is soliciting proxies for use at the Annual Meeting by means of this proxy statement. We will bear the entire cost of the proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon request to brokers and other nominees to forward to the Beneficial Owners of the shares held of record by the brokers or other nominees. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending these proxy materials to Beneficial Owners.

This solicitation of proxies may be supplemented by solicitation by telephone, electronic communication, or other means by our directors, officers, employees or agents. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation. We do not plan to retain a proxy solicitor to assist in the solicitation of proxies.

Is my vote confidential?

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within GT Biopharma or to third parties, except as necessary to meet applicable legal requirements, to allow for the tabulation of votes and certification of the vote, or to facilitate a successful proxy solicitation.

Will members of the Board of Directors attend the Annual Meeting?

We encourage our board members to attend the Annual Meeting. Because this year’s Annual Meeting will be completely virtual, those board members who do attend will not be available to answer questions from stockholders.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted an SEC-approved procedure called “householding,” under which we can deliver a single copy of the Notice and, if applicable, the proxy materials to multiple stockholders who share the same address unless we received contrary instructions from one or more of the stockholders. This procedure reduces our printing and mailing costs. Stockholders of Record who participate in householding will be able to access and receive separate proxy cards. Upon written or oral request, we will promptly deliver a separate copy of the Notice and, if applicable, the proxy materials to any stockholder at a shared address to which we delivered a single copy of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that GT Biopharma only send a single copy of the next year’s Notice and, if applicable, the proxy materials, you may contact us as follows:

GT Biopharma Inc.

Attention: Secretary

8000 Marina Boulevard, Suite 100

Brisbane, California 94005

(415) 919-4040

Stockholders who hold shares in street name may contact their brokerage firm, bank, broker-dealer or other nominee to request information about householding.

| 7 |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Proposal No. 1 is the election of four directors to hold office for a period of one year or until their respective successors have been duly elected and qualified. Our Amended and Restated Bylaws provide that the number of the directors of our company shall be not less than three nor more than nine, as fixed from time-to-time by resolution of our Board of Directors. On November 11, 2020, our Board of Directors fixed the number of directors at five. There is currently one vacancy on our Board of Directors. Our Nominating and Corporate Governance Committee continues to review potential candidates to fill that seat.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named below. If any nominee is unwilling to serve as a director at the time of the Annual Meeting, the proxies will be voted for such other nominee(s) as shall be designated by the then current Board of Directors to fill any vacancy. We have no reason to believe that any nominee will be unable or unwilling to serve if elected as a director.

Our Board of Directors proposes the election of the following nominees as directors:

Michael Breen, Executive Chairman of the Board

Bruce Wendel, Vice Chairman of the Board

Rajesh Shrotriya, M.D.

Charles J. Casamento

If elected, the foregoing four nominees are expected to serve until the 2024 Annual Meeting.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS YOU VOTE “FOR” THE ELECTION OF THE NOMINEES LISTED ABOVE.

The principal occupation and certain other information about the nominees and certain executive officers are set forth on the following pages.

| 8 |

CURRENT DIRECTORS/DIRECTOR NOMINEES

The following table sets forth the name, age, position and date of appointment of each of our directors as of May 1, 2023.

| Name | Age | Position | Date of Appointment | |||

| Michael Breen | 60 | Executive Chairman of the Board and Interim Chief Executive Officer | January 13, 2021 | |||

| Bruce Wendel(1) (4) | 69 | Vice Chairman of the Board | November 11, 2020 | |||

| Rajesh Shrotriya, M.D.(2)(4) | 78 | Director | January 13, 2021 | |||

| Charles J. Casamento.(3)(4) | 77 | Director | May 1, 2023 |

| (1) | Chairman of the Compensation Committee. | |

| (2) | Chairman of the Nominating and Corporate Governance Committee. | |

| (3) | Chairman of the Audit Committee. | |

| (4) | Member of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. |

Michael Breen – Executive Chairman of the Board and Interim Chief Executive Officer

Mr. Breen was appointed to our Board of Directors on January 13, 2021, was appointed Executive Chairman of the Board on November 8, 2021 and was appointed as our Interim Chief Executive Officer on March 2, 2022. Prior to joining our company, Mr. Breen served as a senior partner in the global law firm of Clyde & Co., specializing in all aspects of corporate law, including mergers and acquisitions and fund management regulatory issues, which included advising clients in the biotechnology and health sciences sectors. Prior to joining Clyde & Co., Mr. Breen served as a senior partner and managing partner in the London law firm of Edward Lewis. Prior to his time at Edward Lewis, he was also a partner at Robert Gore & Company. Between 2002 and 2005, Mr. Breen was managing director and a shareholder of the Sports and Entertainment Division of Insinger de Beaufort Bank, a Dutch private banking, asset management and trust group listed on the Luxembourg stock exchange. From 2001 to 2007 Mr. Breen also served as a non-executive director and co-owner of Damon Hill Holdings Limited, a multi franchise motor dealer group. Mr. Breen also serves as a director of a Cayman Islands fund, Bristol Investment Fund, Limited. Mr. Breen is also a non-executive director and co-owner of Colorsport Images Limited, a sports photographic agency and library. Mr. Breen is a U.K. qualified solicitor/attorney who holds an Honours LL.B. degree in law from the University College of Wales, Aberystwyth and qualified as a solicitor of the Supreme Court of Judicature of England and Wales in 1988. Mr. Breen is a former member of the International Bar Association, British Association for Sport and the Law, Law Society of England and Wales, and Holborn Law Society.

Bruce Wendel – Vice Chairman of the Board

Mr. Wendel was appointed to our Board of Directors on November 11, 2020. From April 2018 to May 2019, Mr. Wendel served as the Chief Business Development Officer for Prometic Biotherapeutics, Inc., a pharmaceutical development company. Mr. Wendel also served as Chief Strategic Officer of Hepalink USA, the U.S. subsidiary of Shenzhen Hepalink Pharmaceutical Company from February 2012 to July 2022, and Chief Executive Officer of Scientific Protein Laboratories, LLC from December 2014 to June 2015. He also served as a director of ProMetic Life Sciences Inc. and Vice Chairman and Chief Executive Officer at Abraxis BioScience, LLC, where he oversaw the development and commercialization of Abraxane® and led the negotiations that culminated in the acquisition of the company by Celgene Corporation in 2010. He began his 14 years at Bristol-Myers Squibb as in-house counsel before shifting to global business and corporate development where he served in roles of increasing responsibility. Subsequently, he was VP of Business Development at IVAX Corporation, and at American Pharmaceutical Partners, Inc. Mr. Wendel earned a juris doctorate degree from Georgetown University Law School, and a B.S. from Cornell University.

| 9 |

Rajesh Shrotriya, M.D. - Director

Dr. Shrotriya was appointed to our Board of Directors on January 13, 2021. Prior to joining our company, until 2022, Dr. Shrotriya served as Chairman of the Board and Chief Executive Officer of Spectrum Pharmaceuticals, Inc. from August 2002 and a director since June 2001. From September 2000 to April 2014, Dr. Shrotriya also served as President of Spectrum Pharmaceuticals, Inc. and from September 2000 to August 2002, Dr. Shrotriya also served as Chief Operating Officer of Spectrum. Prior to joining Spectrum, Dr. Shrotriya held the position of Executive Vice President and Chief Scientific Officer from November 1996 until August 2000, and as Senior Vice President and Special Assistant to the President from November 1996 until May 1997, for SuperGen, Inc., a publicly-held pharmaceutical company focused on drugs for life-threatening diseases, particularly cancer. From August 1994 to October 1996, Dr. Shrotriya held the positions of Vice President, Medical Affairs and Vice President, Chief Medical Officer of MGI Pharma, Inc., an oncology-focused biopharmaceutical company. Dr. Shrotriya spent 18 years at Bristol-Myers Squibb Company, an NYSE-listed pharmaceutical company, in a variety of positions, most recently as Executive Director, Worldwide CNS Clinical Research. Previously, Dr. Shrotriya held various positions at Hoechst Pharmaceuticals, most recently as Medical Advisor. Dr. Shrotriya was an attending physician and held a courtesy appointment at St. Joseph Hospital in Stamford, Connecticut. In addition, he received a certificate for Advanced Biomedical Research Management from Harvard University. Dr. Shrotriya received an M.D. from Grant Medical College, Bombay, India, in 1974; a D.T.C.D. (Post Graduate Diploma in Chest Diseases) from Delhi University, V.P. Chest Institute, Delhi, India, in 1971; an M.B.B.S. (Bachelor of Medicine and Bachelor of Surgery — equivalent to an M.D. in the U.S.) from the Armed Forces Medical College, Poona, India, in 1967; and a B.S. in Chemistry from Agra University, Aligarh, India, in 1962. Currently, Dr. Shrotriya is a member of the board of directors of CASI Pharmaceuticals, Inc., a NASDAQ-listed biopharmaceutical company, and on the Board of Trustees at the UNLV Foundation.

Charles J. Casamento

Mr. Casamento was appointed to our Board of Directors on May 1, 2023. Mr. Casamento is currently executive director and principal of The Sage Group, a healthcare advisory group specializing in mergers, acquisitions, and partnerships between biotechnology companies and pharmaceutical companies, since 2007. He was the president and CEO of Osteologix, Inc., a public biopharmaceutical company developing products for treating osteoporosis, from 2004 through 2007. Mr. Casamento was founder of, and from 1999 through 2004, served as chairman of the board, president and CEO, of Questcor Pharmaceuticals, Inc. which was subsequently acquired by Mallinckrodt Pharmaceuticals. Mr. Casamento formerly served as RiboGene, Inc.’s president, CEO and chairman of the board from 1993 through 1999 until it merged with Cypros Pharmaceutical Corp to form Questcor Pharmaceuticals, Inc. He was co-founder, president and CEO of Interneuron Pharmaceuticals, Inc. (Indevus), a biopharmaceutical company, from 1989 until 1993. Indevus was eventually acquired by Endo Pharmaceuticals. Mr. Casamento has also held senior management positions at Genzyme Corporation, where he was senior vice president, pharmaceuticals and biochemicals; American Hospital Supply, where he was vice president of business development and strategic planning for the Critical Care Division; Johnson & Johnson, Hoffmann-LaRoche, Inc. and Sandoz Inc. (now Novartis). Mr. Casamento also serves on the board of directors of the following Nasdaq listed companies: Eton Pharmaceuticals, Inc., PaxMedica, Inc., First Wave Biopharma, Inc. and Relmada Therapeutics, Inc. During his career he has served on the boards of fourteen Biotech/Pharma companies and has also been a director and vice chairman of The Catholic Medical Missions Board, a large not-for-profit organization providing health care services to third world countries. He has served as a guest lecturer at Fordham University and is on the Science Council of Fordham University. He holds a bachelor’s degree in Pharmacy from Fordham University and an MBA from Iona University and was originally licensed to practice pharmacy in the states of New York and New Jersey.

| 10 |

OTHER EXECUTIVE OFFICERS

The following table sets forth the name, age, position and date of appointment of each of our other executive officers as of May 1, 2023.

| Name | Age | Position | Date of Appointment | |||

| Manu Ohri | 66 | Chief Financial Officer & Secretary | February 14, 2022 & May 15, 2022 |

Manu Ohri – Chief Financial Officer

Mr. Ohri joins our company with more than 30 years of hands-on experience in financial management and business leadership and working with boards of directors and financial institutions. Mr. Ohri has assisted several public companies in the areas of compliance with U.S. and international financial accounting and reporting standards, investor relations, mergers and acquisitions, strategic planning, team-building and project management. Immediately prior to joining us, and from 2010 through 2015, Mr. Ohri provided management consulting and business advisory services to privately-held and publicly traded companies. From 2015 to 2019, Mr. Ohri assisted in listing ToughBuilt Industries, Inc. on Nasdaq and served as the Chief Financial Officer and a member of the board of directors. Mr. Ohri is a Certified Public Accountant and Chartered Global Management Accountant with over seven years of experience with the global accounting firms Deloitte, LLP and PriceWaterhouseCoopers, LLP. Mr. Ohri earned a Master’s Degree in Business Administration from the University of Detroit.

FURTHER INFORMATION CONCERNING OUR BOARD OF DIRECTORS

Meetings. Our Board of Directors held two meetings during the fiscal year ended December 31, 2022. Our Board of Directors is authorized to, and did, act by written consent during the fiscal year ended December 31, 2022. Each director then serving attended 75% or more of the aggregate of all of the meetings of our Board of Directors and all of the meetings held by all committees of our Board of Directors on which such director served in the fiscal year ended December 31, 2022. While directors periodically attend annual stockholder meetings, we have not established a specific policy with respect to members of our Board of Directors attending annual stockholder meetings. All directors then serving on our Board of Directors attended our 2022 annual meeting of stockholders.

Committees. Our Board of Directors currently has the following standing committees: Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Our Audit Committee held two meetings, our Compensation Committee held no meetings and our Nominating and Corporate Governance Committee held no meetings during the fiscal year ended December 31, 2022. Our committees are authorized to, and did, act by written consent during the fiscal year ended December 31, 2022. In addition, our Board of Directors designated a Special Committee on August 29, 2021, consisting of Messrs. Breen and Wendel and Dr. Shrotriya, charged with, among other duties, evaluating the current compliance, compensation, operations and personnel of our company, and determining actions appropriate to address any deficiencies or inefficiencies identified through such evaluation. Our Special Committee held multiple formal and informal meetings during the fiscal year ended December 31, 2022, and its review is ongoing.

Our Audit Committee currently consists of Mr. Casamento (Chairman), Dr. Shrotriya and Mr. Wendel. Our Board of Directors has determined that all current and prospective members of our Audit Committee are independent under the Nasdaq listing rules and Rule 10A-3(b)(1) of the Exchange Act. Our Board of Directors has determined that Mr. Casamento is an audit committee financial expert, as defined in Item 407(d)(5) of Regulation S-K, and that each member of our Audit Committee is able to read and understand fundamental financial statements and has substantial business experience that results in such member’s financial sophistication. Accordingly, our Board of Directors believes that each member of our Audit Committee has sufficient knowledge and experience necessary to fulfill such member’s duties and obligations on our Audit Committee. The primary purposes of our Audit Committee are to oversee on behalf of our Board of Directors, (i) our accounting and financial reporting processes and the integrity of our financial statements, (ii) the audits of our financial statements and the appointment, compensation, qualifications, independence and performance of our independent auditors, (iii) our compliance with legal and regulatory requirements, and (iv) the performance of our internal audit function, internal accounting controls, disclosure controls and procedures and internal control over financial reporting. The role and responsibilities of our Audit Committee are more fully set forth in a revised written Charter adopted by our Board of Directors on January 28, 2021, which is available on our website located at www.gtbiopharma.com.

| 11 |

Our Compensation Committee currently consists of Mr. Wendel (Chairman), Mr. Casamento and Dr. Shrotriya. The primary purposes of our Compensation Committee are to (i) determine, or recommend to our Board of Directors for determination, the compensation of our chief executive officer and all other executive officers, (ii) make recommendations to our Board of Directors with respect to compensation of our non-employee directors, (iii) make recommendations to our Board of Directors with respect to incentive compensation plans and equity-based plans that are subject to board approval, (iv) exercise oversight with respect to our compensation philosophy, incentive compensation plans, equity-based plans and other compensation plans covering executive officers and senior management, (v) review and discuss with management, to the extent applicable, our Compensation Discussion & Analysis required by SEC rules to be included in our proxy statement and annual report on Form 10-K, and (vi) to the extent applicable, produce the annual compensation committee report for inclusion in our proxy statement and annual report on Form 10-K, as applicable. The role and responsibilities of our Compensation Committee are more fully set forth in a revised written Charter adopted by our Board of Directors on January 28, 2021, which is available on our website located at www.gtbiopharma.com.

The policies underlying our Compensation Committee’s compensation decisions are designed to attract and retain the best-qualified management personnel available. We routinely compensate our executive officers through salaries. At our discretion, we may reward executive officers and employees through bonus programs based on profitability and other objectively measurable performance factors. Additionally, we use stock options, restricted stock awards and other incentive awards to compensate our executives and other key employees to align the interests of our executive officers with the interests of our stockholders. In establishing executive compensation, our Compensation Committee evaluates compensation paid to similar officers employed at other companies of similar size in the same industry and the individual performance of each officer as it impacts our overall performance with particular focus on an individual’s contribution to the realization of operating profits and the achievement of strategic business goals. Our Compensation Committee further attempts to rationalize a particular executive’s compensation with that of other executive officers of our company in an effort to distribute compensation fairly among the executive officers. Although the components of executive compensation (salary, bonus and incentive grants) are reviewed separately, compensation decisions are made based on a review of total compensation.

Our Nominating and Corporate Governance Committee currently consists of Mr. Wendel (Chairman), Mr. Casamento and Dr. Shrotriya. The primary purposes of our Nominating and Corporate Governance Committee are to (i) identify and select, or recommend to the board for selection, the individuals qualified to serve on our Board of Directors (consistent with criteria that our Board of Directors has approved) either for election by stockholders at each meeting of stockholders at which directors are to be elected or for appointment to fill vacancies on our Board of Directors, (ii) develop, recommend to our Board of Directors, and assess our corporate governance policies and (iii) oversee the evaluation of our Board of Directors. The role and responsibilities of our Nominating and Corporate Governance Committee are more fully set forth in a revised written Charter adopted by our Board of Directors on January 28, 2021, which is available on our website located at www.gtbiopharma.com.

Our Nominating and Corporate Governance Committee’s methods for identifying candidates for election to our Board of Directors (other than those proposed by our stockholders, as discussed below) include the solicitation of ideas for possible candidates from a number of sources - members of our Board of Directors; our executives; individuals personally known to the members of our Board of Directors; and other research. Our Nominating and Corporate Governance Committee may also, from time-to-time, retain one or more third-party search firms to identify suitable candidates.

A stockholder of our company may nominate one or more persons for election as a director at an annual meeting of stockholders if the stockholder complies with the notice, information and consent provisions contained in our Amended and Restated Bylaws. In addition, the notice must be made in writing and set forth as to each proposed nominee the information required under our Amended and Restated Bylaws and any other information concerning the nominee that must be disclosed respecting nominees in proxy solicitations pursuant to Rule 14(a) of the Exchange Act of 1934, as amended. The recommendation should be addressed to our Secretary.

| 12 |

Among other matters, our Nominating and Corporate Governance Committee:

| 1. | Reviews the desired experience, mix of skills and other qualities to assure appropriate Board of Directors composition, taking into account the current members of our Board of Directors and the specific needs of our company and our Board of Directors; | |

| 2. | Conducts candidate searches, interviews prospective candidates and conducts programs to introduce candidates to our management and operations, and confirms the appropriate level of interest of such candidates; | |

| 3. | Recommends qualified candidates who bring the background, knowledge, experience, independence, skill sets and expertise that would strengthen and increase the diversity of our Board of Directors; and | |

| 4. | Conducts appropriate inquiries into the background and qualifications of potential nominees. |

Based on the foregoing, our Nominating and Corporate Governance Committee recommended for nomination and our Board of Directors nominated, Messrs. Breen, Casamento, and Wendel and Dr. Shrotriya for election as directors on our Board of Directors, subject to stockholder approval, for a one-year term ending on or around the date of our 2024 Annual Meeting.

Code of Conduct and Ethics. We have adopted a written code of conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A current copy of the code is posted on the corporate governance section of our website, which is located at https://ir.gtbiopharma.com/governance-docs/. If we make any substantive amendments to, or grant any waivers from, the code of conduct and ethics for any officer or director, we will disclose the nature of such amendment or waiver on our website or in a current report on Form 8-K.

Board Leadership Structure and Role in Risk Oversight. Mr. Breen serves as our Executive Chairman of the Board and Interim Chief Executive Officer. We believe that combining the role of Chairman of the Board and Chief Executive Officer is appropriate to provide the authority necessary for Mr. Breen to effectively lead our company through its current phase of growth. Our Board of Directors plays an active role, as a whole and at the committee level, in overseeing management of our risks and strategic direction. Our Board of Directors regularly reviews information regarding our liquidity and operations, as well as the risks associated with each. Our Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements. Our Audit Committee oversees the process by which our senior management and relevant employees assess and manage our exposure to, and management of, financial risks. Our Nominating and Corporate Governance Committee also manages risks associated with the independence of members of our Board of Directors and potential conflicts of interest. Our Special Committee is reviewing our corporate governance and financial reporting practices to improve those practices. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed about such risks.

| 13 |

Board Diversity. As required by Nasdaq Rule 5606 as approved by the Securities and Exchange Commission in August 2021, we are providing additional information about the gender and demographic diversity of our directors in the format required by such rule. The information in the matrix below is based solely on information provided by our directors about their gender and demographic self-identification. Directors who did not answer or indicated that they preferred not to answer a question are shown as “did not disclose gender” or “did not disclose demographic background” below.

Board Diversity Matrix for GT Biopharma, Inc. As of May 1, 2023 | ||||||||

| Total Number of Directors | 4 | |||||||

| Part I: Gender Identity | Female | Male | Non- Binary | Did Not Disclose Gender | ||||

| Directors | 0 | 4 | 0 | 0 | ||||

| Part II: Demographic Background | ||||||||

| African American or Black | 0 | 0 | 0 | 0 | ||||

| Alaskan Native or American Indian | 0 | 0 | 0 | 0 | ||||

| Asian | 0 | 1 | 0 | 0 | ||||

| Hispanic or Latinx | 0 | 0 | 0 | 0 | ||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||

| White | 0 | 3 | 0 | 0 | ||||

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||

| LGBTQ+ | 0 | |||||||

| Did Not Disclose Demographic Background | 0 | |||||||

Policy on Trading, Pledging and Hedging of Company Stock. Our Insider Trading Policy prohibits our executive officers, the non-employee members of our board of directors and certain other employees from engaging in selling any of our securities that they do not own at the time of the sale (referred to as a “short sale”) and buying or selling puts, calls, other derivative securities of our company or any derivative securities that provide the economic equivalent of ownership of any of our securities or an opportunity, direct or indirect, to profit from any change in the value of our securities or engaging in any other hedging transaction with respect to our securities.

As of the date of this proxy statement, none of our executive officers or non-employee directors have previously engaged in any hedging or pledging transaction involving our securities.

Stockholder Communications. Holders of our securities can send communications to our Board of Directors via email to auditcommittee@gtbiopharma.com or by telephoning the Chief Financial Officer at our principal executive offices, who will then relay the communications to our Board of Directors.

DIRECTOR INDEPENDENCE

Our Board of Directors currently consists of four members: Messrs. Breen, Casamento and Wendel and Dr. Shrotriya. Each director serves until our next annual meeting or until his successor is duly elected and qualified. Our Board of Directors has determined that Messrs. Casamento and Wendel and Dr. Shrotriya are independent directors as that term is defined in the applicable rules for companies traded on The Nasdaq Stock Market. Messrs. Casamento and Wendel and Dr. Shrotriya are each members of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee of our Board of Directors.

| 14 |

REPORT OF AUDIT COMMITTEE

The Audit Committee of our Board of Directors has furnished the following report:

The Audit Committee currently operates under a revised written charter that was approved by the Board of Directors effective January 28, 2021. For the fiscal year ended December 31, 2022, the Audit Committee has performed, or has confirmed that the Board of Directors has performed, the duties of the Audit Committee, which is responsible for providing objective oversight of internal controls and financial reporting processes.

In fulfilling its responsibilities for the financial statements for the fiscal year ended December 31, 2022, the Audit Committee:

| ● | Reviewed and discussed the audited financial statements for the year ended December 31, 2022 with management and Weinberg & Company, P.A., or the Auditors, the Company’s independent auditors; | |

| ● | Discussed with the Auditors the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission; and | |

| ● | Received written disclosures and the letter from the Auditors required by applicable requirements of the Public Company Accounting Oversight Board regarding the Auditors’ communications with the Audit Committee concerning independence, and has discussed with the Auditors their independence. |

Members of the Audit Committee rely, without independent verification, on the information provided to them and on the representations made by management and the Auditors. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions referred to above do not assure that the audits of the Company’s consolidated financial statements have been carried out in accordance with generally accepted auditing standards, that the consolidated financial statements are presented in accordance with U.S. generally accepted accounting principles or that the Company’s Auditors are in fact “independent.”

Based on the Audit Committee’s review of the audited financial statements and discussions with management and the Auditors, the Audit Committee approved the inclusion of the audited financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, for filing with the Securities and Exchange Commission.

| AUDIT COMMITTEE | |

| Rajesh Shrotriya, M.D. | |

| Bruce Wendel |

The information in this Audit Committee Report shall not be deemed to be “soliciting material,” or to be “filed” with the Securities and Exchange Commission or to be subject to Regulation 14A or 14C as promulgated by the Securities and Exchange Commission, or to the liabilities of Section 18 of the Exchange Act.

| 15 |

PROPOSAL NO. 2

INDEPENDENT ACCOUNTANTS

Proposal No. 2 is the ratification of the firm of Weinberg & Company, P.A., or Weinberg, as our independent accountants for the year ending December 31, 2023. Our Audit Committee recommended and our Board of Directors has selected, subject to ratification by a majority vote of the stockholders in person or by proxy at the Annual Meeting, Weinberg as our independent public accountant for the current fiscal year ending December 31, 2023. Representatives of Weinberg are expected to be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so. However, because this year’s Annual Meeting will be completely virtual, those representatives of Weinberg who do attend will not be available to answer questions from stockholders.

While there is no legal requirement that this proposal be submitted to stockholders, it will be submitted at the Annual Meeting nonetheless, as our Board of Directors believes that the selection of auditors to audit our consolidated financial statements is of sufficient importance to seek stockholder approval. If the majority of our stockholders present and entitled to vote at the Annual Meeting do not ratify the appointment of Weinberg as our auditors for the current fiscal year, Weinberg will continue to serve as our auditors for the current fiscal year, and our Audit Committee will engage in deliberations to determine whether it is in our best interest to continue Weinberg’s engagement as our auditors for the fiscal year ending December 31, 2023.

Weinberg is our principal independent public accounting firm. All audit work was performed by the full-time employees of Weinberg. Our Audit Committee approves in advance all services performed by Weinberg, has considered whether the provision of non-audit services is compatible with maintaining Weinberg’s independence, and has approved such services. We engaged Weinberg as our independent public accounting firm on or around December 31, 2020.

The following table presents the aggregate fees for professional audit services and other services rendered by Weinberg in the fiscal years ended December 31, 2022 and 2021.

Year Ended December 31, 2022 | Year Ended December 31, 2021 | |||||||

| Audit Fees | $ | 238,486 | $ | 242,759 | ||||

| Audit Related Fees | — | — | ||||||

| Tax Fees | 19,471 | 19,793 | ||||||

| All Other Fees | 4,975 | 9,420 | ||||||

| Total | $ | 262,932 | $ | 271,972 | ||||

Audit Fees consist of amounts billed for professional services rendered for the audit of our annual consolidated financial statements included in our Annual Reports on Form 10-K, and reviews of our interim consolidated financial statements included in our Quarterly Reports on Form 10-Q.

Audit-Related Fees consist of fees billed for professional services that are reasonably related to the performance of the audit or review of our consolidated financial statements but are not reported under “Audit Fees.”

Tax Fees consist of fees for professional services for tax compliance activities, including the preparation of federal and state tax returns and related compliance matters.

All Other Fees consists of amounts billed for services other than those noted above.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS YOU VOTE “FOR” RATIFYING THE APPOINTMENT OF WEINBERG & COMPANY, P.A. AS OUR INDEPENDENT ACCOUNTANTS.

| 16 |

PROPOSAL NO. 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), we are required to include in this Proxy Statement and present at the Annual Meeting a non-binding stockholder vote to approve the compensation of our executives, as described in this Proxy Statement, pursuant to the compensation disclosure rules of the SEC. Proposal No. 3, commonly known as a “say on pay” vote, gives stockholders the opportunity to endorse or not endorse the compensation of our executives as disclosed in this Proxy Statement. This proposal will be presented at the Annual Meeting as a resolution in substantially the following form:

RESOLVED, that the stockholders approve the compensation of the Company’s executives, as disclosed in the compensation tables and related narrative disclosure in the Company’s proxy statement for the Annual Meeting.

This vote will not be binding on our Board of Directors and may not be construed as overruling a decision by our Board of Directors or creating or implying any change to the fiduciary duties of our Board of Directors. The vote will not affect any compensation previously paid or awarded to any executive. Our Compensation Committee and our Board of Directors may, however, take into account the outcome of the vote when considering future executive compensation arrangements.

The purpose of our compensation programs is to attract and retain experienced, highly qualified executives critical to our long-term success and enhancement of stockholder value.

Required Vote

Endorsement of the compensation of our executive officers will require the affirmative vote of a majority of the shares of our common stock present or represented and entitled to vote at the Annual Meeting with respect to such proposal.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RESOLUTION APPROVING THE COMPENSATION OF OUR EXECUTIVES.

| 17 |

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table summarizes all compensation for the last two fiscal years awarded to, earned by, or paid to our Chief Executive Officer (principal executive officer) and our two most highly compensated executive officers other than our CEO who were either serving as executive officers at the end of our last completed fiscal year or for whom disclosure would have been provided but for the fact that the individual was not serving as an executive officer at the end of our last completed fiscal year, whose total compensation exceeded $100,000 during such fiscal year ends.

Name and principle Position | Fiscal Year | Salary ($) | Bonus ($) | Stock awards ($)(1) | Option awards ($)(2) | All other compensation ($) | Total ($) | |||||||||||||||||||||

| Michael Breen(3) | 2022 | 492,500 | 386,250 | 689,584 | 111,000 | 212,959 | 1,892,293 | |||||||||||||||||||||

| Executive Chairman of the Board of Directors and Interim Chief Executive Officer | 2021 | 62,784 | 80,000 | 2,449,687 | — | 235,232 | 2,827,703 | |||||||||||||||||||||

| Dr. Gregory Berk(4) | 2022 | 897,426 | — | — | 111,000 | — | 1,008,426 | |||||||||||||||||||||

| Former Interim Chief Executive Officer, President of Research & Development and Chief Medical Officer | 2021 | 311,841 | 200,000 | 898,126 | — | 14,552 | 1,424,519 | |||||||||||||||||||||

| Manu Ohri(5) | 2022 | 334,512 | 140,000 | 248,000 | 200,515 | 21,517 | 944,544 | |||||||||||||||||||||

| Chief Financial Officer and Secretary | 2021 | — | — | — | — | — | — | |||||||||||||||||||||

| (1) | The amounts in this column represent the aggregate grant date fair value of restricted stock awards, determined in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718. We determine the grant date fair value of the awards by multiplying the number of units granted by the closing market price of one share of our common stock on the award grant date. These amounts do not reflect the actual economic value that will be realized by the named executive officer upon the vesting or the sale of the common stock awards. | |

| (2) | This column represents option awards computed in accordance with FASB ASC Topic 718, excluding the effect of estimated forfeitures related to service-based vesting conditions. For additional information on the valuation assumptions with respect to the option grants, refer to Note 1 of our financial statements in the Annual Report. These amounts do not correspond to the actual value that will be recognized by the named executives from these awards. | |

| (3) | The information presented for Mr. Breen combines compensation provided in connection with his services as the Executive Chairman of the Board of Directors and as our Interim Chief Executive Officer. Mr. Breen’s compensation for fiscal 2022 includes $689,584 in aggregate grant date fair value of stock awards issued as compensation for service as our Interim Chief Executive Officer (Mr. Breen received 278,058 shares of our common stock effective July 15, 2022 at a closing market price of $2.48 per share), $110,000 in aggregate grant date fair value of options issued as compensation for service on our Board of Directors (following stockholder approval of our 2022 Omnibus Incentive Plan, Mr. Breen was granted a fully-vested option to purchase 50,000 shares of common stock on July 15, 2022 at a per share exercise price of $2.48 in consideration of his service on our Bord of Directors during fiscal 2021), and $212,959 of fees paid for service on the Special Committee of our Board of Directors. Mr. Breen’s compensation for fiscal 2021 includes $2,449,687 in aggregate grant date fair value of stock awards issued as compensation for service on our Board of Directors (Mr. Breen received 278,058 shares of our common stock effective January 13, 2021 at a closing market price of $8.81 per share), and $235,232 of fees paid for service on our Board of Directors. |

| 18 |

| (4) | The information presented for Dr. Berk combines compensation provided in connection with his services as a member of Board of Directors, as our President of Research & Development and Chief Medical Officer and as our Interim Chief Executive Officer. Dr. Berk resigned as a member of our Board of Directors on April 23, 2021, ceased service as our Interim Chief Executive Officer on March 2, 2022 and ceased service as our President of Research & Development and Chief Medical Officer on December 8, 2022. Dr. Berk’s compensation for fiscal 2022 includes $110,000 in aggregate grant date fair value of options issued as compensation for service on our Board of Directors (following stockholder approval of our 2022 Omnibus Incentive Plan, Dr. Berk was granted a fully-vested option to purchase 50,000 shares of common stock on July 15, 2022 at a per share exercise price of $2.48 in consideration of his service on our Bord of Directors during fiscal 2021). Dr. Berk’s compensation for fiscal 2021 includes $898,126 in aggregate grant date fair value of stock awards issued as compensation for service on our Board of Directors (Dr. Berk received 278,058 shares of our common stock on February 16, 2021 but effective as of November 20, 2020 at a closing market price of $3.23 per share), $12,916 in fees for service on our Board of Directors and $1,636 in Company paid life insurance premiums and employer 401(k) contributions. | |

| (5) | Includes $248,000 in aggregate grant date fair value of stock awards issued as compensation for service (Mr. Ohri received 100,000 shares in connection with his appointment as our Chief Financial Officer), $200,515 in aggregate grant date fair value of options issued as compensation for service (Mr. Ohri was granted options to purchase 200,000 shares of common stock on July 15, 2022, with 66,666 shares vested on the date of grant and 66,667 shares vesting on each of February 14, 2023 and 2024), and $21,517 in Company paid health insurance, life insurance and long-term disability insurance premiums. |

Employment Agreements

Michael Breen

On December 31, 2021, we entered into a one-year, annually renewable executive employment agreement with Mr. Breen, effective November 8, 2021. Under the terms of the executive employment agreement, Mr. Breen will receive an annual base salary of $425,000, which increased to $515,000 effective March 2, 2022 upon his taking the position of interim Chief Executive Officer of the Company. Mr. Breen’s annual base salary was further increased by 8% effective January 1, 2023. Mr. Breen is eligible to participate in our performance bonus plan or as otherwise determined by our Compensation Committee, with a target annual bonus of 75% of his annual base salary with a minimum guaranteed performance bonus of 25% of base salary. The Company shall issue to Mr. Breen, pursuant to a stock award agreement and subject to approval by the Compensation Committee, 278,058 shares of common stock of the Company, which shares shall be fully vested. No part of Mr. Breen’s salary is allocated to his duties as a director of our Company.

Upon the termination of Mr. Breen’s employment for any reason, Mr. Breen will receive his accrued but unpaid salary and vacation pay through the date of termination and any other benefits accrued to him under any benefit plans outstanding at such time, and the reimbursement of documented, unreimbursed expenses incurred prior to such date. Upon our termination of Mr. Breen’s employment without cause (as defined in the his employment agreement) or upon Mr. Breen’s termination of his employment for good reason (as defined in his employment agreement) prior to the end of the term of his employment agreement, Mr. Breen shall also receive (i) a lump sum payment equal to the greater of the amount of his annual base salary (at the then-current rate) that he would have earned through the end of the term of the agreement, and 50% of his annual base salary, plus (ii) a lump sum payment equal to the greater of the bonus paid or payable to Mr. Breen for the immediately preceding year, and the target bonus under our performance bonus plan, if any, in effect during the immediately preceding year, plus (iii) monthly reimbursement for the cost of medical, life and disability insurance coverage at a level equivalent to that provided by our company for a period of the earlier of (a) one year and (b) the time Mr. Breen begins alternative employment wherein said insurance coverage is available and offered to Mr. Breen. Mr. Breen will also be designated for election to our Board of Directors during the term of his employment agreement.

| 19 |

Manu Ohri

On May 15, 2022, we entered into a two-year, annually renewable executive employment agreement with Mr. Ohri, effective February 14, 2022. Pursuant to the terms of his employment effective February 14, 2022, Mr. Ohri will receive an annual base salary of $325,000, which increased to $400,000 on May 15, 2022, and is eligible to participate in our executive bonus plans as determined by our Board of Directors, with a target bonus of up to 40% of his annual base salary. Mr. Ohri’s annual base salary was further increased by 8% effective January 1, 2023. Mr. Ohri is entitled to receive a stock award in the amount of 25,000 shares of our common stock, and an option to purchase 175,000 shares of our common stock, vesting in three equal annual installments on the annual anniversary of the date of his employment, subject to full acceleration upon a change of control transaction.

Upon the termination of Mr. Ohri’s employment for any reason, Mr. Ohri will receive his accrued but unpaid salary and vacation pay through the date of termination and any other benefits accrued to him under any benefit plans outstanding at such time, and the reimbursement of documented, unreimbursed expenses incurred prior to such date. Upon our termination of Mr. Ohri’s employment without cause (as defined in the his employment agreement) or upon Mr. Ohri’s termination of his employment for good reason (as defined in his employment agreement) prior to the end of the term of his employment agreement, Mr. Ohri shall also receive (i) a lump sum payment equal to the greater of the amount of his annual base salary (at the then-current rate) that he would have earned through the end of the term of the agreement, and 50% of his annual base salary, plus (ii) a lump sum payment equal to the greater of the bonus paid or payable to Mr. Ohri for the immediately preceding year, and the target bonus under our performance bonus plan, if any, in effect during the immediately preceding year, plus (iii) monthly reimbursement for the cost of medical, life and disability insurance coverage at a level equivalent to that provided by our company for a period of the earlier of (a) one year and (b) the time Mr. Ohri begins alternative employment wherein said insurance coverage is available and offered to Mr. Ohri.

Outstanding Equity Awards at Fiscal Year End

The following table sets forth information regarding unexercised stock options for each named executive officer as of December 31, 2022.

| Name | Number of securities underlying unexercised options exercisable (#) | Number of securities underlying unexercised options unexercisable (#) | Option

exercise

price ($) | Option

expiration

date | ||||||||||

| Michael Breen | 50,000 | (1) | — | 2.48 | 7/14/2032 | |||||||||

| Dr. Gregory Berk | 50,000 | (2) | — | 2.48 | 7/14/2032 | |||||||||

| Manu Ohri | 66,666 | (3) | 133,334 | 2.48 | 7/14/2032 | |||||||||

| (1) | Consists of options granted to Mr. Breen as compensation for service on our Board of Directors. The options were fully vested on July 15, 2022, the date of grant. | |

| (2) | Consists of options granted to Dr. Berk as compensation for service on our Board of Directors. The options were fully vested on July 15, 2022, the date of grant. | |

| (3) | Consists of options granted to Mr. Ohri as compensation for service as our Chief Financial Officer. The options vest as follows: 66,666 shares on July 15, 2022, the date of grant, and 66,667 shares on each of February 14, 2023 and 2024. |

| 20 |

Pay Versus Performance

| Year | Summary Compensation Table Total for PEO(1) | Compensation Actually Paid to PEO(2) | Summary Compensation Table Total for PEO(3) | Compensation Actually Paid to PEO(4) | Average Summary Compensation Table Total for Non-PEO NEO(5) | Average Compensation Actually paid to Non-PEO NEOs(6) | Value of Initial Fixed $100 Investment Based on Total Shareholder Return(7) | Net Loss (In Thousands)(8) | ||||||||||||||||||||||||

| 2022 | $ | 1,892,293 | $ | 1,498,165 | $ | 1,008,426 | $ | 503,299 | $ | 944,544 | 1,029, 311 | $ | 42.31 | $ | 20,884 | |||||||||||||||||

| 2021 | $ | 2,827,703 | $ | 1,947,991 | $ | 1,424,519 | $ | 2,096,368 | — | — | $ | 12.29 | $ | 58,013 | ||||||||||||||||||